- There are many reasons why precious metals have been on the rise lately

- Still, with rising bond yields and the potential for a dollar recovery, the risk of a correction is high

- I have my doubts as to whether the current rally will hold for gold

Admittedly, there are good reasons why investors are buying gold and silver – namely, to protect against high inflation damaging the value of fiat currencies and given the turmoil in crypto and stock markets.

But with bond yields rising and the potential for a dollar recovery, there is the risk of a correction. Still, given the recent bullish trend, bears must see the potential reversal candle before looking to short gold or silver.

Gold (+1.7%) and especially silver (+5%) rallied sharply on Tuesday, mainly on the back of the BoJ’s surprise change to its yield curve policy. But I wonder whether the metals overreacted to the news. The BoJ’s decision has added to the hawkish ECB and FOMC meetings last week, which is why we have also seen European and U.S. yields climb higher as well. Rising yields are normally bad news for non-interest-bearing precious metals, but traders bought gold and silver anyway.

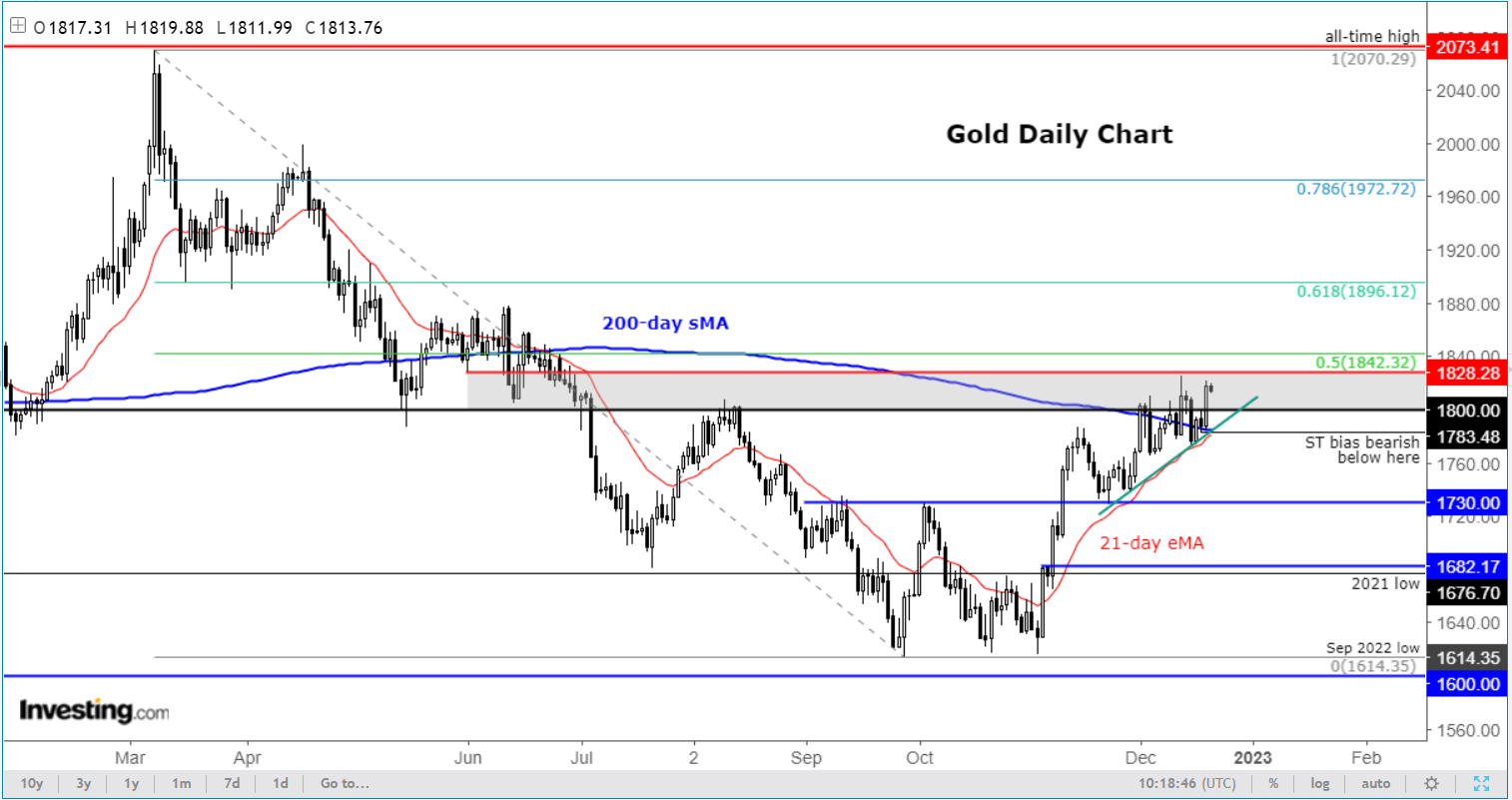

Despite my doubts, you have to respect the price action. For now, gold remains above the key $1800 level, which had been a significant support and resistance in the past. While above here, I wouldn’t act on my bearish thoughts by shorting the metal.

There might be something else that is bigger, supporting the metal. As well as central bank purchases, the fact that the likes of the Fed have pivoted to a less hawkish stance may be why investors are still happy to keep bidding gold prices higher.

Many people are also presumably buying gold to protect against high inflation damaging the value of fiat currencies and given the turmoil in crypto and stock markets.

But gold usually follows the indices, which have broken down of late. So, I have my doubts as to whether the rally will hold for gold.

Tactically, I will need to see gold go back below $1800, ideally below $1783, first. This level was the last low prior to Tuesday’s rally. A move below this level would also move gold below the 200-day average and thus provide additional technical reasons for the bears to step in.

The 200-day average has been quite an important technical indicator this month for indices. We saw big drops for the likes of the S&P 500, Russell 2000, and Nikkei 225 once they moved below their respective 200-day MAs. Will gold follow a similar pattern?

A lot will also depend on the direction of the US dollar. While the USD/JPY has sold off, providing good support for the metals, the GBP/USD, EUR/USD, and commodity dollars might all come under renewed pressure if risk appetite falls further. Stock market wobbled later owing to concerns over an economic slowdown and rising interest rates by central banks, something which precious metals investors have shrugged off – for now.

Disclosure: The author does not own any of the securities mentioned in this article.