- Eurozone CPI data paves the way for more cuts.

- This comes at a time when the market is debating between a 25 or 50 bps cut by the Fed.

- Meanwhile, the EUR/USD pair is nearing a key support area.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

With Labor Day now behind us, traders are gearing up for a busy September filled with macro data and key events that could stir up market volatility.

Central bank meetings this month are set to drive action in the forex market. Both the European Central Bank and the Fed are expected to cut interest rates, but the Fed may take a less dovish stance compared to the ECB.

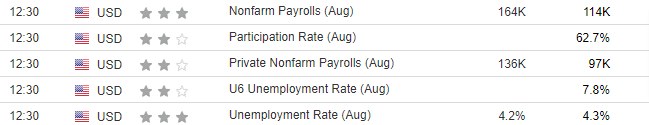

The Fed's next move—whether a 25 or 50 basis point cut—will depend heavily on upcoming U.S. labor market data, which sparked a major sell-off in equity markets earlier in August.

As the EUR/USD pair nears a key support level, the differing dovishness of these central banks, coupled with U.S. dollar strength, is likely to dictate the pair’s next moves.

The Labor Market and PMIs Set the Tone for This Week’s Trading

With last month's strong market reaction to labor market data and PMIs in mind, investors should stay alert as another round of these reports hits this week.

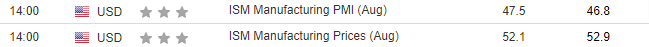

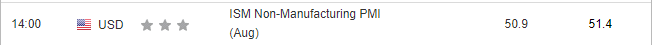

First up are the industrial and services sector figures, with ISM Manufacturing PMI is expected to edge up while services is poised to see a modest decline.

If there are no major surprises with this data, the direction of the EUR/USD pair will likely be influenced by the U.S. labor market data.

Early forecasts suggest a pause in the negative trends for both the unemployment rate and non-farm payrolls. If this consensus holds, it could increase the odds of a smaller rate cut by the Fed.

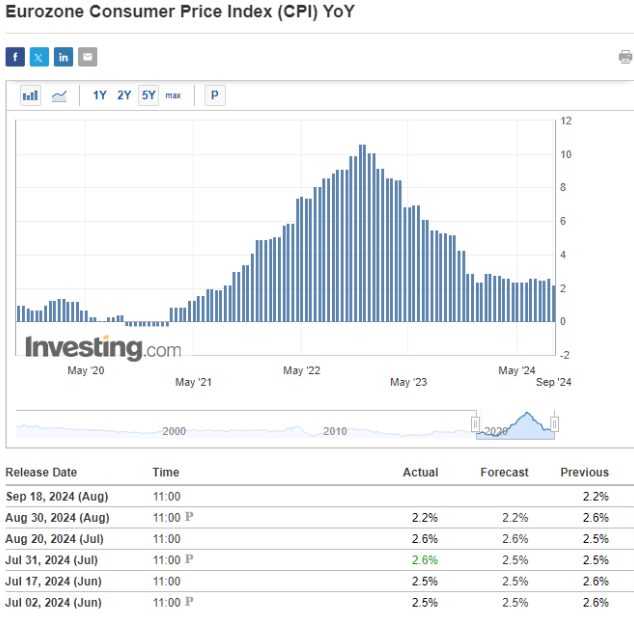

ECB's Fight Against Inflation Over?

Inflation data released last week from the Eurozone confirmed that the ECB is nearing its 2% target. The latest reading of 2.2% marks the lowest inflation rate in three years.

Germany is seeing a similar trend, with disinflation advancing even more rapidly. According to July’s data, the price change rate slowed to 1.9% compared to forecasts of 2.1% y/y and the previous reading of 2.3% y/y.

With inflation data shaping up this way and GDP growth hovering around 0% for the entire Eurozone, the ECB has little choice but to continue its rate-cutting cycle.

EUR/USD – The Correction Continues

The expectation of a modest initial rate cut by the Fed remains the main driver behind the corrective move in the EUR/USD pair. Sellers are currently testing the first significant support level around 1.1050.

In this zone, the market will gauge the strength of sellers’ resolve to push prices lower. A breakout here could target the 1.0950 support area and the accelerated uptrend line.

However, a strong demand reaction might lead to another attempt to challenge the key resistance at 1.12, recently defended by the market.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.