- Reports Q2 2021 results on Thursday, July 29, after the close

- Revenue expectation: $115.33 billion

- EPS expectation: $12.24

When Amazon.com (NASDAQ:AMZN) reports its second quarter earnings later today, investors will focus on sales, which could show some slowdown after hitting a blistering pace during the pandemic.

Since the outbreak of COVID-19 in March of last year, Amazon’s sales have continued to surpass expectations as people staying at home made more and more purchases online. But, as the U.S. economy reopens and people begin returning to their normal routines, chances are that some portion of sales will go back to brick-and-mortar stores.

By the end of the first quarter, there was no evidence that this trend was ebbing, however. The Seattle-based company reported in April that its Q1 revenue jumped 44% and earnings were a record $15.79 a share, exceeding analysts’ estimates. For the quarter ending in June, Amazon projected sales between $110 billion and $116 billion.

The Q2 results have likely benefited from the company’s two-day Prime Day event in June, the company’s shopping bonanza for members of its $119-a-year speedy shipping program. According to JPMorgan) estimates, the event could bring in $8.4 billion in total Prime Day revenue this year, up 12% from its estimate from last year’s haul.

In addition to Amazon’s e-commerce business, the company’s cloud computing and ad businesses continue to show strong momentum. These units generate fatter margins than the retail operation. Sales at Amazon Web Services climbed 32% in Q1, while ads posted a 77% jump in revenue.

Amazon Stock Still A Buy

After surging more than 70% last year, shares of Amazon are up more than 12% this year, tracking the performance of the tech-heavy NASDAQ 100 Index. The stock closed on Wednesday at $3,630.32.

After this strong pandemic-era performance, analysts remain bullish on this e-commerce powerhouse’s growth prospects as they believe the company’s sales momentum will continue through the reopening.

Several Wall Street analysts have recently raised their price targets on Amazon, citing a favorable environment for its business units. Telsey analysts reiterated their outperform rating on the e-commerce giant ahead of its earnings report, saying Amazon has “superior execution.”

According to its note:

“We maintain our above consensus 2Q21 sales and profit estimates, reflecting the ongoing favorable shift toward online, strong business trends, including Prime Day, market share gains across categories and superior execution.”

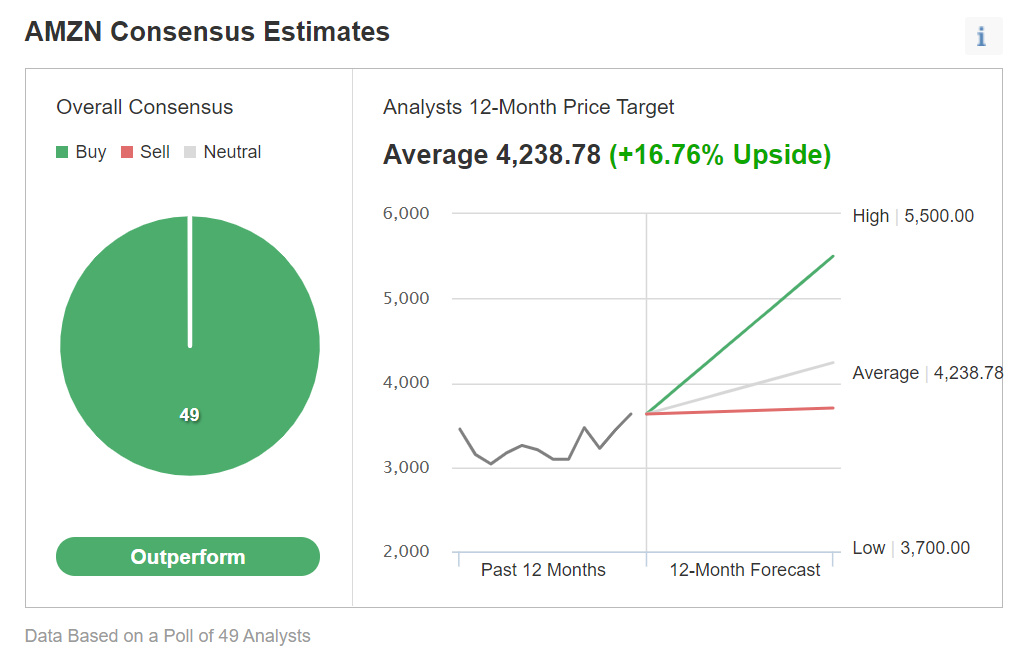

Of 49 analysts polled by Investing.com, the average 12-month price target is $4,238.78.

That represents a 16% upside potential above the current share price.

Bottom Line

Amazon continues to remain a solid holding for long-term investors due to its leading position in the e-commerce arena. The factors that fuelled the 2020 rally are still in play, given still-low e-commerce penetration, expanded fulfillment capacity, and the shift toward cloud computing.