In this Bitcoin (BTC) price prediction for 2025, 2026-2030, we will analyze the price patterns of BTC by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

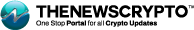

Bitcoin (BTC) Current Market Status

What is Bitcoin (BTC)?

Bitcoin (BTC) is the original decentralized digital currency created by the pseudonymous founder(s) Satoshi Nakamoto in 2009, introducing the concept of blockchain technology. BTC utilizes a peer-to-peer network and operates on a proof-of-work (PoW) consensus, where validators secure transactions through energy-intensive “mining.” The cryptocurrency has a fixed supply cap of 21 million BTC, with less than 1.35 million BTC remaining to be mined as of February 2024.

Bitcoin has shown a significant transformative journey since its inception. From being the first cryptocurrency to gaining widespread recognition, it has become a dominant force in the global financial landscape. Bitcoin holds the title of the “largest cryptocurrency” by market capitalization, and its adoption has expanded into various sectors, from retail to education and the introduction of real-world Bitcoin ATMs.

Bitcoin has recently gained mainstream attention, experiencing widespread adoption following Donald Trump’s victory in the U.S. presidential election. The cryptocurrency has been reaching new highs daily, as the U.S. administration under Trump plans to adopt “Bitcoin as a reserve currency.” Additionally, Trump has promised to make America the global crypto capital, signaling strong support for the pro-crypto agenda.

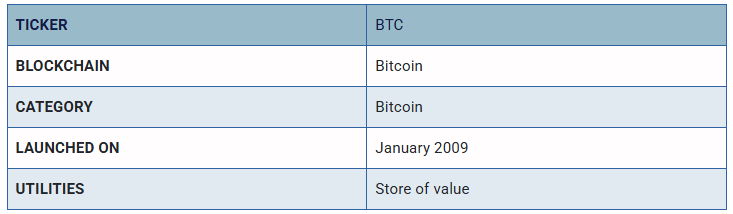

Bitcoin 24H Technicals

Bitcoin (BTC) Price Prediction 2025

Bitcoin (BTC) ranks 1st on CoinMarketCap in terms of its market capitalization. The overview of the Bitcoin price prediction for 2025 is explained below with a daily time frame.

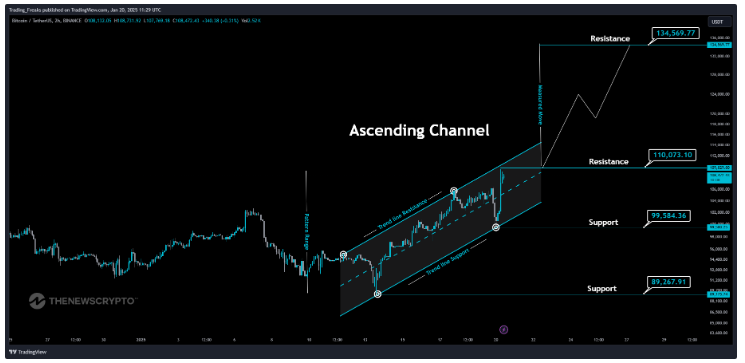

In the above chart, Bitcoin (BTC) laid out an Ascending Channel pattern. An ascending channel, or rising channel, is a bullish pattern that forms when an asset’s price makes higher highs and higher lows. The price moves between two parallel trend lines—an upper line connecting the higher highs and a lower line connecting the higher lows. As the channel slopes upward, it signals a continued uptrend. Traders see this as a positive sign, with the price likely to keep rising as long as it stays within the channel.

At the time of analysis, the price of Bitcoin (BTC) was recorded at $108,472.43. If the pattern trend continues, then the price of BTC might reach the resistance levels of $110,073.10 and $134,569.77. If the trend reverses, then the price of BTC may fall to the support levels of $99,584.36 and $89,267.91.

