- Carl Icahn is one of the greatest names in value investing

- Like Warren Buffett, Icahn has been big on energy companies this year

- Let's take a deep look at the legendary investor's portfolio with InvestingPro

Born in Queens, New York City, on February 16, 1936, Carl Icahn started his investing career at Dreyfus & Co. as a stockbroker. From there, the philosophy major and medicine dropout climbed up the investing world ladder by working with options first at Tessel Patrick & Co and then at Gruntal & Co, where he eventually went on to head the company's options department.

His greatest breakthrough, however, came only a little later when Icahn got a family member to help fund his idea of acquiring major stakes in troubled companies in order to improve their performance and, later, re-sell them for hefty profits. That’s how Icahn & Co. was born, and, as the saying goes, the rest is history.

From then on, Icahn built a global conglomerate that helped shape the history of investing. Until this day, Icahn is widely known for finding diamonds in the rough—but only if the risk/reward ratio is interesting and attractive. Like Warren Buffett, he is a fervent advocate of value investing.

Carl Icahn's Portfolio

Now let's take a look at Carl Icahn's current portfolio using the InvestingPro tool.

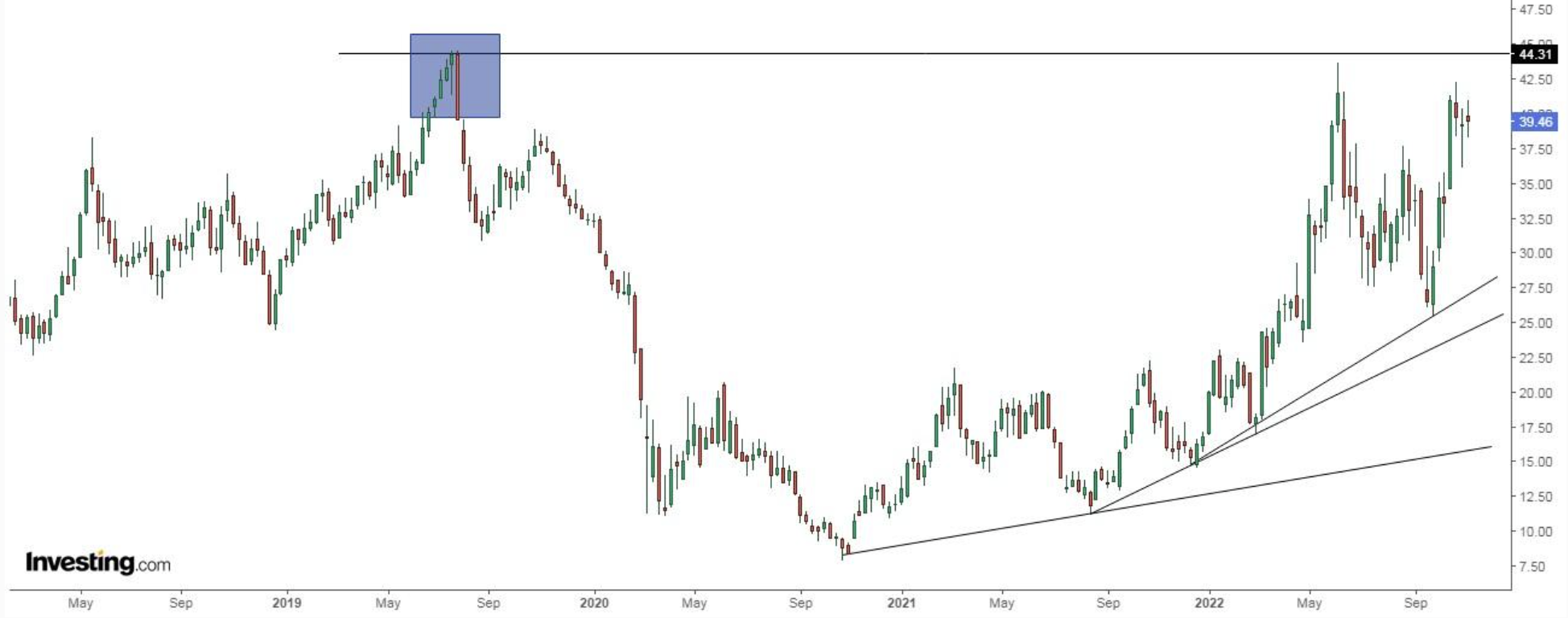

In the following chart, we can see the evolution and the accumulated profitability. Clearly ascending and, undoubtedly, an investment success.

