- InvestingPro's dividend champions portfolio is ideal for dividend-seeking companies.

- It exclusively features firms that have consistently shared profits with shareholders for at least 25 years.

- The major contributors to this portfolio are Walmart, Johnson & Johnson, and Exxon Mobil.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

It's still early for the dividend season to kick into high gear, but it's a good time to start considering building a portfolio focused on companies that share profits with shareholders.

For those seeking simplicity, the Dividend Champion portfolio on InvestingPro offers a convenient option. This curated list features established market giants that consistently pay solid dividends.

The portfolio includes major stocks like Exxon Mobil (NYSE:XOM), and Johnson & Johnson (NYSE:JNJ), among others. And these are just a few of the 131 stocks available.

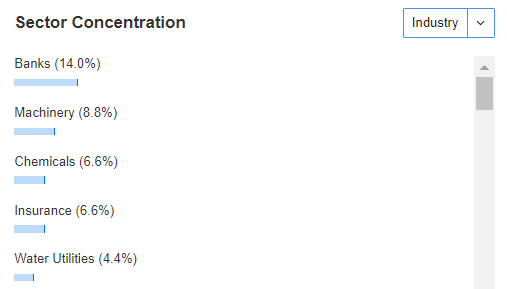

Here are the main characteristics of InvestingPro's Dividend Champion Portfolio:

- Companies in the portfolio are equally weighted.

- The portfolio maintains a balanced distribution across various sectors.

- The banking sector, topping the list, comprises 14% of the total portfolio.

Source: InvestingPro

Defensive portfolios emphasize diversification and minimizing losses during a market slump. While this strategy reduces the potential for significant gains, it prioritizes the payment of dividends.

Comparing the portfolio's performance with the S&P 500 benchmark over the past year shows lower gains (although over 3 years, the portfolio performs better).

It's crucial to focus on dividends, and noteworthy companies in this context include J&J and Exxon Mobil. Let's take a look at each company individually.

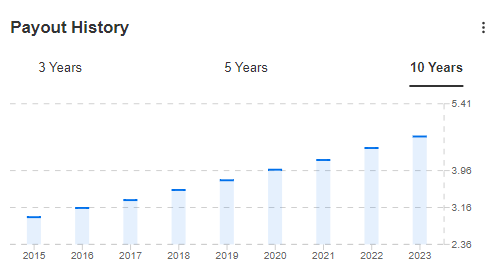

Exxon Mobil Offers a Solid Dividend Yield

Exxon Mobil claims the top spot among the three major companies in the portfolio, boasting a high dividend yield of 3.65% based on the latest quarterly profit distribution. Crucially, for nearly a decade, this ratio has consistently remained above the 3% threshold.

Source: InvestingPro

Considering its consistent dividend track record and strong standing in the energy market, there is no sign of any significant changes anticipated for the upcoming year compared to what we observed throughout 2022 and 2023.

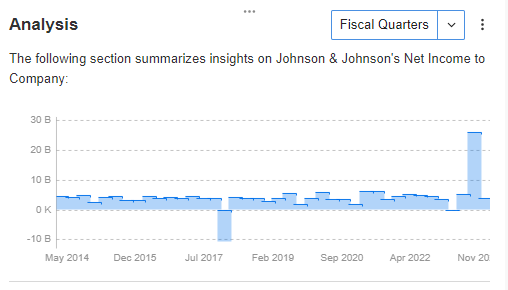

Johnson & Johnson: More Than Half a Century of Dividends

Johnson & Johnson stands out when considering the dividend history. The company has been distributing profits to shareholders for an impressive period of more than half a century—53 years, to be exact.

What sets this medical and pharmaceutical giant apart is its remarkable track record of consistently increasing the dividends per share every quarter, a trend noticeable since at least 2014.

Source: InvestingPro

Also working in the company's favor is the fact that the pharmaceutical/medical industry is considered potentially crisis-proof, which is very important for defensive companies.

J&J, apart from two deviations, boasts stability in net income, so the dividend payments are set to continue.

Source: InvestingPro

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Now with CODE INWESTUJPRO1 you can get as much as a 10% discount on InvestingPro annual and two-year subscriptions.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.