- Shares of Boeing are down 2% since the beginning of the year

- Disappointing Q4 metrics and Russia’s invasion of Ukraine have put pressure on stock

- Long-term investors could consider buying the dip, especially if it declines toward $190.

At the end of January, shares of the aerospace and defense giant Boeing (NYSE:BA) slumped to a 52-week low of $183.77. But since then, the stock has rallied about 8%, and is down only 2% year-to-date.

By comparison, the Dow Jones US Select Aerospace & Defense Index is up 11.6% in 2022. On the other hand, Boeing’s main competitor Lockheed Martin (NYSE:LMT) is enjoying solid returns of more than 25% so far in 2022.

The past 12 months have not been good for BA shareholders. On Mar. 15, 2021, the stock went over $278 to hit a 52-week high. But since then, shares are down around 28%. BA stock’s 52-week range has been $183.77-$278.57, while the market capitalization stands at $116.0 billion.

Boeing released Q4 financials Jan. 26. Overall, the results were a big miss. However, the positive cash flow figure of $494 million was also a surprise for analysts.

Total revenue came in at $14.79 billion, down 3% year-over-year. In the commercial airplane division, revenues remained flat at $4.75 billion. But the defense, space and security division suffered a 14% decline. Meanwhile, revenues in the global services division enjoyed a 15% increase.

Adjusted loss per share was $7.69. A year ago, the comparable figure had been $15.25.

On the results, CEO David Calhoun, said:

“2021 was a rebuilding year for us… As the commercial market recovery gained traction, we also generated robust commercial orders, including record freighter sales. Demonstrating progress in our overall recovery, we also returned to generating positive cash flow in the fourth quarter.”

In 2022, management expects to see higher 787 and 737 deliveries in the commercial division, and has solid growth expectations for the global services division. However, revenues for the defense, space and security should remain flat.

Investors were not pleased with the results. Prior to the release of the fourth quarter results, BA stock was at $206. Now, it is shy of $198. Meanwhile, Russia’s invasion of Ukraine has also added to their volatility.

What To Expect From Boeing Stock

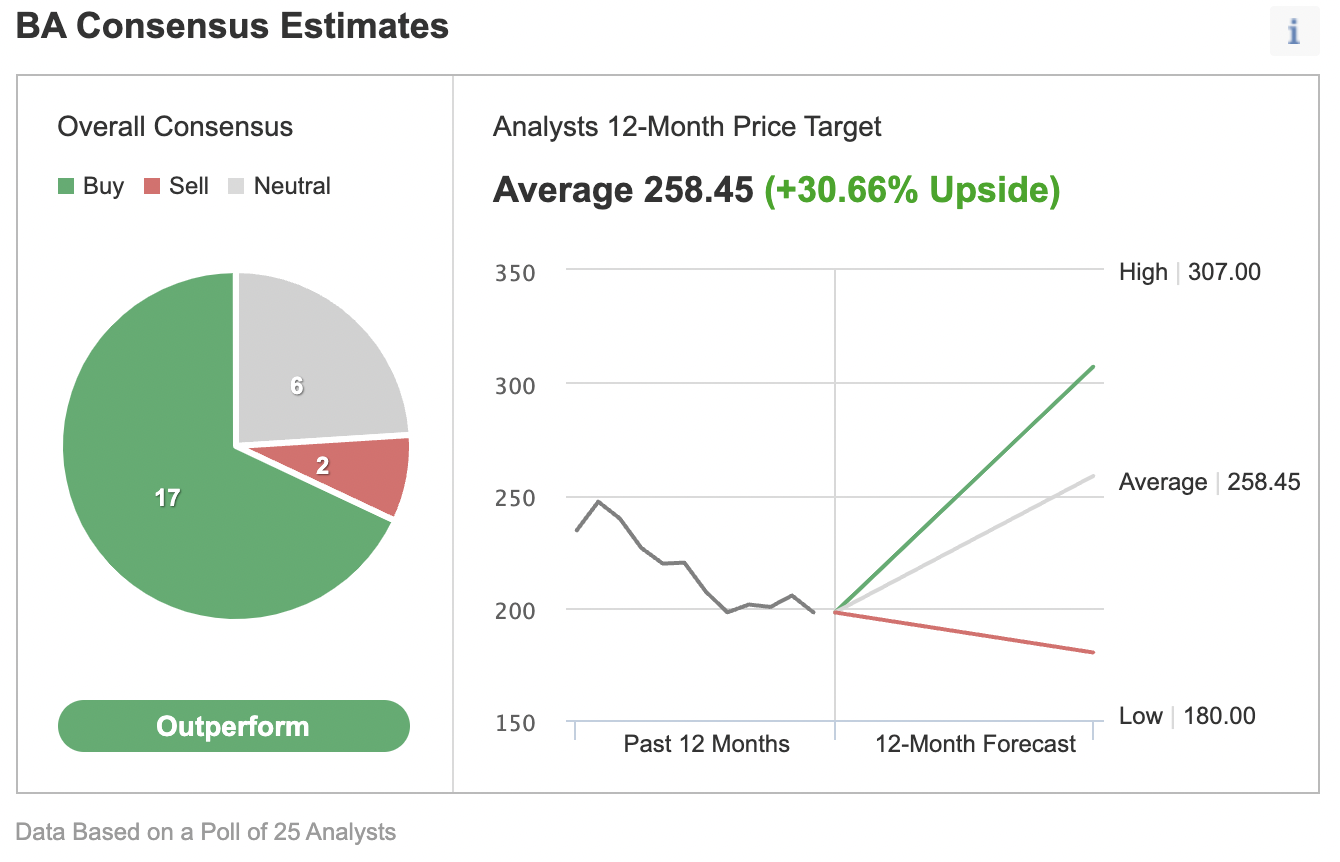

Among 25 analysts polled via Investing.com, BA stock has an "outperform" rating. Wall Street also has a 12-month median price target of $258.45 for the stock, implying an increase of more than 30% from current levels. The 12-month price range currently stands between $180 and $307.

