A little over six weeks ago, we showed Bitcoin (BTCUSD) was forming a Bull flag, and based on our Elliott Wave Principle (EWP) analyses, we found in our last update that

“…it will require at least a break back above the 20-day Simple Moving Average (20d SMA) followed by a daily close above the blue 50d SMA to ensure the low is in place. In that case, Bitcoin can attack the upper descending grey trend line of the potential Bull-flag pattern still in play. A break above that trendline will seal the deal in favor of the Bulls, and we should then ideally look for ~$92K (the Bull flag pattern’s target).”

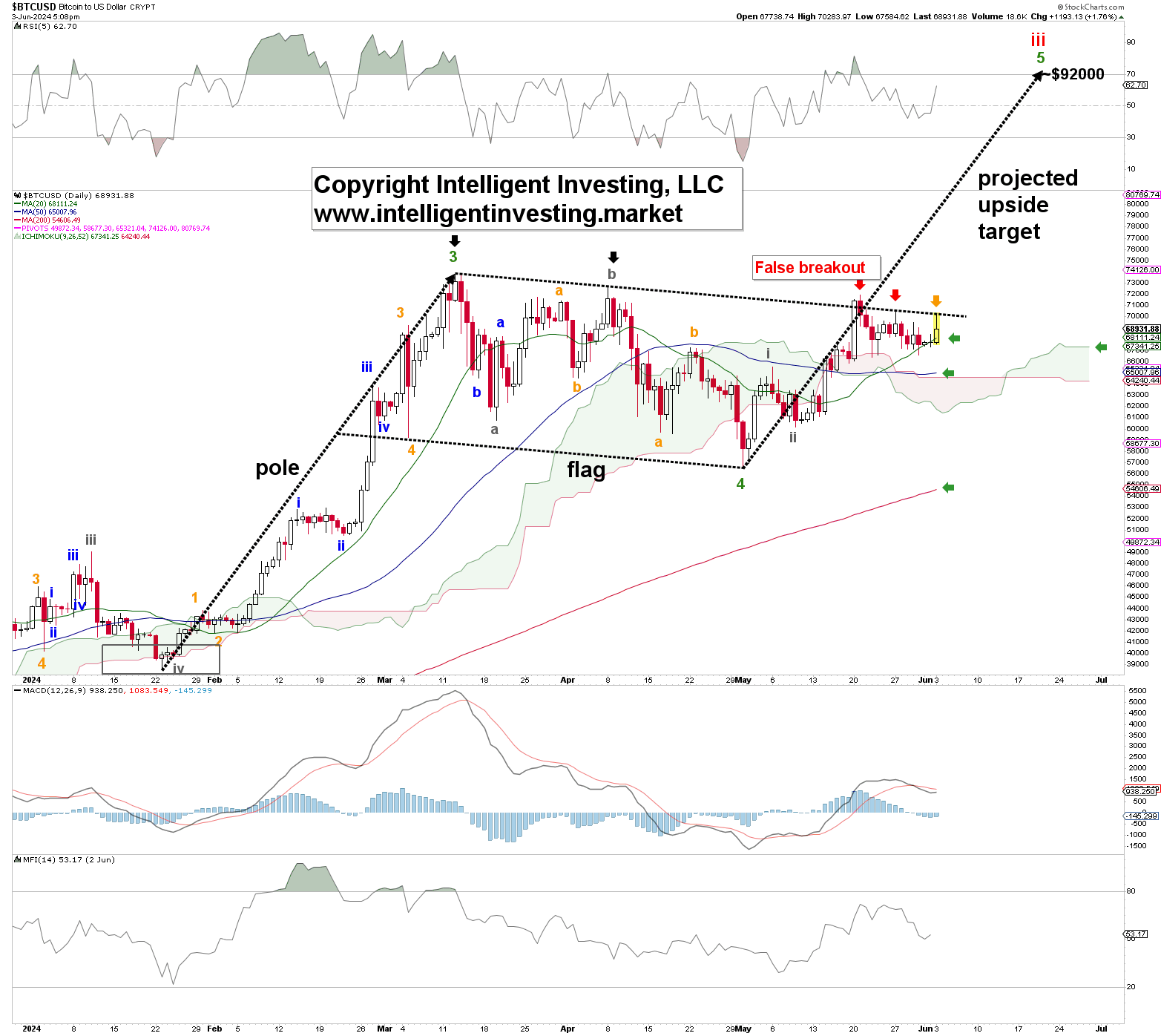

Fast forward, and BTCUSD cleared its 20d- and 50d SMAs and Ichimoku Cloud (green horizontal arrows). See Figure 1 below. Besides, it is still above its 200d SMA, and all three are rising. Thus, Bitcoin’s price is above its 20>50>200d SMA and Cloud. Thus, the daily chart is 100%, so we must be Bullish as well. However, there’s one fly in the ointment. Allow us to explain below.

Figure 1. The daily chart of BTCUSD with several technical indicators and preferred EWP count.