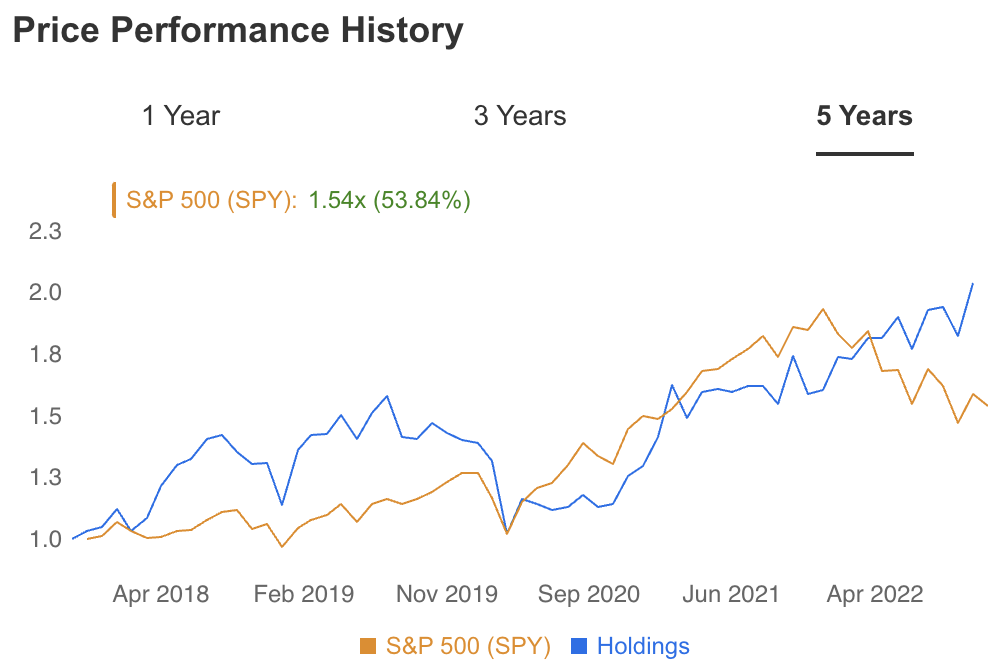

In the second chart, we can see a comparison of the profitability of its portfolio versus the performance of the S&P 500 in the last five years.

Here's the current sectoral composition of Icahn's market-beating portfolio:

- Industrial Conglomerates (64.1%)

- Oil, gas, and fuels (18.1%)

- Technology hardware (3.7%)

- Electric utilities (3.5%)

- Household durables (3.0%)

- Gas utilities (2.1%)

- Trading companies and distributors (1.7%)

- Pharmaceuticals (1.4%)

- Automotive components (1.0%)

- Computer services (0.8%)

- Chemicals (0.4%)

- Healthcare equipment and supplies (0.3%)

Let's look at the top 5 holdings in his portfolio, i.e., those five stocks that dominate the portfolio and have the highest weight, all based on the latest official report.

1. Icahn Enterprises

Incorporated in 1987, the diversified holding conglomerate that holds Icahn's name accounts for around 64.1% of the portfolio.

The Sunny Isles Beach, Florida-based Icahn Enterprises (NASDAQ:IEP) is engaged in various sectors, including investment, energy, automotive, food packaging, real estate, home fashions, and pharmaceuticals.

Expectations are that earnings per share (EPS) for the next quarter could rise to $0.15 per share. It will pay a dividend in December.

2. CVR Energy

The Sugar Land, Texas-based CVR Energy Inc (NYSE:CVI) was founded in 1906 and has delivered great returns to investors ever since.

Engaged in petroleum refining and nitrogen fertilizer manufacturing activities in the United States, the company ranks second in the portfolio with a weight of 11.4%.

After a few strong earnings results this year on the back of rising global energy prices, the market still expects earnings per share (EPS) for the next quarter to increase strongly to $1.62 per share. It will pay a dividend on November 21.

3. Cheniere Energy

Headquartered in Houston, Texas, Cheniere Energy (NYSE:LNG) is an energy company primarily engaged in the liquefied natural gas-related business. In fact, in February 2016, LNG became the first U.S. company to export liquefied natural gas. Since 2018 it has been a Fortune 500 company.

It ranks third in Icahn's portfolio, with a weight of 3.6%.

In September, Cheniere distributed its last dividend. It has yet to announce the date of the distribution of the next one. Forecasts suggest that earnings per share (EPS) for the next quarter could rise to $6.77 per share. The company will release its fourth-quarter results on February 23, 2023.

4. FirstEnergy

Created from the merger of Ohio Edison and Centerior Energy in 1997, FirstEnergy Corporation (NYSE:FE) is an electric utility company based in Akron, Ohio.

Its subsidiaries and affiliates are engaged in electricity distribution, transmission, generation, energy management, and other related services. Its ten electric utility operating companies comprise one of the largest investor-owned utilities in the United States.

It ranks fourth in the portfolio with a weight of 3.5%.

FE holds a dividend yield of 4.1%, which is remarkably above the industry's average of 1.02%.

Forecasts suggest that earnings per share (EPS) for the next quarter could rise from $0.46 to $0.53 per share. The company will release its fourth-quarter results on February 9, 2023.

5. Newell Brands

Newell Brands (NASDAQ:NWL) is a U.S. multinational company specializing in brands for office equipment and writing instruments.

Headquartered in Atlanta, Georgia, it owns over 100 internationally recognized brands, such as Rotring, Paper Mate, and Parker.

The market expects earnings per share (EPS) for the next quarter to decrease from $0.45 to $0.12 per share. The company will release its fourth quarter 2022 results on February 10, 2023.

Disclosure: The author currently does not own any of the securities mentioned in this article.