Aviation giant Boeing (NYSE:BA) reports Q3 earnings on Wednesday, Oct. 27, ahead of the open. For the Chicago-based company, this upcoming release has the potential to be pivotal in terms of how investors perceive the firm's comeback from COVID-19 and it's reversal from ongoing errors and negative news (also see this story) that have damaged the aerospace and defense behemoth's reputation.

Optimism on BA was high in early 2021, with the shares rising 26% from the start of the year to Mar. 12. The shares have been in decline since mid-March, as more bad news emerged. The stock is 21% below the YTD high closing price of $269.19 reached on Mar. 12th.

At the most recent closing price, BA has delivered a total return of 25.97% over the past 12 months and -0.51% YTD.

Chart: Investing.com

Buying into BA is a bet that the company is getting back on track and that current bad news is already reflected in the share price. The consensus expected EPS for Q3 is -$0.15 per share. If the company shows signs of meaningful improvement, ideally by reporting positive EPS, the market is likely to respond favorably.

The Wall Street analyst consensus rating was bullish at the start of 2021, anticipating a faster recovery. As I noted in a discussion of BA from January 2021, however, the consensus outlook implied by options prices was quite bearish at that time.

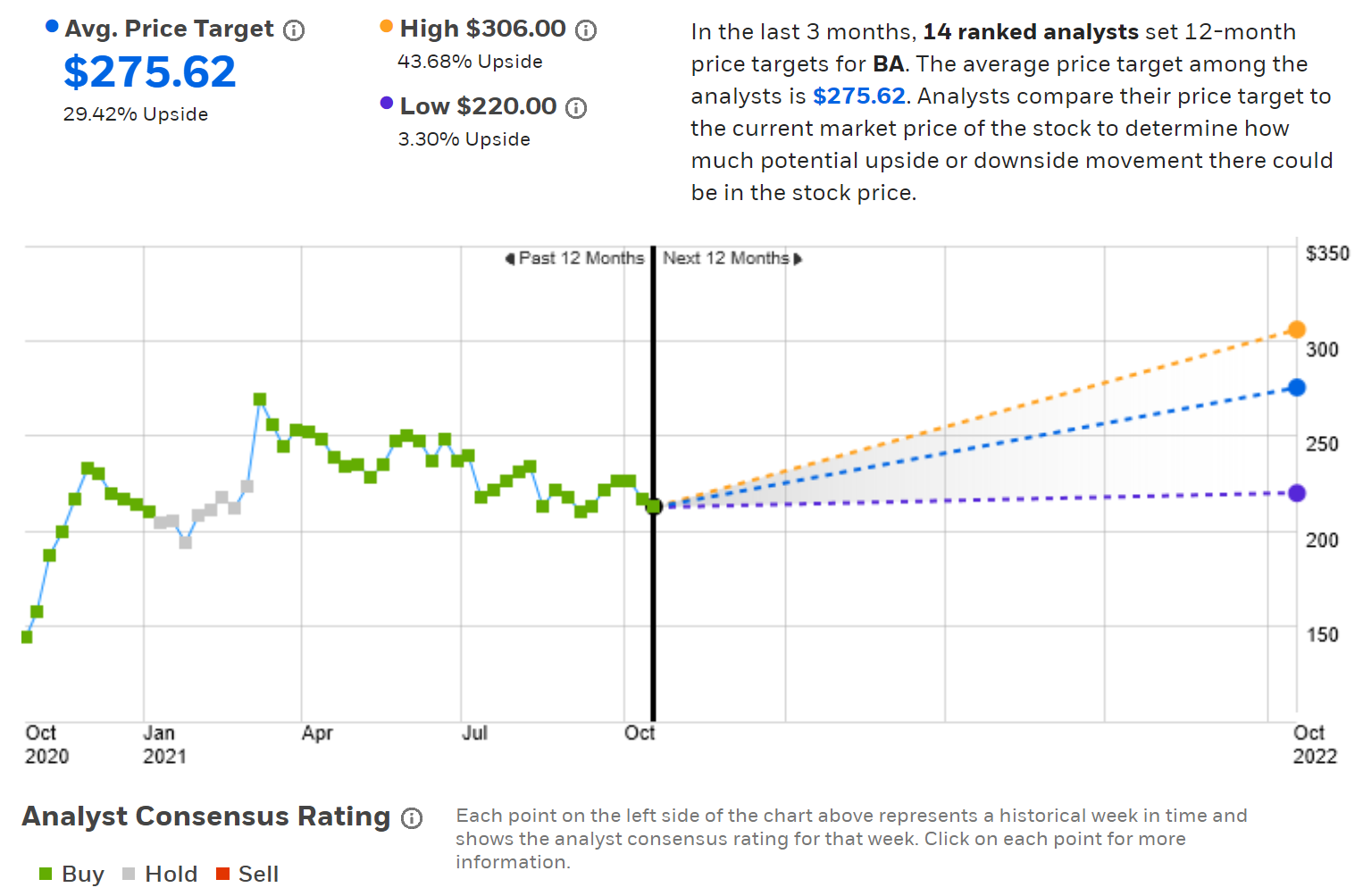

The Wall Street consensus has gotten even more bullish as the year progressed, even as the company continued to stumble. Between my January article and today, for example, the 12-month consensus price target for BA (calculated by ETrade) has risen by 21.6%, from $226.65 to $275.62, a period over which the share price has increased by less than 3%. The Wall Street analysts believe that the company is turning the corner.

Options prices provide valuable insight into the expectations of traders, and these are often quite different from those of analysts. The market price of an option on a stock represents the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the strike price) between now and when the option expires. By analyzing options at a range of strike prices (all with the same expiration date) it is possible to calculate a probabilistic forecast of the share price that is implied by the options prices. This is referred to as the market-implied outlook or the option-implied outlook.

Back in January, the market-implied outlook for BA was quite bearish, in contrast to the Wall Street consensus outlook. By early September, the market-implied outlook had improved dramatically and was slightly bullish.

With the earnings report imminent, and with considerable negative news on BA since early September, I have updated the market-implied outlook for comparison with the Wall Street consensus outlook.

Wall Street Analyst Consensus Outlook for BA

ETrade calculates the Wall Street consensus outlook for BA by combining the views of 14 ranked analysts who have published ratings and 12-month price targets within the past 90 days. The consensus rating on BA is bullish and the consensus 12-month price target, $275.62, is 29.4% above the current share price. Of the 14 analysts, 8 give BA a buy rating and 6 assign a hold rating.

