- The EUR/USD pair is experiencing a short correction upwards but remains within a broader downtrend.

- Meanwhile, the policy divergence could occur between the Fed and the ECB depending on the Eurozone CPI data this week.

- US GDP, PCE data will also play a key role in deciding the pair's next move.

- Invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The EUR/USD pair is experiencing a local uptrend, but this rally sits within a broader downtrend. Recent US dollar weakness stems from speculation about a potential Fed pivot later this year, fueled by softer macroeconomic data. However, Fed officials haven't confirmed this shift.

Meanwhile, the European Central Bank (ECB) seems poised to cut interest rates by 25 basis points (bps) at their next meeting. ECB officials have been laying the groundwork for this move. While one cut is likely priced in, the key question is whether the ECB will embark on a full-blown pivot or maintain a wait-and-see approach.

Will the Policy Gap Between the Fed and ECB Keep Widening?

Central bank policy, particularly interest rates, is a major driver of currency valuation. Divergences in monetary policy can trigger long-term trends in currency pairs. A prime example is USD/JPY, where the Bank of Japan's dovish stance contrasted sharply with the Fed's hawkishness, leading to a sustained appreciation of the yen to multi-decade highs.

A similar scenario, albeit less dramatic, could unfold with EUR/USD in the coming months. If the Fed delays its pivot until next year while the ECB cuts rates now, the EUR/USD could weaken.

EUR/USD: Key Data to Watch This Week

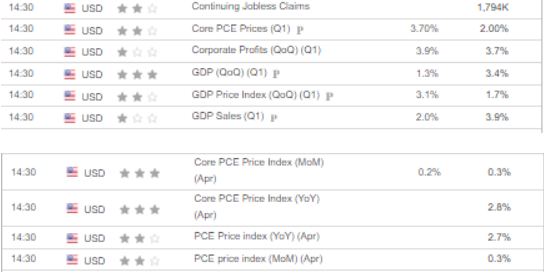

The latter half of the week brings a packed macroeconomic calendar, likely to increase EUR/USD volatility. Investors will be closely watching key US data points, including GDP and the Fed's preferred inflation gauge, PCE.

The market is watching both GDP and inflation data closely. A renewed negative surprise in GDP could prompt the Federal Reserve to accelerate its pivot and shield the economy from a deep recession. High inflation, traditionally a key indicator, shouldn't be ignored either.

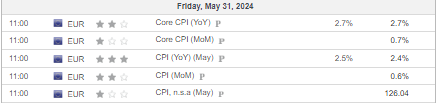

Meanwhile, in the Eurozone, more inflation data is due on Friday. If the numbers meet market expectations, they likely won't significantly influence the ECB's decision next week.

Technical View

The EUR/USD chart, before the data release, reveals a continuation of its upward climb. The key target remains the supply zone just above 1.09.

For a potential reversal of the broader correction, watch closely. Not only the lower channel limits but also the critical support level at 1.08 are crucial. A break below this support could trigger further declines, with the first target at 1.0740.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.