- The crypto market rally that started this month is fizzling out already.

- Bitcoin and Ethereum remain stuck below key resistances.

- But, the two altcoins discussed below seem to be diverging from the broader market.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The cryptocurrency market started May with a flourish, with the total market capitalization showing signs of growth. However, this momentum proved fleeting, and the market has been unable to push past the $2.3 trillion mark.

This week, the negative sentiment has solidified, with outflows dominating the market and dragging prices down.

Bitcoin has yet to regain its footing. After a failed attempt to break through the $65,000 resistance level, Bitcoin is currently stuck in a sideways trading pattern.

Ethereum, on the other hand, hasn't fared much better. Rejected at $3,200, Ethereum has retreated to its support zone, which has been under pressure since April.

While the overall trend remains bearish, there are a few bright spots. RNDR/USD and TON/USD continue to defy the broader market weakness and exhibit independent price movements.

RNDR and TON Defy Broader Market Direction

RNDR has been on a year-long uptrend with only a brief correction in March-April. May saw a surge in demand that helped RNDR break free from this recent dip.

Technically, RNDR found support around $7.5 during its recent weakness. It quickly surpassed the $9 resistance level but is currently struggling to break through the second resistance near $10.7.

Indicators suggest RNDR might be overbought in the short term but remain oversold on the weekly view. This hints at a potential pullback towards $9, followed by renewed buying pressure and a possible volume increase.

If RNDR can hold above $9, it has the potential to break past the $10.7 resistance and climb toward its previous highs of $13.6, possibly even reaching $15-17. However, a daily close below $9 could trigger a drop to the $6 support level.

Overall, RNDR presents a unique opportunity in this bearish market. By staying above $9, it could complete its current uptrend and reach new heights. Investors should be aware of potential short-term pullbacks and downside risks if support levels are breached.

Toncoin (TON)

Telegram Open Network (TON) has defied the bearish trend plaguing the crypto market too. Backed by the popular messaging app Telegram, TON's positive momentum stems from several factors.

These include the expanding usage area within Telegram, a growing ecosystem of projects on the TON Blockchain network, and the addition of Tether support.

TON reached a record high of $7.66 last month but saw a correction as investors cashed out, dropping the price to $4.8. May, however, brought renewed strength for TON, with the price currently facing resistance at $6.

Technically, a daily close above $6 could propel TON towards resistance zones between $6.7-$7.4 and potentially even $8. If the price falls below $5.7, the current bullish momentum might weaken, limiting recovery potential.

A further decline could see TON test the $4.6 support level, which corresponds to the 3-month EMA value.

Overall, TON's resilience in a bearish market is impressive. A breakout above $6 could unlock further gains, but investors should be mindful of potential pullbacks and downside risks if support levels are breached.

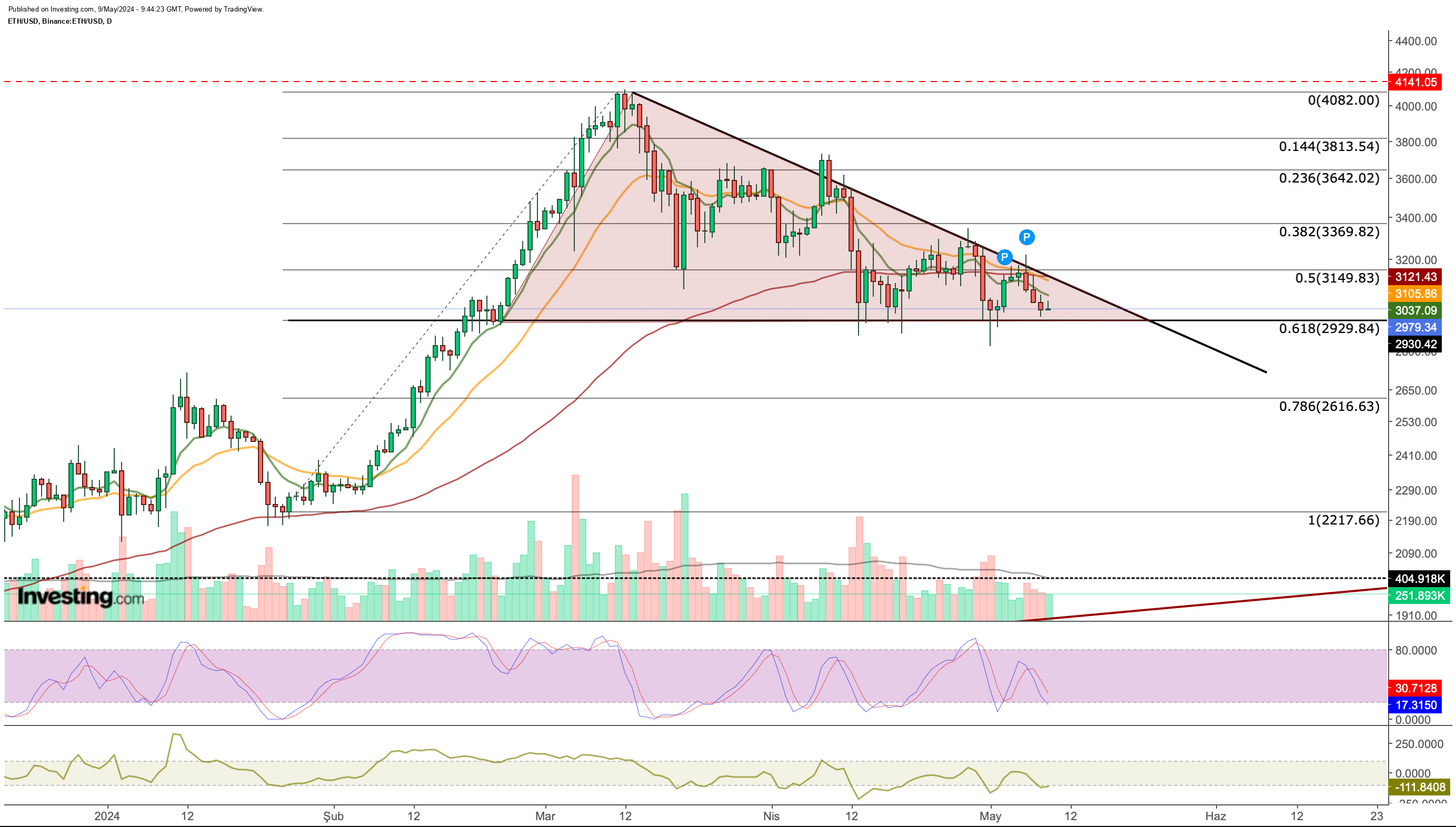

Meanwhile, Ethereum Remains Stuck in a Triangle Pattern

Ethereum remains stuck in a falling triangle pattern, raising concerns about a potential price drop. The cryptocurrency found temporary support at $2,930 last week but failed to break above $3,200 and started this week with a decline.

If the coin falls below $2,900, it could signal a bearish breakout from the pattern, potentially pushing Ethereum down to $2,600. Technical indicators also suggest selling pressure. Holding above $2,900 is crucial to prevent a steeper decline.

The $3,100-$3,150 range remains a significant resistance level for Ethereum. This month will see decisions on spot Ethereum ETFs. While the SEC currently seems hesitant to approve them, a surprise approval could lead to a surge in price towards $3,600-$3,800.

The lack of positive news could keep the Ethereum market seller-dominated for a while. Ethereum faces a critical moment. Maintaining support above $2,900 is vital to avoid a deeper fall. Positive developments or a surprise ETF approval could trigger a breakout upwards, but the current outlook leans bearish unless key support levels hold.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,745% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.