Source: Investing.com

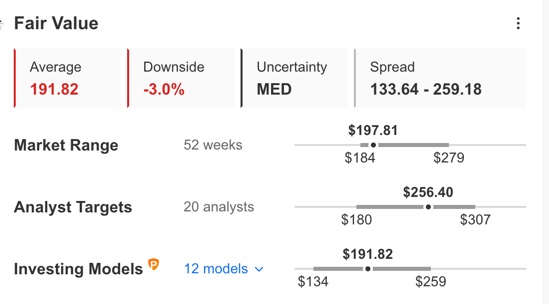

However, according to a number of valuation models presented on InvestingPro, like those that might consider P/E or P/S multiples or terminal values, the average fair value for Boeing stock stands at $191.82.

Source: InvestingPro

Put another way, fundamental valuations suggest shares should fall by 2.8%.

In comparison, LMT stock’s fair value stands at almost $550, implying a return of more than 22%.

Our expectation is for Boeing stock to trade in a wide range and build a base between $185 and $205 in the coming weeks. Afterwards, a new up leg in BA shares could possibly begin.

Adding BA Stock To Portfolios

Boeing bulls who believe the decline in the stock is likely to come to an end could consider investing now. Their target price would be analyst forecasted price of $258.45.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has BA stock as a holding. Examples include:

- iShares U.S. Aerospace & Defense ETF (NYSE:ITA)

- ALPS Global Travel Beneficiaries ETF (NYSE:JRNY)

- SPDR S&P Kensho Final Frontiers (NYSE:ROKT)

- SPDR Dow Jones Industrial Average ETF Trust (NYSE:DIA)

- Fidelity® MSCI Industrials Index ETF (NYSE:FIDU)

Although investors might want to buy BA stock for their long-term portfolios, they could also be nervous about further declines in the coming weeks. Therefore, some might prefer to put together a “poor man’s covered call” on the stock instead.

So, today, we introduce a diagonal debit spread on Boeing by using LEAPS options, where both the profit potential and the risk are limited. Investors who are new to the strategy might want to revisit our previous articles on LEAPS options first before reading further.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on BA stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Diagonal Debit Spread On BA Stock

Price at time of writing: $197.40

A trader first buys a longer term call with a lower strike price. At the same time, the trader sells a shorter term call with a higher strike price, creating a long diagonal spread.

Thus, the call options for the underlying stock have different strikes and different expiration dates. The trader goes long one option and shorts the other to make a diagonal spread.

Most traders entering such a strategy would be mildly bullish on the underlying security. Instead of buying 100 shares of BA, the trader would purchase a deep in the money LEAPS call option, where that LEAPS call acts as a “surrogate” for owning the stock.

For the first leg of this strategy, the trader might buy a deep in the money (ITM) LEAPS call, like the BA Jan. 19, 2024, 150-strike call option. This option is currently offered at $58.30. It would cost the trader $5,830 to own this call option, which expires in less than two years, instead of $19,740 to buy the 100 shares outright.

The delta of this option is close to 80. Delta shows the amount an option’s price is expected to move based on a $1 change in the underlying security.

If BA stock goes up $1 to $198.40, the current option price of $58.30 would be expected to increase by approximately 80 cents, based on a delta of 80.

However, the actual change might be slightly more or less depending on several other factors that are beyond the scope of this article.

For the second leg of this strategy, the trader sells a slightly out of the money (OTM) short-term call, like the BA April 14 200-strike call option. This option’s current premium is $10.65. The option seller would receive $1,065, excluding trading commissions.

There are two expiration dates in the strategy, making it quite difficult to give an exact formula for a break-even point. Different brokers might offer “profit-and-loss calculators” for such a trade setup.

Maximum Profit Potential

The maximum potential is realized if the stock price is equal to the strike price of the short call on its expiration date. So, the trader wants the BA stock price to remain as close to the strike price of the short option (i.e., $200) as possible at expiration (on April 14), without going above it.

Here, the maximum return, in theory, would be about $1,188 at a price of $200 at expiry, excluding trading commissions and costs. (We arrived at this value using an options profit-and-loss calculator). Without the use of such a calculator, we could also find an approximate dollar value. Let’s take a look:

The option seller (i.e., the trader) received $1,065 for the sold option. Meanwhile, the underlying Boeing stock increased from $197.40 to $200, a difference of $2.60 per share, or $260 for 100 shares.

Because the delta of the long LEAPS option is taken as 80, the value of the long option will, in theory, increase by $260 X 0.8 = $208.

However, in practice, it might be more or less than this value. There is, for example, the element of time decay that would decrease the price of the long option. Meanwhile, changes in volatility could increase or decrease the option price as well.

The total of $1,065 and $208 comes to $1,273. Although it is not the same as $1,188, we can regard it as an acceptable approximate value.

Understandably, if the strike price of our long option had been different (i.e., not $150), its delta would have been different, too. Then, we would need to use that delta value to arrive at the approximate final profit or loss value.

Here, by not investing $19,740 initially in 100 shares of Boeing, the trader’s potential return is leveraged.

Ideally, the trader hopes the short BA call will expire out of the money, or worthless. Then, the trader can sell one call after the other, until the long Boeing LEAPS call expires in close to two years.