- The market’s shift towards more interest rate cuts, supported by Fed signals, strengthens EUR/USD prospects.

- With inflation nearing target and recession risks rising, the Fed’s actions could further weaken the dollar.

- If market conditions stay steady, a correction in EUR/USD is likely, followed by a rise towards $1.15.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The past few days have brought some relief, especially in the stock markets, which are recovering as more reports suggest a softer approach to tariffs. One example is that President Donald Trump excluded electronics from the tariffs he announced.

Still, the situation remains highly uncertain. It is very difficult to make even short-term predictions because the trade conflict could take many unexpected turns.

One surprising outcome of this global uncertainty is that the EUR/USD may be gaining appeal as a safe-haven currency. Its value has been rising for several weeks. In fact, the EUR/USD exchange rate has now reached its highest level in over three years

Could the Fed Soften Its Stance?

For over a month now, the market has slowly but steadily shifted toward expecting more interest rate cuts this year. This view is backed by recent signals from the Federal Reserve, which suggest that cuts may come sooner than previously expected at the start of the year.

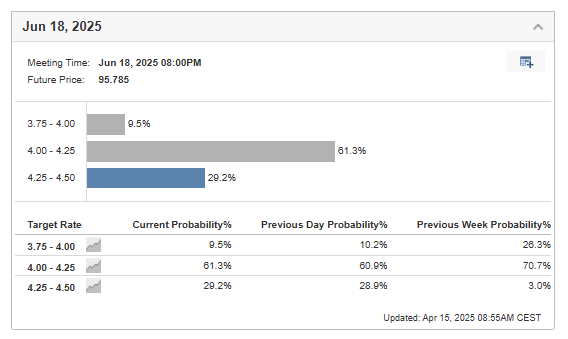

This outlook is also reflected in the probability index tied to Fed meetings. It now shows nearly a 90% chance of a 25 basis point cut as early as June.

GDP dynamics should be at the forefront, as any clear signs of the emergence of a recession, which is more likely in a high-tariff environment, will prompt U.S. monetary policymakers to act decisively. This is currently the main driver of the US Dollar’s repricing, as investors discount the Fed’s future moves in advance.

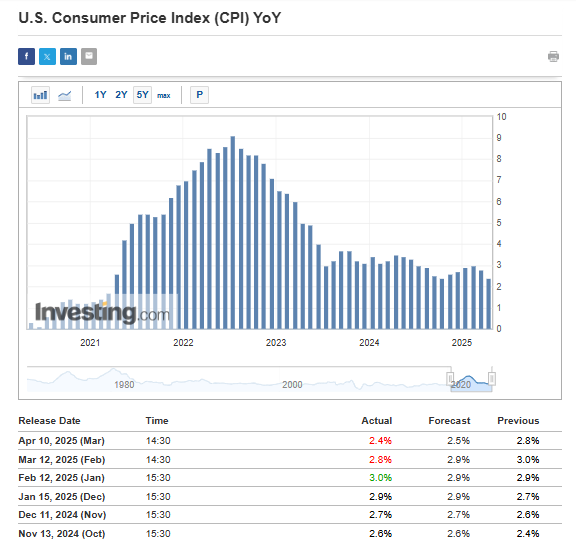

US inflation Getting Closer to Target (NYSE:TGT)

Last week’s US inflation data suggests that inflation could realistically return to the Fed’s target in the coming months—unless higher tariffs slow down this progress.

As a result, the Federal Reserve is running out of reasons to keep interest rates unchanged—apart from the strong labor market. Based on market expectations, rates are likely to be cut by 50 basis points by September, with the first cut possibly coming as early as May.

A more dovish stance from the Fed would likely weaken the dollar, which would support buyers of the EUR/USD pair.

Momentum Builds for EUR/USD Rally

The strong upward momentum that pushed EURUSD above $1.14—its highest level in over three years—points to a potential continuation of this move after a short correction. A possible pullback could find support around the $1.20 zone, where several support levels align with the rising trendline, making it a key area to watch for a rebound.

If current market conditions hold and the upcoming ECB meeting delivers the expected 25 basis point cut without surprises, the base scenario remains unchanged. A short-term correction is likely, followed by a continued rise in EUR/USD, with $1.15 as the next target.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.