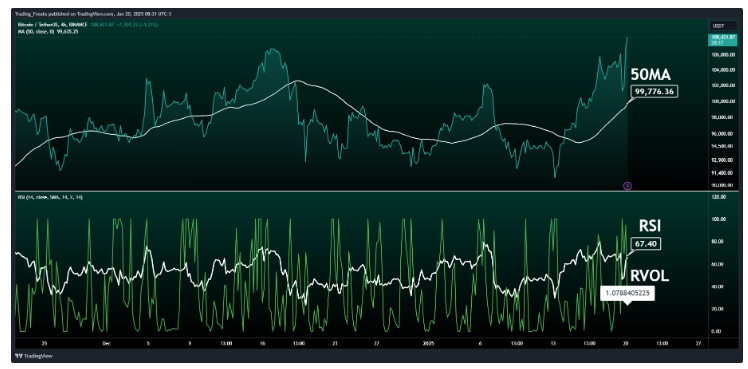

Bitcoin (BTC) Resistance and Support Levels

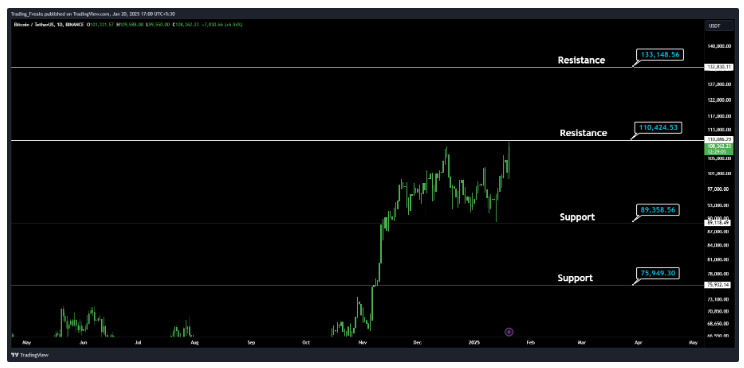

The chart given below elucidates the possible resistance and support levels of Bitcoin (BTC) in 2025.

From the above chart, we can analyze and identify the following as resistance and support levels of Bitcoin (BTC) for 2025.

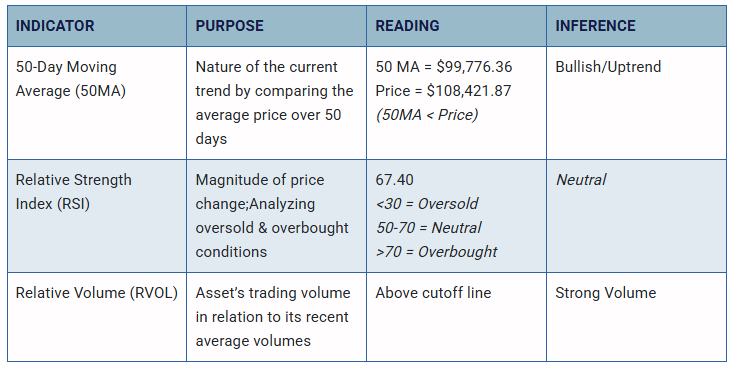

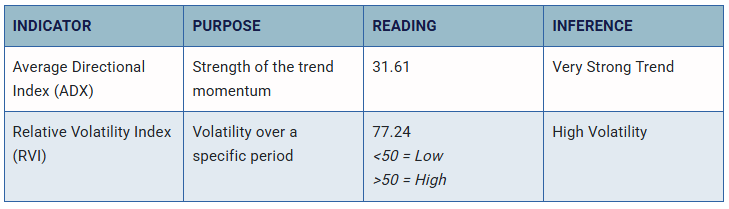

Bitcoin (BTC) Price Prediction 2025 — RVOL, MA, and RSI

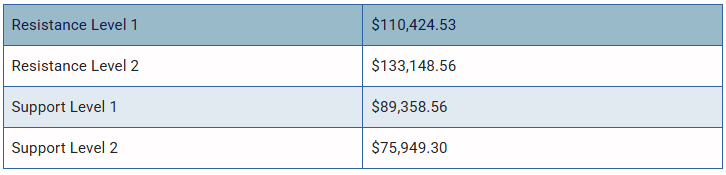

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Bitcoin (BTC) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Bitcoin (BTC) market in 2025.

