- Etsy stock has had a strong 52 weeks

- Covid-19 has provided tailwinds to online marketplaces like Etsy

- As growth now slows down, potential buy-and-hold investors could wait for a decline toward $200 for a better entry point

Investors in the online marketplace for artisans, Etsy (NASDAQ:ETSY), have seen robust returns in the past 12 months.

Shares of ETSY, which are up 27.5% year-to-date (YTD) and over 103% over the past 52 weeks, hit an all-time high (ATH) of $251.86 in early March. On Sept. 17, the stock closed at $226.98.

Founded in 2005, Etsy went public in April 2015 at an opening price of $31. The 52-week range for shares has been $104.30 - $251.86.

With 5.2 million sellers and 90.5 million buyers, “Etsy.com is the 4th largest e-commerce site by monthly visits in the US.” The UK is next market with the highest growth rate.

In addition to its namesake market place, Etsy also owns the Reverb, Elo7 and Depop platforms. Its asset-light business has enabled management to acquire additional businesses that could help fuel the group’s growth.

The digital retailer issued strong Q2 metrics on Aug. 4. Etsy’s gross merchandise volume (GMS), or the total value of goods sold on its platforms, increased 13.1% YOY and came in at $3.04 billion. Its top line rose 23.4% year-over-year (YOY) to $528.9 billion.

The company reports revenue in two main segments:

- Marketplace (revenue of $395.5 billion, up 19.1%);

- Seller services (revenue of $133.4 billion, up 38.0%).

Net income came in at $98.3 million translated into diluted earnings per share (EPS) of 68 cents. A year ago, EPS had been 75 cents. The company ended the quarter with $2.5 billion in cash and short-term investments.

On the recent results, CEO Josh Silverman said:

“It is deeply gratifying to me and our entire team that we are able to report strong year-over-year growth, with GMS and revenue up approximately 13% and 23% respectively. In fact, excluding facemasks, which were an important driver of the prior year period, second quarter GMS for the Etsy marketplace increased 31%.”

Etsy expects to achieve $2.9 - $3.0 billion GMS for Q3 2021, indicating a growth rate of around 12.5% Revenue guidance for the same period stands at $500 - $525 million, up13.5% YOY.

However, investors were concerned about the company's Q3 guidance which suggested a revenue slowdown. Following the release of Q2 results, on Aug. 5, ETSY stock saw an intraday low of $174.91. However, since then a new leg has taken the shares up to $228.89.

Given the recent increase of about 30%, investors wonder what could be next for the stock. Let’s take a closer look.

What To Expect From ETSY Stock

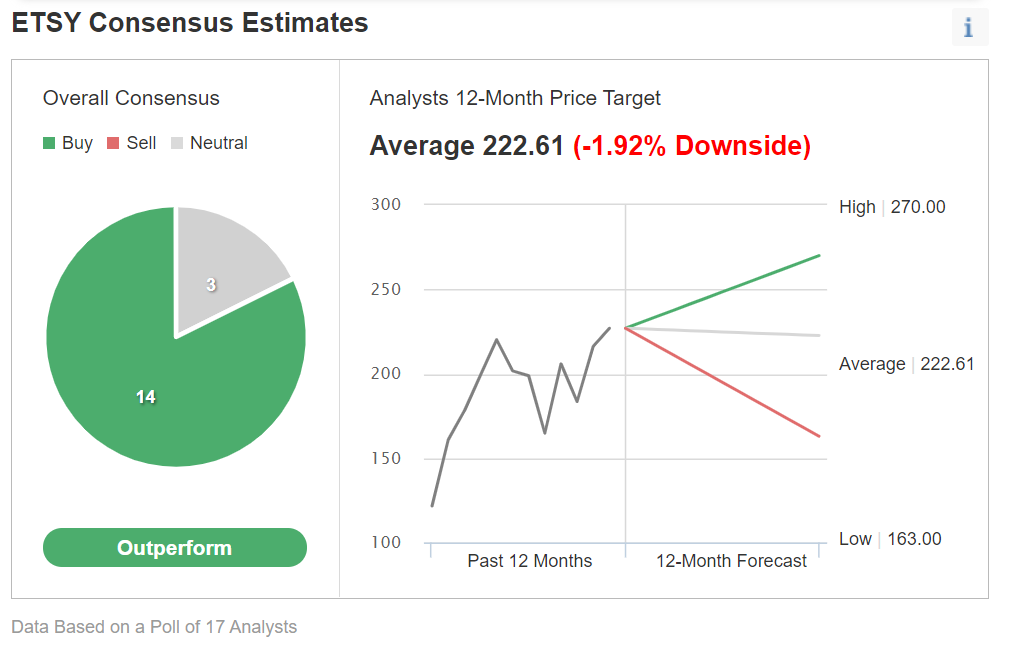

Among 17 analysts polled via Investing.com, Etsy stock has an ‘outperform' rating.

