- Reports Q2 2022 earnings on Wednesday, May 11, after the close

- Revenue Expectation: $20.05B

- EPS Expectation: $1.19

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

When the Walt Disney Company (NYSE:DIS) reports its latest quarterly earnings tomorrow, expectations are that surging inflation, intense competition in the video streaming business and higher labor costs will weigh on the global entertainment giant’s ability to maintain a solid post-pandemic rebound. Disney closed Monday at $106.98.

Like other media companies, Disney has projected a big part of its future growth on the streaming space, betting that consumers will increasingly cancel traditional cable TV to watch movies and TV shows online.

Disney’s performance in that segment has been quite impressive since the launch of its streaming app in November 2019. The company’s total subscriber number was approaching the 130 million mark by the end of last year, closing its market share gap with Netflix (NASDAQ:NFLX), which reported 222 million subscribers last month.

However, the post-pandemic environment has created a more challenging backdrop for the sector. The recent dismal earnings release by Netflix supports the case that the House of Mouse will likely struggle to add new subscribers for its Disney+ services as the streaming business goes through a major correction.

The bright side for the Burbank, California-based entertainment giant is its legacy businesses, including theme parks, cruises, and movie theaters which, despite growing macroeconomics risks, should continue to thrive amid rising travel and leisure demand.

The division saw revenues top $7.2 billion during the fiscal first quarter, double the $3.6 billion generated in the prior-year quarter. The segment saw operating results jump to $2.5 billion compared to a loss of $100 million in the same period last year.

Diversified Revenue Stream

This year, Disney’s stock performance indicates that the company’s diversified revenue stream is helping the company perform better than its peers in the current market downturn.

Its shares have lost more than 30% in 2022, about half the losses suffered by Netflix. Both companies had similar stock market values as recently as late December, at about $275 billion.

On a call with investors in February, Disney Chief Financial Officer Christine McCarthy said new technologies, such as mobile phones for hotel check-in and food ordering, have reduced costs, adding that a return of live events and international visitors should boost attendance in the near future.

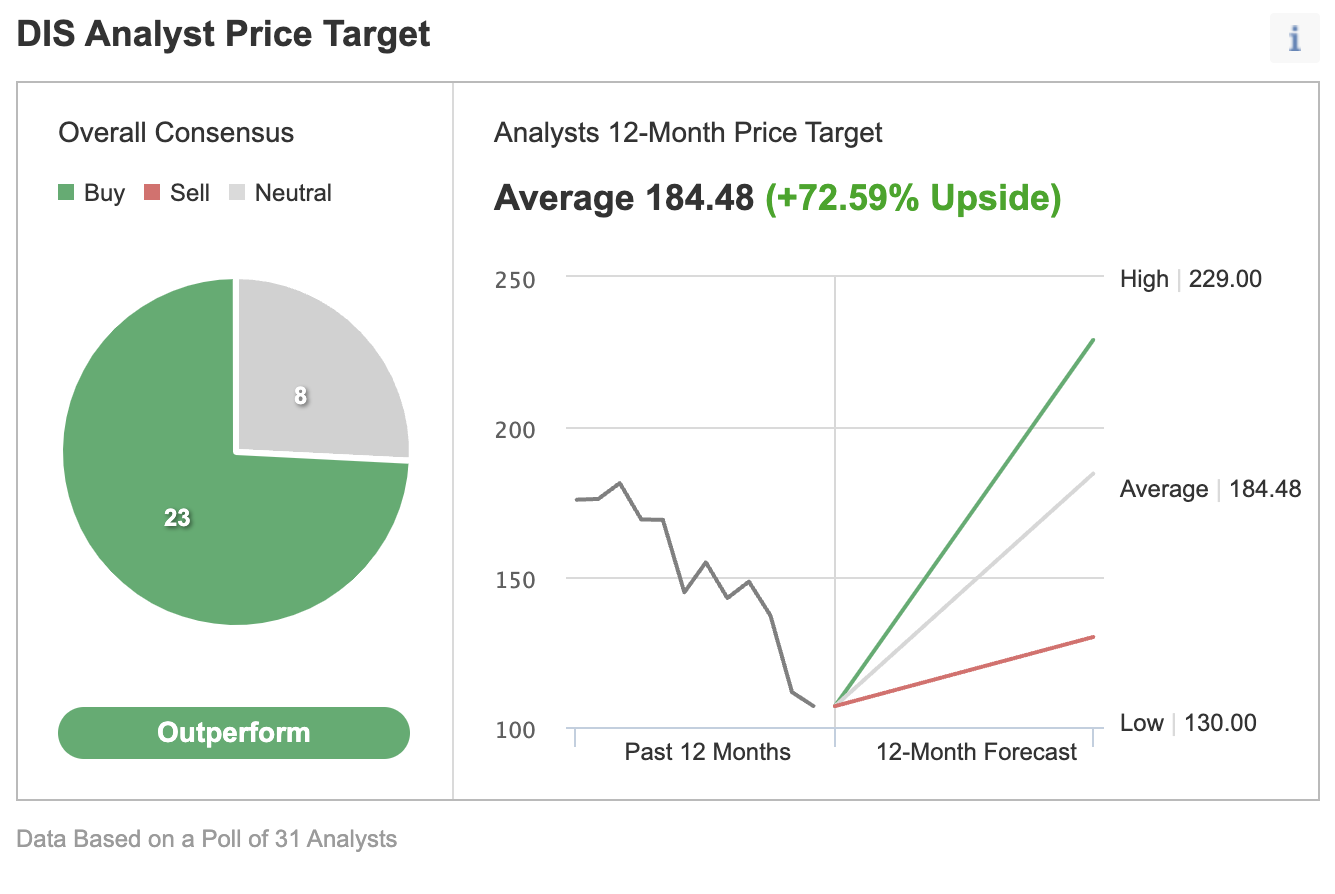

Disney’s resilience during one of the most challenging times for the entertainment industry has encouraged many Wall Street analysts to remain positive on its outlook. Analysts’ consensus estimate in an Investing.com poll of 31 forecasters implies a 72.5% upside potential for the stock.

Source: Investing.com

In a recent note, Morgan Stanley reiterated Disney as overweight, saying Disney’s Parks division will help strengthen the company’s earnings per share outlook. The note said:

“We raise our Parks estimates and believe Disney is implementing technology and operational tools that should drive structurally higher growth and incremental margins in the years ahead. However, streaming remains a show-me story, but success is not priced in.”

Wells Fargo also sees more upside in Disney’s Parks business. According to its note:

“Looking at peer businesses and operating performance, we see scope for both revenues and margins to track higher than our current model/consensus.”

Bottom Line

Disney remains a top pick for many Wall Street analysts due to a strong rebound in demand for its parks and other entertainment assets that got hit during the pandemic.

Due to this strength, the company is in a privileged position to deal with economic shocks, such as interest rate hikes and a recession.

The current market makes it harder than ever to make the right decisions. Think about the challenges:

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »