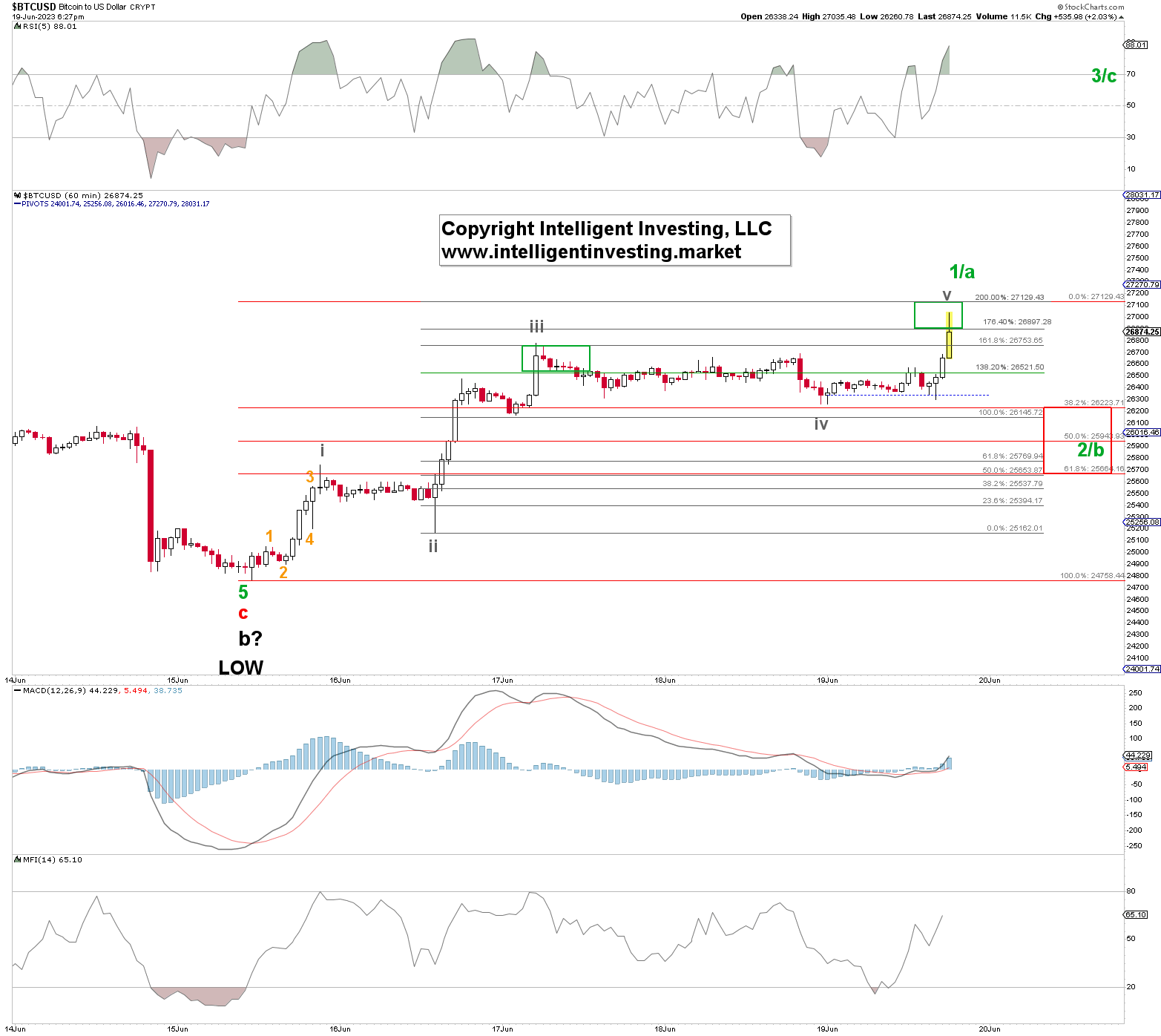

Bitcoin (BTC) made an almost picture-perfect Fibonacci-based impulse pattern, from last week’s low where grey waves I, iv, and v topped and bottomed almost precisely where they ideally should (green boxes). See Figure 1 below.

Grey wave-v of green W-1/a should now be underway as it has reached the 176.40-200.0% extension and note grey W-i comprised five (orange) waves as well. This is the first time we have seen it this good and evident in a while.

So, green W-1/a is most likely topping, and green W-2/b to ideally $25600-26200 should soon be underway, and then the next rally should target at least $28000 but preferably $29500+ for green W-3/c. Thus, a low-risk/high-reward setup (green W-2/b) is in play, because BTC must hold last week’s low at $24758 to allow for this path to unfold.

Figure 1:

Bigger picture-wise, the larger (black) b-wave we have been tracking -see Figure 2 in our last update- has likely bottomed, and a C-wave rally to $36-48K, with $42K as the optimal middle, should be underway, with the only caveat that this is a smaller counter-trend (a-b-c) bounce staying below the April high.

Hence, why we project an initial upside potential of $28-29.5K. From the EWP we know, C-waves comprise five waves. In this case, W-i, ii, iii, iv, and v. Thus, if we see five green waves up from last week’s low development to ideally around $30500 over the next few days to weeks, then we know those five are only W-i of W-c of W-B. For now, and at this stage we take it step by step and focus on green W-2/b and 3/c.

Once complete, we will monitor for the potential, albeit highly likely, W-4 and W-5.