This article was written exclusively for Investing.com

- Demand creates new products

- New SEC chief is a fin-techie

- Coinbase IPO, a suite of crypto ETFs will turbocharge the asset class

- Tradeoffs and compromise on regulation will lead to ETFs

- Expect another surge when ETFs come to market

Bitcoin, Ethereum, and many other digital currencies have exploded higher over the past months in a parabolic move for the crypto asset class. These instruments have only been around for a little over a decade.

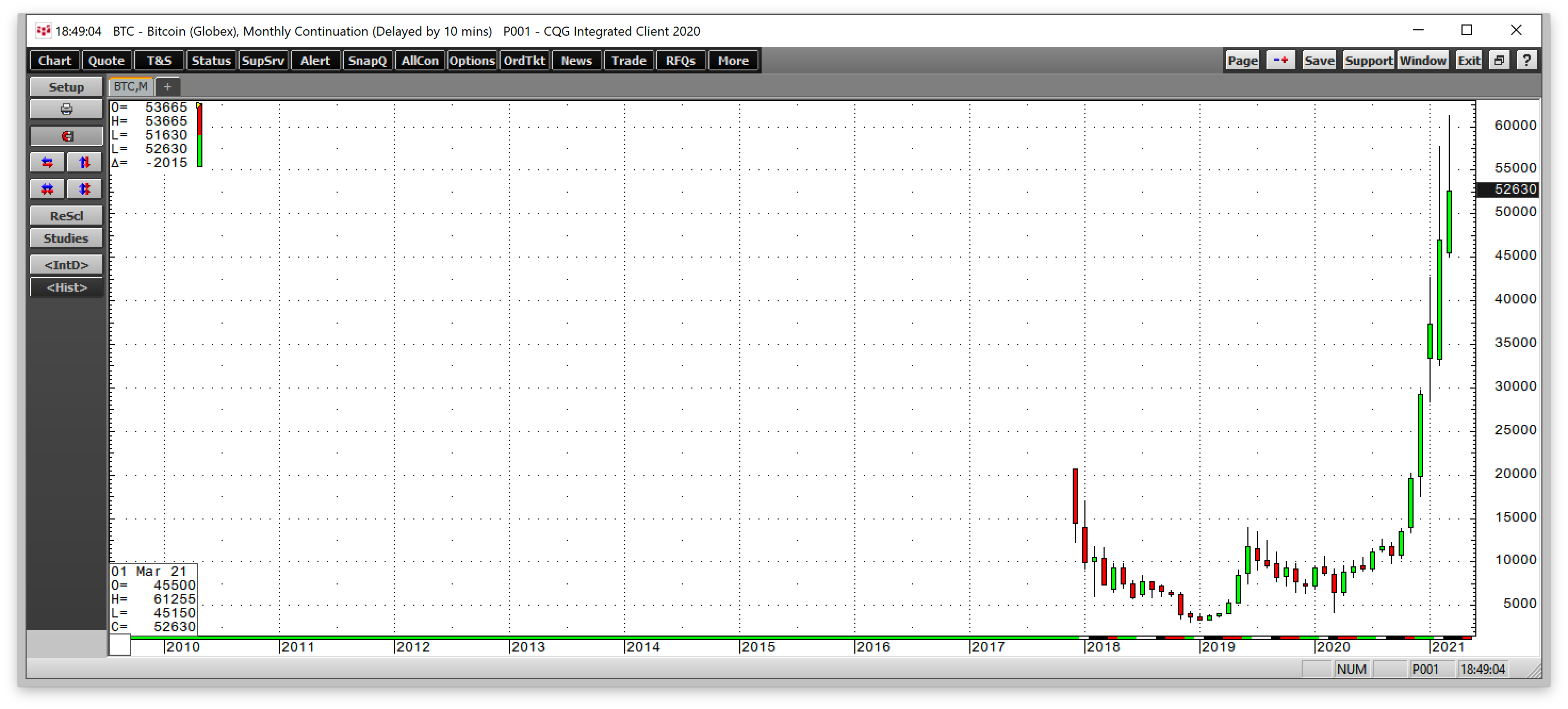

It is hard to believe that in 2010, a Bitcoin token that recently traded over the $61,000 level cost only 6 cents. At $60,000, a $10 investment in Bitcoin in 2010 is now worth nearly $10 million.

