Shares of department store chain Macy’s (NYSE:M) have been trending lower since November of last year. The stock is down more than 30% since reaching a 52-week high on Nov. 18, hurt by investors’ tendency to exit from riskier assets as the Federal Reserve moves to hike interest rates.

However, the sharp decline presents a buying opportunity. This New York City-based retail giant is well on track in turning around its business even as the environment for retail spending remains robust.

US consumer spending has been showing a strong uptrend in recent months. Retail sales figures for January rose 3.8%, surging by the most in 10 months, according to Commerce Department figures released last week. The advance was nearly double the median estimate of 2%.

The retailer, which also owns Bloomingdale’s and beauty store chain Bluemercury, is scheduled to report its latest quarterly earnings today, before the market open. Analysts expect $8.44 billion in sales, a 24% jump from the same period a year ago. Profit per share is likely to surge $1.99, more than double that of the same period last year.

Some analysts are turning quite bullish on the store’s future outlook as the company’s turnaround is gaining traction with Macy's e-commerce unit providing more upside potential.

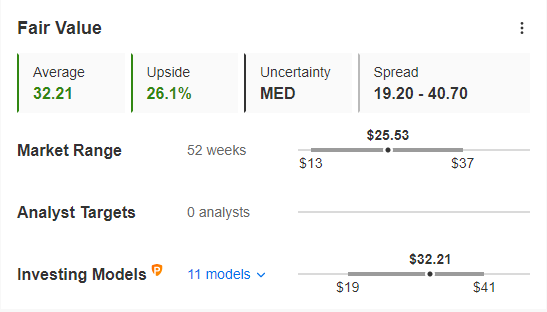

Source: InvestingPro

Based on InvestingPro analytics, Macy’s stock, which closed at $25.70 ahead of the US holiday weekend, has 26.1% upside potential based on its fair value metrics.

Depressed Stock Valuation, 90% Upside

Evercore ISI, in a note last week, said it sees a 90% upside potential in Macy’s stock, as the chain takes advantage of several opportunities. The note said:

“Not only do we see the opportunity for Macy’s to more aggressively leverage its core assets (real estate, web traffic) to create significant incremental equity value from the current depressed valuation, we are observing a culture and strategy shift that is embracing a more data-driven, disciplined approach to managing all aspects of the business (stores, inventory, marketing, promotions, costs, etc.).

In addition, the note said, the company has attracted a young customer base during the pandemic that may continue to benefit its sales: “Macy’s captured a lot of new younger customers during the pandemic, and is also just now seeing the return of its core older customer.”

Cowen, in a note last week, named Macy’s its top pick, saying the stock’s valuation is extremely attractive.

“Our top pick is M given greater upside potential on category strength, merch margins, and digital innovation.”

Macy’s aggressive e-commerce strategy is emerging as one of the biggest drivers of future growth. M is in the process of launching a digital marketplace set to begin in the second half of this year, aiming to expand its product assortment and highlight third-party merchants. The move is part of the company’s goal to generate $10 billion in sales by 2023.

Macy’s Chief Executive Jeff Gennette told The Wall Street Journal in November that the company has hired a consultant to evaluate whether it makes sense to spin off its e-commerce operations from the department store chain’s physical stores.

He added, the market is assigning huge value to e-commerce businesses and the company’s decision would depend on whether a separation would yield additional shareholder value beyond Macy’s current strategy.

Bottom Line

Macy’s earnings strength, combined with its e-commerce success, suggests that the store’s turnaround strategy remains on a solid footing and its stock presents a good buying opportunity after its recent pullback.