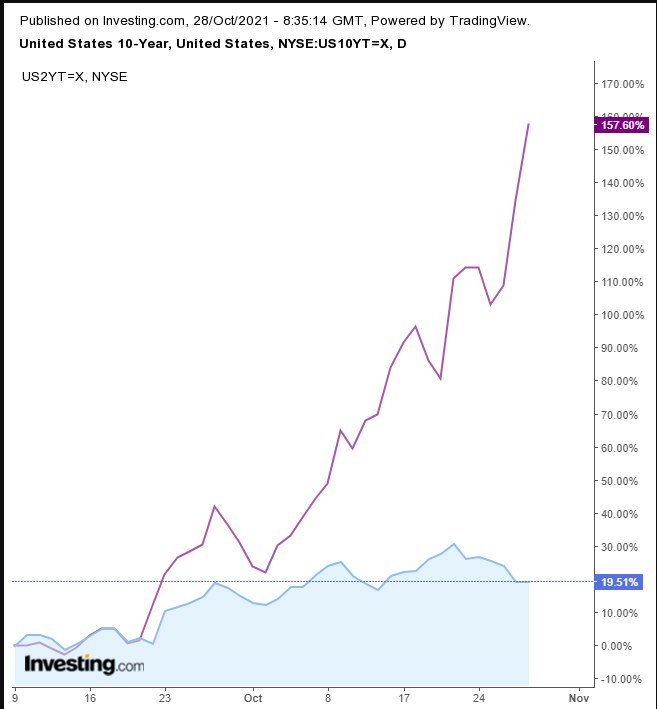

After posting a new all-time high on Tuesday, the S&P 500 Index fell Wednesday, losing 0.5%. The move coincided with a flattening yield curve as the 2-year note, representing shorter term bets, shot up while the longer-term 10-year benchmark bond moved with far less momentum.

Usually, longer-dated bonds provide a higher yield to compensate for the lengthier wait an investor must tolerate until receiving the principle.

However, yesterday, short-term yields jumped even as longer-term issues fell. That's a clear indication investors are moving their money out of short-dated notes, causing those yields to pop. When prices for longer-dated Treasuries are bid up, their payout becomes relatively smaller vs the investment, which is why their yields fall.

Presumably, investors are moving their money into longer-term bonds to preserve buying power in the face of the highest inflation in 30 years, as measured by the core personal consumption expenditures index. That's the Fed's preferred measure of inflation, as it excludes volatile food and energy prices.

The metric rose 0.3% in August, up 3.6% YoY. The September PCE data will be released tomorrow and a 0.2% gain is expected for the core measure.

That's the highest it's been since May 1991, prompting Fed Chair Jerome Powell to characterize the development as "frustrating," after insisting for months that inflation was going to be transitory.

Perhaps in anticipation, yesterday, stock investors were shifting funds out of risk assets and into safer havens.

The broad benchmark completed an Evening Star, a three-session bearish pattern.

An Evening Star begins when a rally is still going strong. Bulls add a long green candle. On the following day, the price extends the rally. However, there is a warning sign. The SPX produced only a small candle. On the one hand, it gapped up, supposedly showing momentum. However, it failed to rise beyond its opening price. That could be a cause for concern.

On the third day, Wednesday, the S&P index was unable to extend the rally, falling instead. The picture has flipped from bullish to potentially bearish. Possibly worse, when the price did not merely drop from Tuesday's advance but totally erased Monday's gains, a powerful message of pessimism was being sent. It looks like the bears are in charge now.

Finally, the middle candle is either a shooting star or a high wave candle. Either is bearish, reinforcing signs that sellers are taking over.

Yesterday, the price found support by the previous peak on Sept. 2. Will sufficient buying interest consider the fact that price overcame it as a sign of a continued uptrend? The Rate of Change (ROC) which measures momentum says no.

Trading Strategies

Conservative traders should stay out of this trade, considering it negates the uptrend.

Moderate traders would consider a short if the index retests the 4600 level again and falls back, proving continued oversupply.

Aggressive traders could short at will, provided they accept the risk to match the reward of moving before the rest of the market. Operate according to a coherent plan. Here is an example:

Trade Sample - Short Position

- Entry: 4575

- Stop-Loss: 4600

- Risk: 25 points

- Target: 4500

- Reward: 75 points

- Risk:Reward Ratio: 1:3

Author's Note: Trading is not fortune-telling. Rather, it's working the odds. Traders know there are up and down days. Professionals know not to get excited about either, but if they trust their strategy, they stay the course. The objective is to show steady, consistent returns on a statistical basis. Until you learn how to write a plan that agrees with your budget, timing and temperament, you may use our samples as long as you realize they're for your education only, not profit, or you'll end up with neither. Guaranteed. And there's no money back.