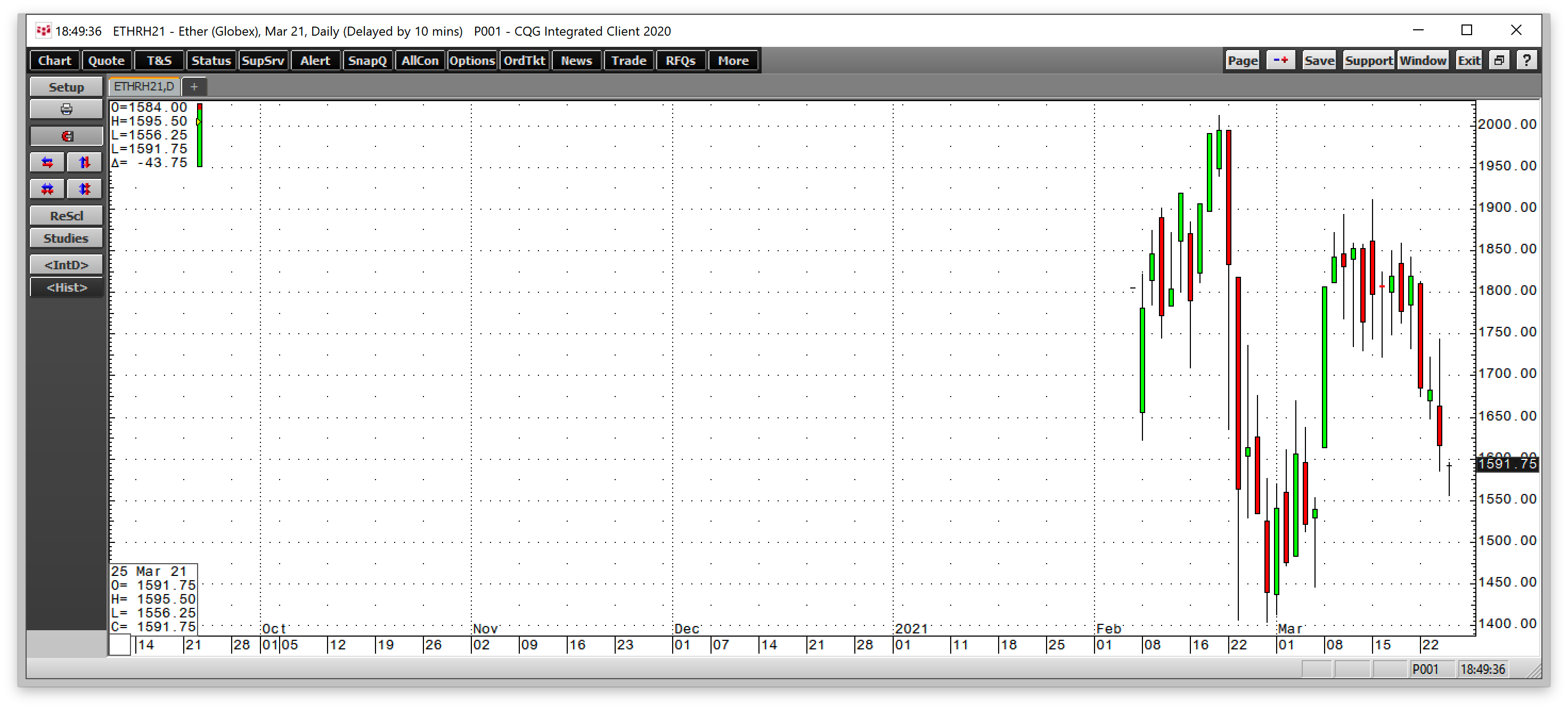

The rally that took Bitcoin to the $20,000 level for the first time in late 2017 came on the back of the introduction of futures contracts based on the cryptocurrency's value. On Feb. 8, the rollout of futures on Ethereum lifted the price of the second-leading cryptocurrency to almost $2000. On Mar. 24, both tokens backed off from the recent highs, but were still at lofty levels.

Later this year, Coinbase, the leading US digital currency exchange, will go public. The latest forecasts for its value are in the $90 to $100 billion range. The next significant event for the asset class will be introducing ETF and ETN products on Bitcoin, Ethereum, and some of the other nearly 8,800 tokens.

However, approval of ETFs and ETNs will require some much-needed cooperation between the burgeoning markets and government regulators. If they get it right, we could see the current $1.7 trillion market cap of the crypto universe explode. The asset class is still worth less than Apple (NASDAQ:AAPL), the world’s largest company. ETFs and ETNs would power the cryptocurrency’s value to new heights.

Demand creates new products

The ascent of the digital currency asset class has sparked lots of interest in the tokens. Everyone loves a bull market as rising prices create a magnetic pull for investors and traders.