Source: ETrade

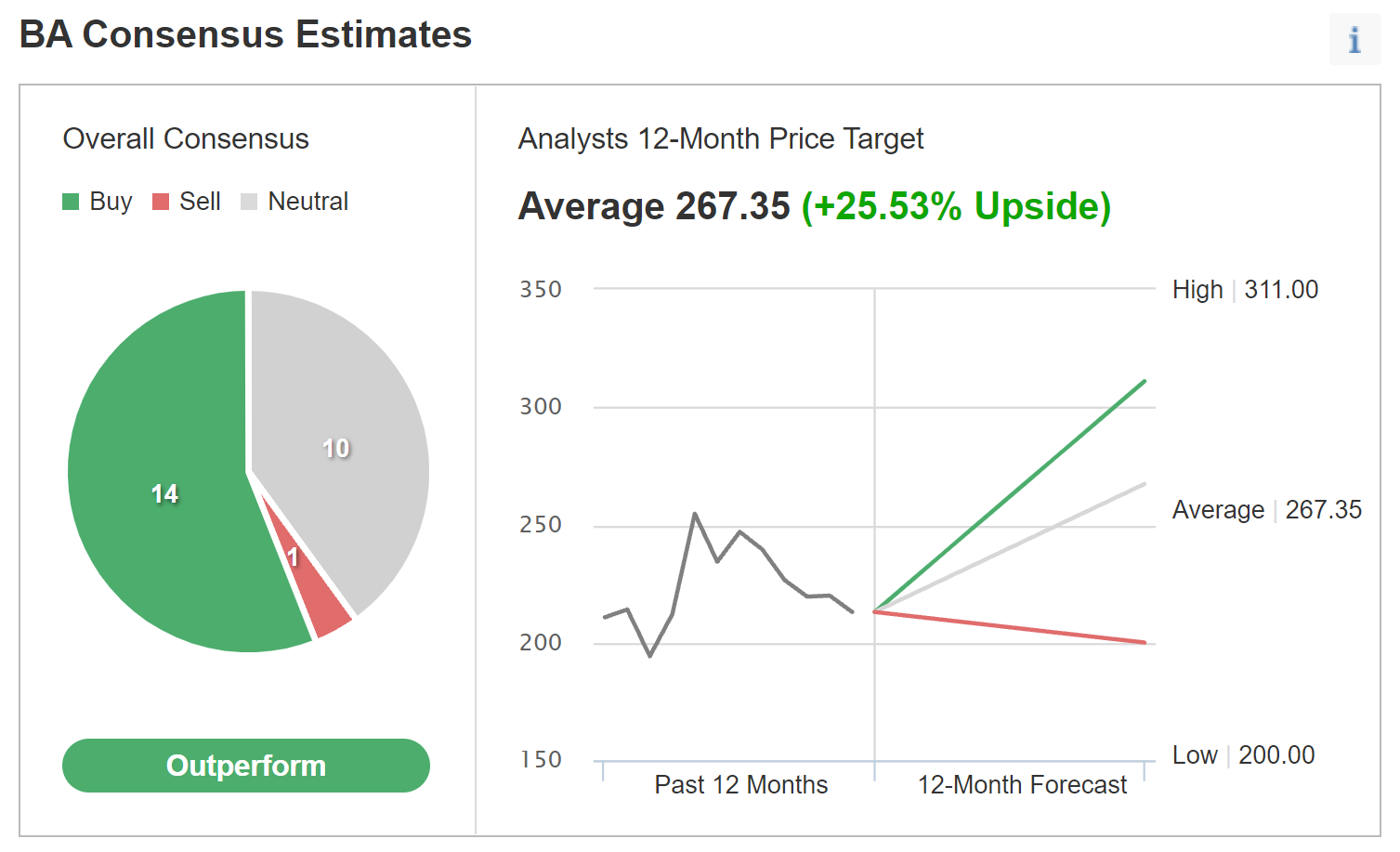

Investing.com calculates the Wall Street consensus outlook for BA using ratings and price targets from 25 analysts. The consensus rating is bullish and the 12-month price target is 25.5% above the current share price. Of the 25 analysts, only 1 assigns a sell rating.

Source: Investing.com

The two calculations of the Wall Street consensus outlook are bullish, with an average expected 12-month price appreciation of 27.5%. The analysts, collectively, anticipate that BA will recover in the relatively near-term. One of the limitations of the Wall Street consensus is that the analyst opinions are aggregated over some period of time. Some of the opinions may predate emerging news and BA has had some significant news stories over the past couple of months.

Market-Implied Outlook for BA

I have analyzed the prices of call and put options at a range of strike prices, all expiring on Jan. 21, 2022, to generate the market-implied outlook for BA for the next 2.9 months (from now until the expiration date). I have also calculated the market-implied outlook from now until June 17, 2021 using options that expire on that date. I selected these two expiration dates to provide a view to early- and mid-2022 and because these options tend to be highly traded.

The market-implied outlook is the distribution of price outcomes that reconciles the options prices as closely as possible. The average difference between theoretical option prices calculated using the market-implied outlook and the market prices of the options is within 0.3% of the market prices of the options.

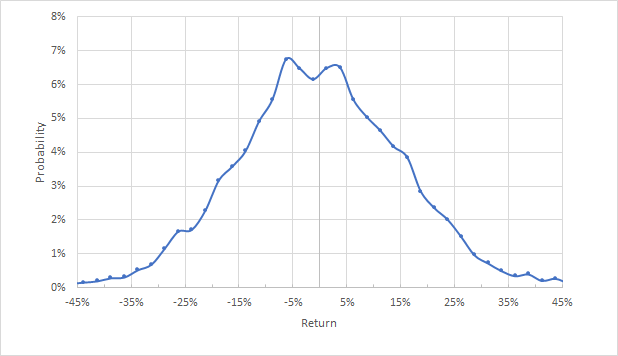

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Market-implied price return probabilities for BA for the 2.9-month period from now until Jan. 21, 2022 (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook to Jan. 21, 2022 is generally symmetric and does not have a well-defined peak value. Instead, there are two smaller peaks. The maximum probability corresponds to a price return of -6.25% and the secondary peak probability corresponds to a price return of +3.5%. This shape of market-implied outlook is not uncommon. The annualized volatility derived from this distribution is 35.8%.

