- The Federal Reserve's November policy meeting is set to be a pivotal moment for markets.

- While investors are almost certain of a 25bps rate cut, the Fed’s guidance will be closely watched, particularly in light of Donald Trump’s return to the White House.

- The November Fed meeting, therefore, is not just a policy event but a precursor to how the central bank may adapt to a renewed Trump administration’s economic agenda.

- Looking for more actionable trade ideas? Unlock access to InvestingPro for less than $8 a month!

The Federal Reserve’s November meeting is set to take place just a day after Donald Trump’s election as the 47th president of the United States, and markets are anticipating notable policy implications from both events.

With inflation moderating, the Fed is widely expected to cut interest rates by 25 basis points, bringing the benchmark closer to neutral territory.

Beyond the rate cut, however, Fed Chair Jerome Powell’s comments on Thursday will provide insight into whether another pause in December is in the cards, as the Fed assesses longer-term inflation and employment dynamics.

Powell’s tone could set the stage for a shift toward a cautious, data-dependent stance into early 2025.

What to Expect from the Meeting

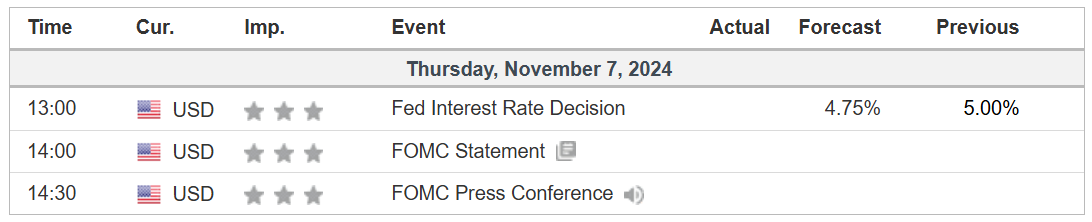

Analysts overwhelmingly expect a modest 25-basis-point rate cut on Thursday, marking the Fed’s second reduction this year. That would take the Fed funds rate to the 4.50%-4.75% range.

Source: Investing.com

However, Fed Chair Jerome Powell's post-meeting commentary could bring more volatility than the rate cut itself, as he may signal the potential for a December pause.

The case for a potential pause in rate cuts for December has been strengthening amid a recent batch of strong economic indicators, including brisk GDP growth and low unemployment at 4.1%.

Should Powell signal a December pause, this could suggest a wait-and-see approach as the Fed assesses the sustainability of economic growth against inflationary pressures.

Trump’s Victory: What It Could Mean for Fed Policy

Trump’s re-election introduces several new dynamics that may sway the Fed’s strategy in the months ahead.

Historically vocal about his preference for lower interest rates, Trump has often pushed the Fed to adopt policies that favor economic growth. As such, his return could renew calls for dovish policies.

His comeback could also renew discussions around tax cuts, deregulation, and government spending. Such policies tend to boost economic activity but also may lead to inflationary pressures, potentially influencing Fed decisions in 2025 and beyond.

With a renewed emphasis on fiscal stimulus and an eye toward regulatory rollback, the Fed may need to rethink its long-term strategies to balance growth and inflation risks in an era of Trump-led fiscal expansion.

Furthermore, trade policies, which may shift toward a more aggressive stance on tariffs, add another layer of complexity, as the Fed might have to adjust to potential shifts in global trade and pricing impacts.

Preparing for Market Responses

For investors, the Fed’s meeting and Trump’s victory create an environment ripe for volatility across sectors. Equities in industries like tech), energy (NYSE:XLE), defense, and industrials could gain traction from expectations of a growth-focused agenda.

Market volatility may heighten if Powell’s tone hints at a more cautious outlook, with defensive positioning and diversified portfolios likely proving beneficial.

A potential ‘pause’ signal could bolster financials and consumer discretionary stocks, while investors keep a close watch on the Fed’s response to Trump’s anticipated policy push into 2025.

If Trump initiates stimulus-driven growth measures, the Fed might need to revisit its approach to manage inflation.

At the same time, heightened uncertainty surrounding potential trade renegotiations could create additional volatility, challenging the Fed’s efforts to stabilize the economy.

Conclusion

While the anticipated 25bps rate cut is largely priced in, Powell’s guidance on future policy will play a vital role in setting market expectations, making Thursday’s meeting a must-watch for investors looking to navigate these uncertain times.

For those in the market, remaining agile and diversified will be key, as political shifts could continue to influence Fed decisions in unexpected ways.

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now to get an additional 10% off the final price and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.