Since its March all-time high, BTCUSD has bumped twice into the upper trend line that forms the potential Bull flag. See the red arrows in Figure 1 above. Moreover, on May 20, it gave us a false breakout: Bitcoin closed above the trendline but closed below it the next day. Exactly one week later, on May 27, the BTCUSD Bulls tried again but failed again. Today, on June 3, see the orange down arrow, it is exactly another week later and we are back at the crime scene. We usually don’t give too much weight to trendlines as they are often subjective, but in this case, it is clearly the last hurdle the Bulls must take to be able to rally Bitcoin’s price to ideally ~$92K. That is the Bull flag’s projected upside target from the potential green W-4 low made in April. If the Bulls fail again, then our alternative comes into play. See Figure 2 below.

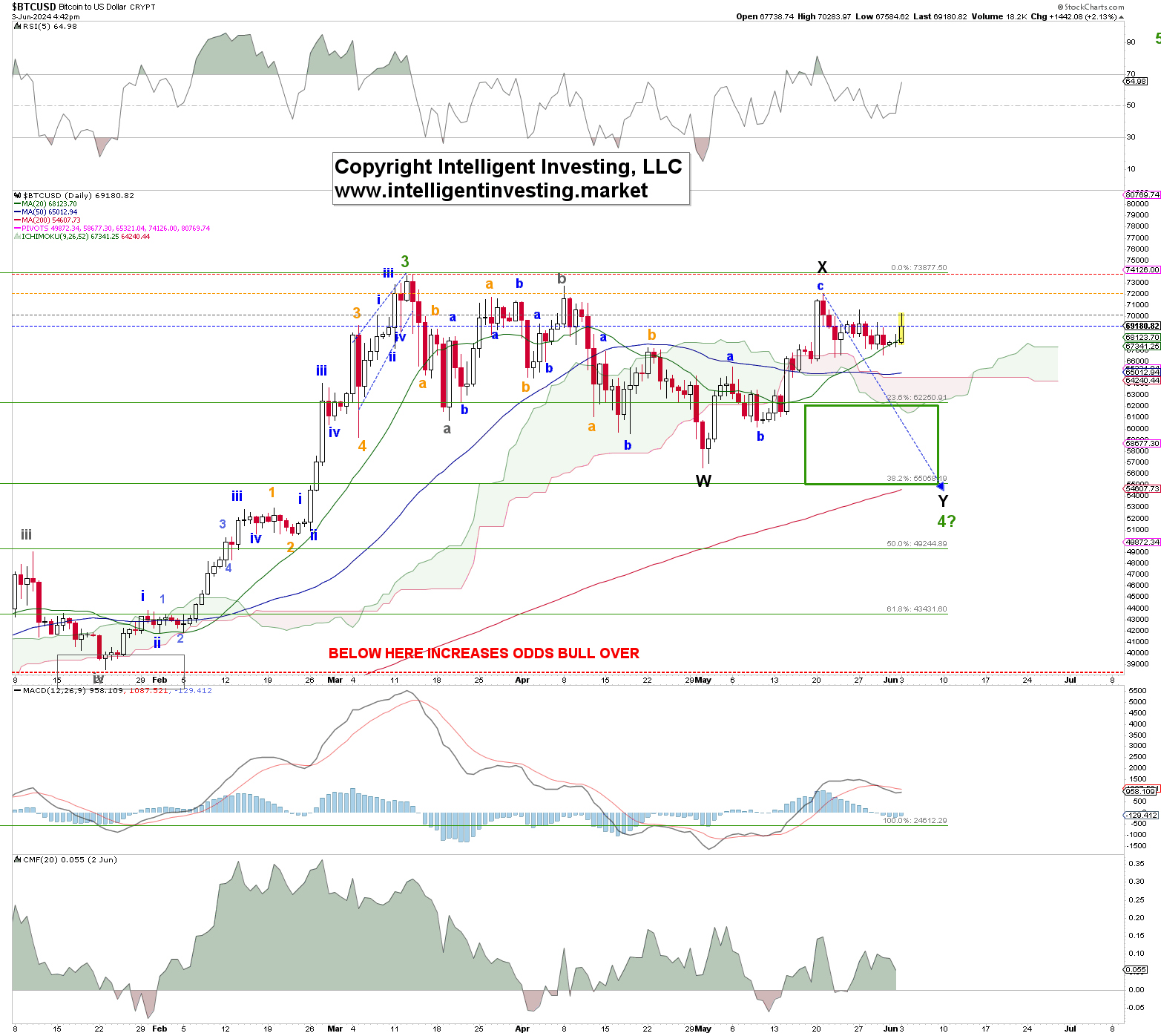

Figure 2. The daily chart of BTCUSD with several technical indicators and alternative EWP count.

In that case, BTC’s correction and the Bull flag pattern will continue for several more weeks, and the green W-4 will then morph into a double zigzag (WXY) correction, targeting ideally $54-55K. Given that Bitcoin’s chart is currently, however, and as stated prior, 100% Bullish, we must view this as less likely to happen, and we need to see BTCUSD break back below the 20d, 50d, and Ichimoku Cloud to know this is the case. Hence, our alternative is our insurance/contingency plan. If we see the breakdown happen, we will be ready for it. Until then, the chart says, objectively, we must be bullish until proven otherwise.

Thus, although we remain bullish over the long term for BTCUSD and expect it to reach well over $100K before the run since the 2022 low is over, the Bulls have one last hurdle to clear. They showed they meant business by providing a rally back above the critical SMAs, and now they need to clear the Bull flag’s upper trendline.