Global markets experience a calmer outlook as inflation continues to decrease. The latest US CPI figures came in at 4% year-on-year, recording the lowest reading since March 2021.

For the first time in 15 months, the Fed has paused interest rate hikes, a move that should have spiked confidence in the equity markets.

However, despite the positive outlook, the Fed is yet to achieve its 2% target, and on yesterday’s FOMC meeting, the Committee clearly signaled that they are not considering easing the interest rate levels anytime soon.

If you ask me, I think we are closing in on the last quarter of the bear market conditions. Sentiment turned bullish for the first half of the year, and now market participants are waking up to the fact that it will take even more time before things get better.

Such times are not ideal for being long in the market as the rapid shift in sentiment will likely continue with valuations going nowhere. However, I find it likely that now is the time to eye for positions.

With that, a well-meant reminder that the tides always turn at some point.

Crypto Market Fatigue: BTC Slightly Holds as Altcoins Tumble

The crypto market liquidity dropped by close to 4% on Wednesday, signalling fatigue and the effects of SEC lawsuits against Binance and Coinbase (NASDAQ:COIN) last week.

What’s interesting to observe is that Bitcoin's price is holding up much better compared to altcoins; the former has only tanked by around 5% so far, in comparison to most altcoins which are down over 15% over the past week.

It is in times like this that BTC's resilience in the face of market fluctuations showcases its perceived store of value as the ‘digital gold’ and potential to act as a safe haven asset.

Binance Woes Continue

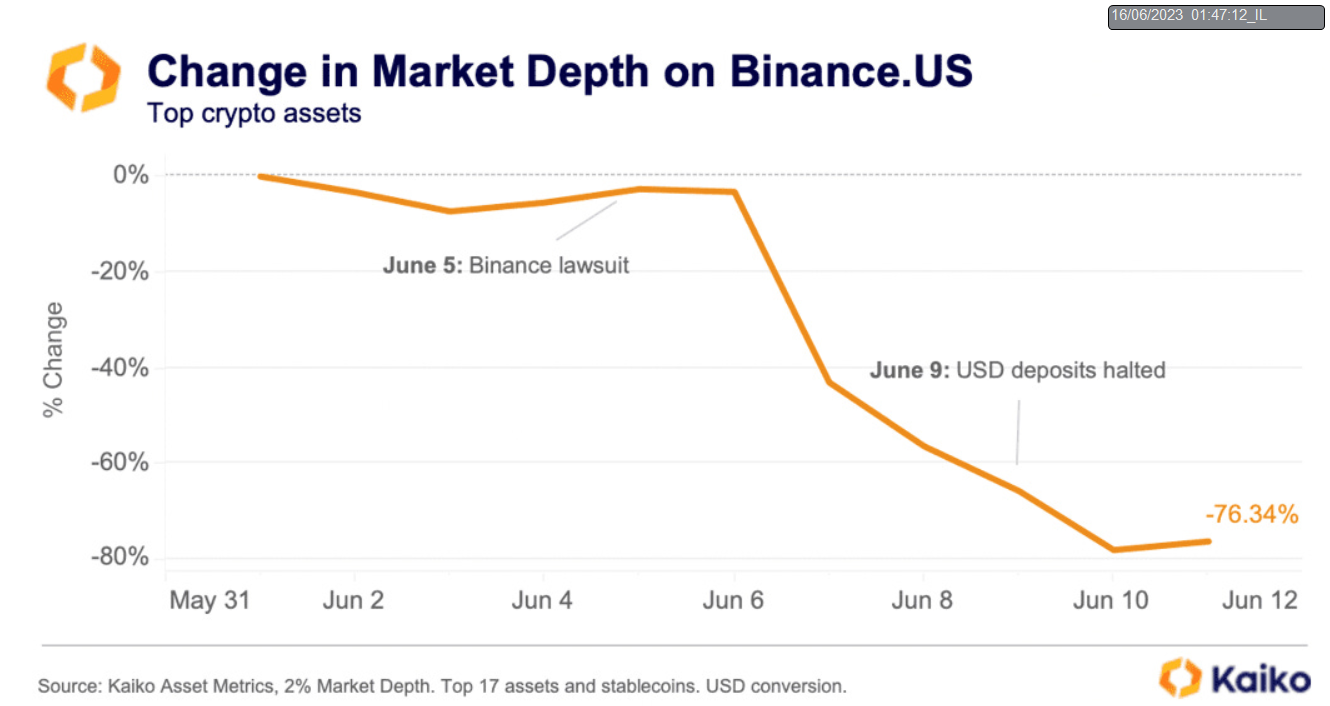

Binance.US's woes seem to be far from over. Although a US judge recently denied the SEC's request to freeze funds, this has not stopped market makers from fleeing the troubled exchange.

According to the latest data from Kaiko Research, liquidity on Binance.US has dropped by over 80% within the past week, from highs of $34 million to below $7 million. The BNB native token is also down to $247 as of writing, from over $310 before the SEC lawsuit news broke.

Image source: Kaiko

The latest actions by the US SEC will undoubtedly have far-reaching consequences for the crypto industry. On one hand, it could be the final blow for crypto companies to exit the US, while on the other hand, it could set the stage for regulatory clarity.

Noteworthy Mentions

-

Blockchain and AI: The Forces Shaping the Fourth Industrial Revolution

Artificial Intelligence (AI) is currently the hottest topic in the tech industry, with VCs pivoting, and companies like Nvidia (NASDAQ:NVDA) reaping big from their AI-oriented products. But what can a combination of AI and Blockchain achieve? You'd be surprised by how complementary these two revolutionary technologies are.

Industry Shakers

-

BlockFi says customer withdrawals could start this summer

BlockFi, the infamous crypto lending company that temporarily halted withdrawals following the collapse of the FTX exchange, has announced its plans to enable certain customers to retrieve their funds starting this summer. The company is currently working on necessary improvements and testing to facilitate the process. Withdrawals will be conducted in batches, and eligible individuals will receive personalized emails from BlockFi.

-

House Republicans try to oust Gensler with a new bill

After going hammer on crypto last week, Gary Gensler is facing some heat. Two House Republicans, Rep. Warren Davidson of Ohio and House Majority Whip Tom Emmer of Minnesota have collaborated on a bill called the SEC Stabilization Act. The proposed legislation aims to remove Gary Gensler from his position as SEC chair and replace it with an "executive director" responsible for overseeing operations.

-

a16z Opening Office in London (citing clear regulatory guidelines)

Just days after intensified regulatory actions by U.S. authorities on the digital assets industry, a16z crypto, the crypto investment division of Andreessen Horowitz, announced the launch of its first overseas office in London. Recognizing the significance of a robust regulatory framework for the success of the crypto space, a16z crypto cited the United Kingdom's existing regime as conducive to fostering startups while ensuring consumer protection from fraud and manipulation.

-

Bank of China issues $28M in digital structured notes on Ethereum blockchain

BOCI, the investment bank subsidiary of Bank of China, recently revealed the launch of digital structured notes valued at 200 million Chinese yuan ($28 million) on the Ethereum blockchain. This groundbreaking initiative establishes BOCI as the first Chinese financial institution to issue a tokenized security in Hong Kong. UBS will play a key role in developing and offering the product to its clients in the Asia-Pacific region.