Chart: Investing.com

The shares have a 12-month price target of $222.61, implying a decline of close to 2%. Which means, for now, the Street believes the stock has run its course. The 12-month price range currently stands between $163 and $270.

The trailing P/E, P/S and P/B ratios for ETSY stock stand at 65.14x, 13.37x and 54.11x, respectively. By comparison, comparable ratios for eBay (NASDAQ:EBAY) are 22.78x, 4.47x and 3.76x. Similarly, ratios for Amazon.com (NASDAQ:AMZN) stands at 60.35x, 3.96x and 15.26x.

Put another way, ETSY stock looks overvalued compared to two other leading e-commerce sites. Investors have, in part, put a premium on Etsy's future growth prospects.

For those who watch technical charts, a number of ETSY stock's short-term oscillators are overbought. Although they can stay extended for weeks, if not months, potential profit-taking could also be around the corner.

If broader markets, or online retailers, were to come under pressure during the rest of the month or in October, we could potentially see Etsy shares decline toward $200, after which the stock could trade sideways while it establishes a new base. Such a potential decline would offer new ETSY investors a better entry point.

With a market capitalization (cap) of $28.8 billion, Etsy is likely to enjoy many years of growth. We expect management to grow its product categories both stateside and internationally. However, there could be short-term profit-taking in the shares.

3 Possible Ways To Trade ETSY Stock

1. Buy Shares At Current Levels

Investors who are not concerned with daily moves in price or Wall Street's one-year target price, could consider investing in Etsy stock now.

On Sept. 17, ETSY stock closed at $226.98.

Such buy-and-hold investors should expect to hold this long position for several months—or most possibly longer—while the stock potentially makes an attempt at the record high of $251.86.

Assuming an investor enters this trade at the current price and exits around $250, the return would be about 10%.

However, investors who are concerned about large declines might also consider placing a stop-loss at about 3-5% below their entry point.

2. Buy An ETF With ETSY As A Main Holding

Many readers are familiar with the fact that we regularly cover exchange-traded funds (ETFs) that might be suitable for buy-and-hold investors. Thus, readers who do not want to commit capital to ETSY stock but would still like to have substantial exposure to the shares could consider researching a fund that holds the company as a top holding.

Examples of such ETFs include:

- Global X E-Commerce ETF (NASDAQ:EBIZ): This fund is down 0.41% year-to-date (YTD), and ETSY stock’s weighting is 5.18%;

- AlphaClone Alternative Alpha ETF (NYSE:ALFA): The fund is up 15.02% YTD, and ETSY stock’s weighting is 2.99%.

- SPDR S&P Internet ETF (NYSE:XWEB): The fund is up 9.38% YTD, and ETSY stock’s weighting is 2.59%.

3. Bear Put Spread

Readers who believe there could be more profit-taking in ETSY stock in the short run might consider initiating a bear put spread strategy. As it involves options, this set-up will not be appropriate for all investors.

It might also be appropriate for long-term ETSY investors to use this strategy in conjunction with their long stock holding. The set-up would offer some short-term protection against a decline in price in the coming weeks.

This trade requires a stakeholder to have one long Etsy put with a higher strike price and one short put with a lower strike price. Both puts will have the same expiration date.

Such a bear put spread would be established for a net debit (or net cost). It will profit if Etsy shares decline in price.

For instance, the trader might buy an out-of-the-money (OTM) put option, like the ETSY Dec.17 220-strike put option. This option is currently offered at $17.60. Thus, it would cost the trader $1,760 to own this put option, which expires in about three months.

At the same time, the trader would sell another put option with a lower strike, like the ETSY Dec.17 200-strike put option. This option is currently offered at $9.88. Thus, the trader would receive $988 to sell this put option, which also expires in slightly over three months.

The maximum risk of this trade would be equal to the cost of the put spread (plus commissions). In our example, the maximum loss would be ($17.60 - $9.88) X 100 = $772.00 (plus commissions).

This maximum loss of $772 could easily be realized if the position is held to expiry and both ETSY puts expire worthless. Both puts will expire worthless if the Etsy share price at expiration is above the strike price of the long put (higher strike), which is $220.00 at this point.

This trade’s potential profit is limited to the difference between the strike prices (i.e, ($220.00 - $200.00) X 100) minus the net cost of the spread (i.e., $772) plus commissions.

In our example, the difference between the strike prices is $20.00. Therefore, the profit potential is $2000 - $772 = $1,228.

This trade would break even at $212.28 on the day of the expiry (excluding brokerage commissions).