There have been few markets that offered the same percentage gains as digital currencies. Moreover, the decline in the faith and credit of traditional currencies provide further support for Bitcoin, Ethereum, and the other over 8900 cryptocurrencies.

As the market cap and transaction volumes rise, the demand for new products that replicate the price action in the cryptos increases. Meanwhile, custody issues, the fear of holding digital currencies in computer wallets, and uncertainty over transacting through new exchanges have prevented many market participants from buying and selling the tokens.

The lack of regulation and government support has kept many of the leading financial institutions from offering the asset class to their customers. New products that ease these concerns would expand the addressable market. We could see an explosion of participation almost overnight should any of this occur.

New SEC chief is a fin-techie

Gary Gensler, the former head of the Commodity Futures Trading Commission, was the first to designate Bitcoin and digital currencies as commodities. Commissioner Gensler served as CFTC Chairman during the Obama administration. His successor, under the Trump administration, Christopher Giancarlo, continued the work that allowed the CME to introduce Bitcoin futures in 2017. In February 2021, Ethereum futures began trading on the CME.

After his service at the CFTC, Commissioner Gensler became a professor of the practice of global economics and management at the MIT Sloan School of Management and co-director of MIT’s Fintech program at the MIT Media Lab Digital Currency Initiative. He conducted research and taught on blockchain technology, digital currencies, financial technology, and public policy.

In 2021, President Joseph Biden appointed Mr. Gensler as the chairman of the Securities and Exchange Commission. At the SEC, Gensler will be in a position to approve ETF and ETN products on digital currencies. Given his experience at the CFTC and MIT, it is likely that the fin-techie will work with markets to roll out the products sooner rather than later.

Coinbase IPO, a suite of crypto ETFs will turbocharge the asset class

The CME futures were the first step that provided official acknowledgment of Bitcoin and Ethereum as mainstream assets. Later this year, Coinbase, a US digital currency exchange, will offer shares in an IPO currently valued at the $90 to $100 billion level. Coinbase seeks to become the premier exchange platform for cryptocurrencies like the Chicago Mercantile Exchange, and Intercontinental Exchange are for other asset classes.

As Exchange Traded Funds (ETF) and Exchange Traded Notes (ETN) on the digital currencies appear on the scene, it would increase liquidity. The ETFs and ETNs would hold risk positions in individual cryptos or baskets of digital currencies.

An actively traded options market would likely emerge, further increasing the volume and open interest necessary to increase the asset class’s breadth. Added liquidity would make digital currencies more accessible to market participants. A Coinbase IPO, ETF and ETN products, and an options market would likely turbocharge the asset class’s market cap, which currently stands at the $1.7 trillion level.

While $1.87 trillion is a substantial number, it is less than the latest US stimulus package, making it low for an entire asset class containing over 8900 tokens.

Tradeoffs and compromise on regulation will lead to ETFs

One of the hurdles cryptocurrencies face is a wide gulf between the asset class’s philosophy and the vested interest of governments. Cryptos are global currency assets that operate on blockchains, a technological marvel. Governments are embracing blockchain, but when it comes to the individual cryptos, not so much.

Digital currency devotees favor the means of exchange because they transcend borders, move higher and lower on equilibrium prices determined by buyers and sellers, and cannot be manipulated by governments, central banks, and monetary authorities.

The government entities derive power, at least partially, from the control of the money supply. Controlling the purse strings via traditional currency instruments is not a power they want to surrender. The current tidal wave of liquidity from the US Fed that is supposed to be “stabilizing” the economy would be impossible in a world where the means of exchange were pan-global digital currencies.

Still, it is only a matter of time until governments roll out versions of digital money. One of Chairman Gensler’s challenges will be to reach a compromise between the crypto market and US and European regulators.

Success could earn him the Nobel prize for economics. Failure would leave a two-tier financial system where regulated means of exchange compete with a rising unregulated system. I believe Chairman Gensler has the background, knowledge, and support from governments and the crypto markets to succeed. His first challenge will be to approve ETF and ETN products with the right regulatory balance.

Expect another surge when ETFs come to market

When ETFs burst on the scene, expect another surge in the digital currency asset class’s market cap as we saw in late 2017 when the CME rolled out Bitcoin futures.

Source, all charts: CQG

The chart above shows that the Bitcoin price surged to over $20,000 per token in December 2017 when the CME introduced the first futures contract, which was an all-time high at the time.

On Feb. 8, 2021, Ethereum futures began trading on the CME. The price rose to over $2000 per token, an all-time high.