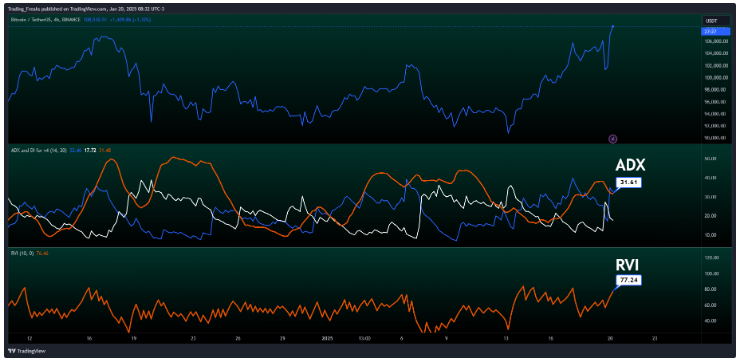

Bitcoin (BTC) Price Prediction 2025 — ADX, RVI

In the below chart, we analyze the strength and volatility of Bitcoin (BTC) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Bitcoin (BTC).

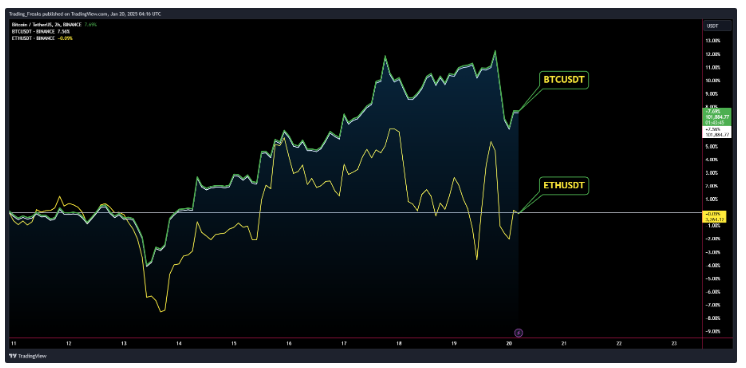

Comparison of BTC with ETH

Let us now compare the price movements of Bitcoin (BTC) with that of Ethereum (ETH).

From the above chart, we can interpret that the price action of BTC and ETH are seen to exhibit similar trajectories.

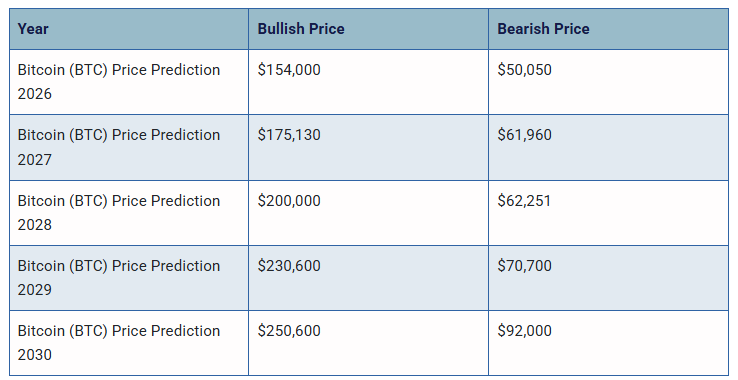

Bitcoin (BTC) Price Prediction 2026, 2027 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Bitcoin (BTC) between 2026, 2027, 2028, 2029, and 2030.

Conclusion

In conclusion, the bullish Bitcoin (BTC) price prediction for 2025 is $133,148.56. Comparatively, if unfavorable sentiment is triggered, the bearish Bitcoin (BTC) price prediction for 2025 is $75,949.30.

If the market momentum and investors’ sentiment positively elevate, then Bitcoin (BTC) might hit $150,000. Furthermore, with future upgrades and advancements in the Bitcoin ecosystem, BTC might surpass its current all-time high (ATH) of $109,114.88 and mark its new ATH.

This content was originally published by our partners at The News Crypto.