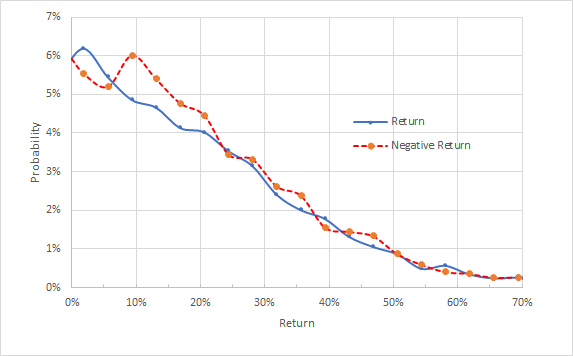

To make it easier to directly compare probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

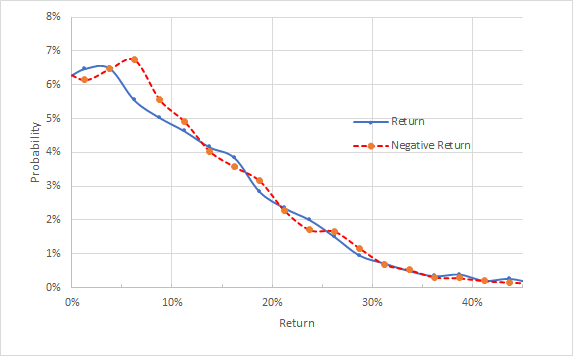

Market-implied price return probabilities for BA for the 2.9-month period from now until Jan. 21, 2022. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view shows that the probabilities of positive and negative returns are very similar for returns greater than +/-11% (the solid blue line and the dashed red line are very close to one another from 11% return and higher on the chart above). There is a slightly elevated probability of negative returns for smaller-magnitude returns (the dashed red line is above the solid blue line for returns from 4% to 11% on the chart above).

Theory suggests that the market-implied outlook will have a negative bias (assigning higher probability to negative returns) because investors, in aggregate, tend to be risk averse and, as a result, pay more than fair value for put options. In this market-implied outlook, the probabilities of positive and negative returns are very close to one another overall, suggesting a slightly bullish view in light of the tendency towards a negative bias. Having the probabilities favor small-magnitude negative returns over positive returns is a bearish indicator. Overall, I interpret this market-implied outlook as neutral. In early September, the market-implied outlook to Jan. 21, 2022 was similar but more bullish.

Looking out to the middle of next year (using options that expire on June 17, 2022), the market-implied outlook is qualitatively very similar to the 2.9-month outlook. There is a range of outcomes that favor negative returns (dashed red line above solid blue line) but the probabilities of positive and negative returns are very close for larger-magnitude price moves. The annualized volatility calculated from this distribution is 36.4%. I interpret this outlook as neutral. Contrast this outlook to the bearish market-implied outlook to June 17, 2022 from my analysis in early September.

Market-implied price return probabilities for BA for the 7.7-month period from now until June 17, 2022. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

The market-implied outlook is neutral to early 2022 and to the middle to 2022. At the start of September, the outlook to early 2022 was slightly bullish, but moderately bearish to the middle of 2022. The options market suggests that the longer-view is looking better but that there is slightly less optimism for the balance of the year.

Summary

Assessing BA is particularly challenging because the issues that the company faces are due to unprecedented events (demand for aircraft following COVID) or a string of management errors. If one concludes that the company has systemic problems that are not being resolved, BA will not be attractive.

The consensus view of the Wall Street analysts who follow the company is that BA is going to rebound in the near future. The consensus rating is bullish and the consensus 12-month price target is 27% above the current price. Even if one accepts this expected gain, what about the risks?

The market-implied outlook yields expected volatility for BA of about 36%. This is not especially high for an individual stock. Further, the options market is not pricing in elevated risks of big negative surprises. As a rule of thumb for a buy, I look for an expected 12-month return that is at least ½ the expected (annualized volatility).

Taking the analyst consensus at face value (expected 12-month return of 27%), BA is far above this threshold. The market-implied outlook to early- and mid-2022 is neutral, which suggests that the consensus opinion of buyers and sellers of options is somewhat less optimistic than the analyst consensus.

Overall, however, with the bullish Wall Street consensus outlook and the neutral market-implied outlook with moderate volatility, I am cautiously optimistic and I am maintaining a bullish rating on BA.