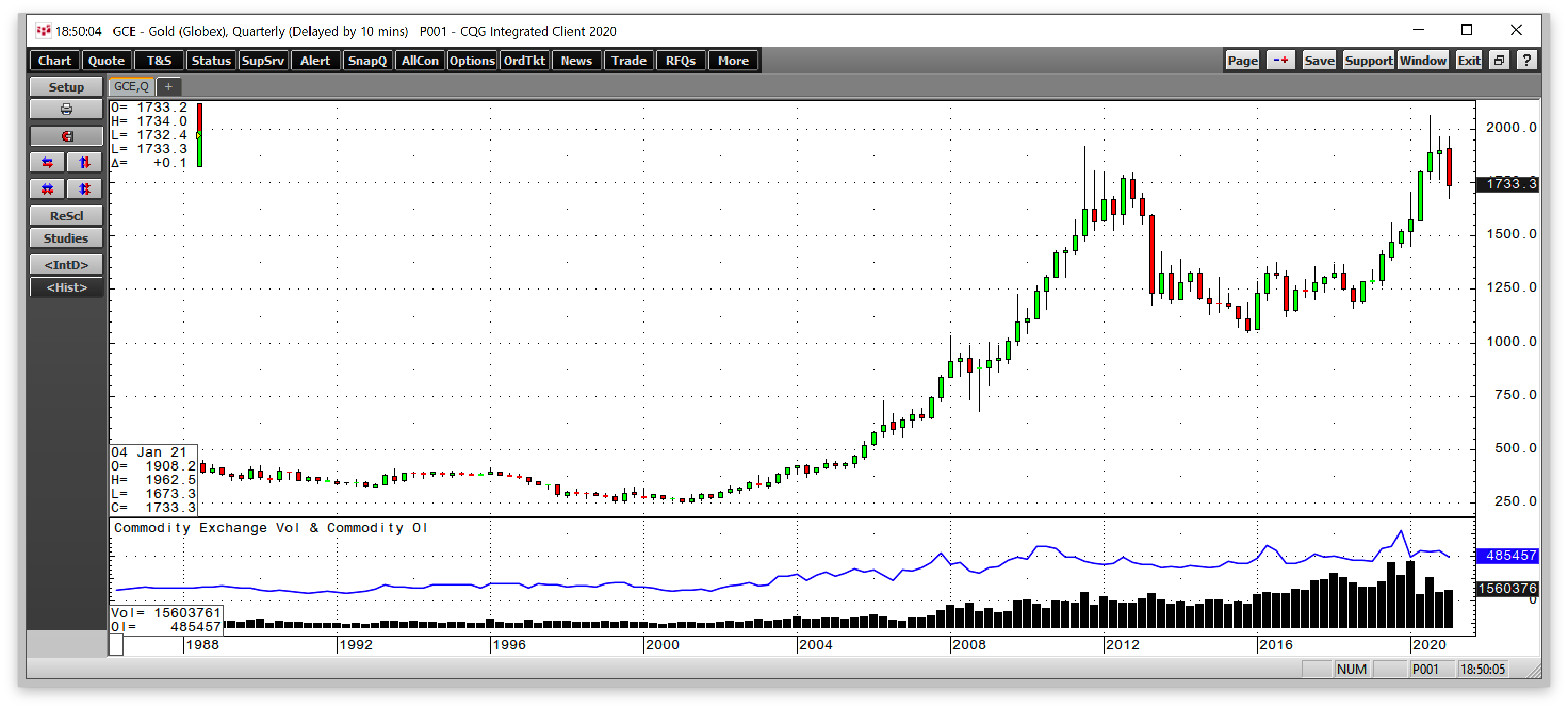

In 2004, The SPDR® Gold Shares (NYSE:GLD) began trading. Before 2004, the all-time high in gold was in 1980 at $875 per ounce.

The quarterly chart shows that the total number of open long and short positions on the COMEX gold futures contracts was below the 300,000 level before 2004. Quarterly volume was below 355,000 contracts. After releasing of the GLD ETF product that made gold available through market participant’s stock investment and trading accounts, the open interest and volume metrics moved significantly higher.

Moreover, the gold price was at $415.80 at the end of 2003. After the introduction of the first ETF, and many others followed, the gold price exploded higher. Gold has not traded below $500 per ounce since 2005.

With over 8900 digital currency tokens circulating, the potential for ETF and ETN products is incredible. The introduction of these products and options on digital currencies will cause the asset class to take a giant step towards becoming mainstream assets of the future.