The bungee jumper doesn’t just bounce once.

Stated in a more high-falutin’ way, perturbed systems normally don’t converge straight back to equilibrium.

Obviously, the 2020-2021 COVID-triggered episode took the form of a severe shock to the system. The initial shock (to relitigate the familiar story for the thousandth time) was the panicky global shutdown initiated due to a fear of the unknown parameters of the virus. The counter-shock was the massive fiscal and monetary response to that shutdown.

Almost all of the inflation-related problems we have had since then can be traced back to the fact that the initial shock lasted 6-9 months while the counter-shock lasted multiple years. “Can you give me a little push, Daddy?” says the child on the swing. “Sure,” says Dad, who then launches Junior screaming into orbit with a mighty shove.

It doesn’t matter if Daddy stops pushing; it’ll take a while for Junior’s oscillations to get back to zero. (The therapy sessions will last for years.) And so it is with the economy. Positive momentum succumbs to gravity, which induces negative momentum, which succumbs to gravity again on the other side of the zero mark.

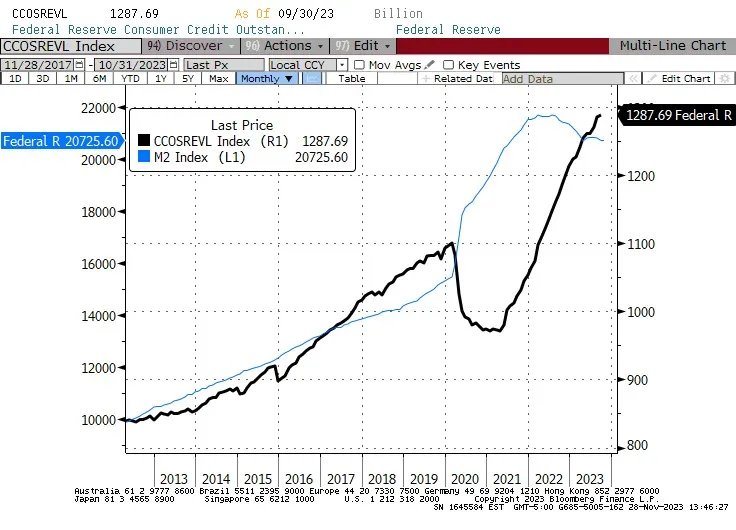

The Fed’s massive push shows up in the following chart (source: Bloomberg); highlighted in blue (left scale) is the sharp rise in M2 from 2020-2022. This surge – which indirectly financed the direct Federal stimulus payments – was meant to offset the various contractionary forces caused by forced idleness among the ‘non-essential’ workforce, such as the 140bln contraction in revolving consumer credit (in black, right scale).

So far, so good, although you can see that the M2 explosion lasted far longer than the damage to consumer credit and most other growth and liquidity metrics. The Fed adroitly (if belatedly) began to shrink its balance sheet slowly, leaning against the continued recovery in private markets. Inflation began to subside, and although it has happened more slowly than everyone would like it is going to continue a while further as rents gradually recede to a 3-4% rate of increase.

That does not, though, get the inflation rate to smoothly converge on the target even though that seems to be the forecast of a great majority of the economists out there who are employed in fancy glass and steel buildings by fancy institutions. Indeed, we are starting to see signs of a ‘hook’ higher in certain metrics that could presage a second wave of upside surprises in inflation.

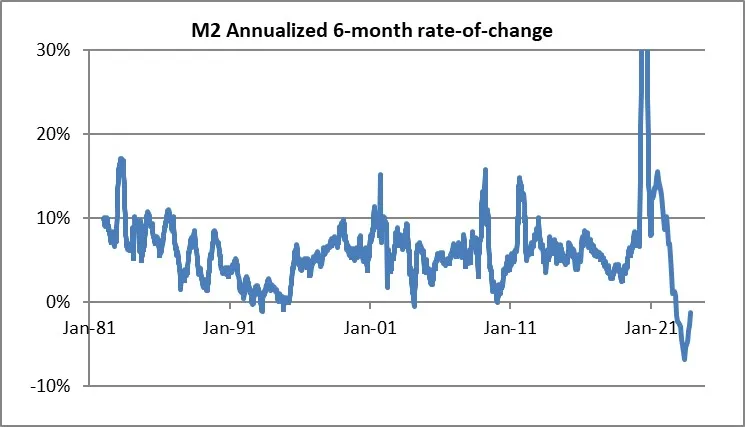

The system overcorrects the latest news from Black Friday and Cyber Monday that sales were stronger than expected driven partly by the increased popularity of ‘buy now pay later’ plans something that we perhaps should have expected. And so the combination of slow-but-constant balance-sheet shrinkage at the Fed and faster credit growth is helping to produce a gentle hook higher in money growth.

To be clear, I do not expect this ‘hook’ to produce a new high in the inflation rate, and any increase is probably not even to be enough to trigger further Fed tightening from here. But it should keep the Fed sternly standing off to the side, hands on hips, with a gaze that says plainly “Stop playing on that swing. You have chores.”

The point is…and I guess this goes back to some extent to my observation back in July that the volatility of inflation is a tell that the oscillations still have a ways to go before dampening back to equilibrium this hook is evident in lots of measures.

Recently, it has been pointed out that the year-ahead inflation expectations measure in the University of Michigan consumer sentiment survey has leaped higher despite declining gasoline prices (see chart), as consumers react negatively to the disconnect between politicians saying that prices are declining and their perceptions that prices are still increasing (even if inflation is declining).

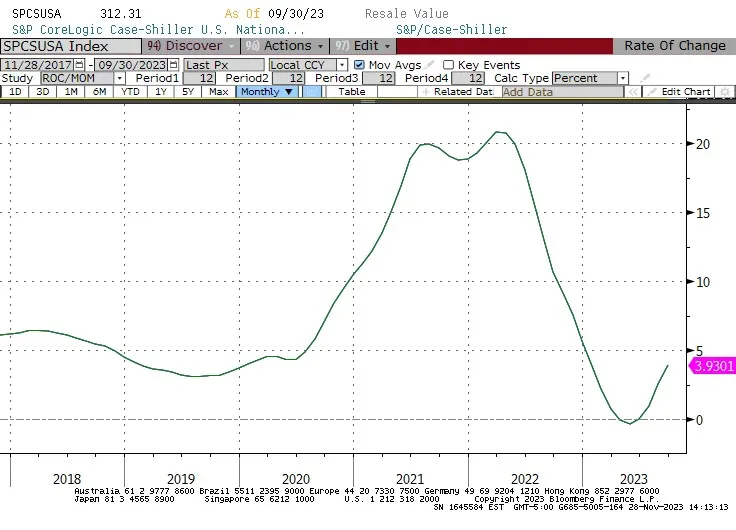

And, since the Case-Shiller numbers were out today, I’d be remiss if I didn’t point out that y/y home prices are rising again in sharp contrast to where public forecasts of rents, home prices, and housing futures have been mooted.

The reason this matters is that it seems like the investing universe is all-in on the idea that not only has inflation crested, but it is heading right back down placidly to target. The bungee jumper’s bounce is distinctly out of consensus, and it could scare some people if it is perceived as a new wave, rather than as a bounce.

The housing market re-acceleration, in particular, could start to get some attention and some observers might think that means the Fed needs to hike interest rates further. The reality here isn’t as important as the inflection in the narrative. Beware the hook.