This article was written exclusively for Investing.com

- ADM shares reached an all-time high in April

- Broad market correction weighs

- Earnings have been spectacular

- A respectable dividend and booming market for ADM’s products

- Implied and historical volatility - Option spreads could be attractive for risk positions

-

If you’re interested in upgrading your search for new investing ideas, check out InvestingPro+

Food and fuel prices have skyrocketed, which is bad news for consumers. For the companies that feed the world, input prices are likewise soaring, but so are profits.

The group of four large companies that control the import and export of agricultural commodities in the US is known as ABCD—an acronym for Archer-Daniels-Midland (NYSE:ADM), Bunge (NYSE:BG), Cargill, and Louis Dreyfus.

These companies produce, process, and distribute many ingredients that feed the world daily. The growing biofuel business is another integral part of their businesses.

While Bunge is a publicly traded company, Cargill and Louis Dreyfus are private firms. Archer-Daniels-Midland is the A-lister that trades on the stock market.

ADM’s slogan was “the supermarket to the world” for many years. These days, ADM not only feeds but also fuels the world with its agricultural businesses. In April, ADM shares reached an all-time high, but they have pulled back with the broad market.

We believe that the recent dip in ADM shares could be the perfect buying opportunity as the agricultural bull market looks likely to continue over the coming years.

ADM Shares Reached An All-Time High In April

Archer-Daniels-Midland shares fell to a low of $28.92 in March 2020 when the global pandemic gripped markets across all asset classes. In early 2020, agricultural commodity prices declined to lows along with other markets.

The chart shows the steady rally from March 2020 low that took ADM shares to a high of $98.88 on Apr. 21, 2022.

The long-term chart shows that the March 2020 low was a continuation of mostly higher lows since the 2008 financial crisis. The Apr. 21 peak was at a new record level. ADM shares were sitting at the $87.20 level on May 16, after a 11.8% correction from the most recent high.

Broad Market Correction Weighs

With inflation at an over four-decade high, US interest rates are rising. Higher rates push the US dollar higher against other reserve currencies, with the dollar index trading at the highest level since 2002. Last week, the dollar index probed above the 105 level.

Rising rates and a strong dollar are weighing on the overall stock market.

The chart of the S&P 500 index shows the decline from a record 4,818.62 record high on Jan. 4 to 3,994.60 on May 16, a 17.1% drop. ADM shares have outperformed the stock market over the period as the shares were at the $69.15 level on Jan. 4 and were 26.1% higher as of May 16.

While many commodity prices have declined because of higher rates and a stronger US currency, agricultural commodities remain at elevated levels as the war in Europe’s breadbasket is causing supply concerns. Ukraine and Russia export one-third of the world’s annual wheat supplies and are corn exporters.

Earnings Have Been Spectacular - Staying Ahead Of Rising Input Costs

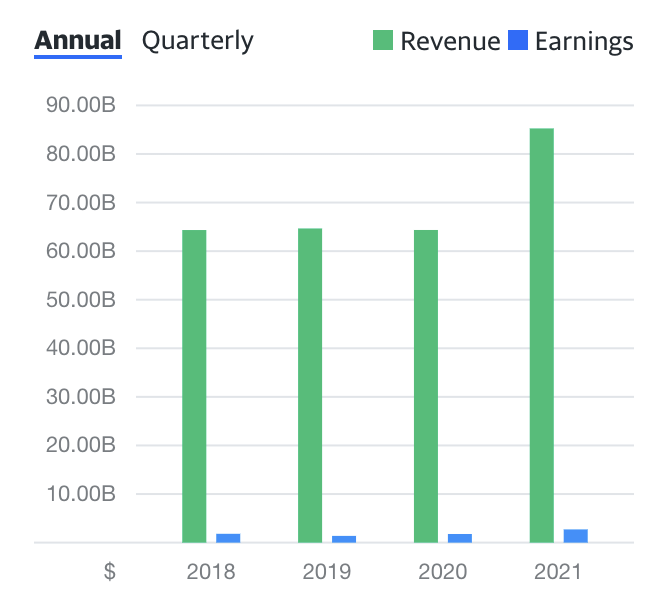

ADM earnings have been impressive even though inflation is causing input costs to skyrocket.

Source: Yahoo Finance

The chart shows that ADM has beat analysts’ EPS forecasts over the past four consecutive quarters. The consensus estimates for Q2 2022 are at $1.64 per share.

Source: Yahoo Finance

Annual revenues and earnings increased in 2021, and the prospects are for a continuation of the trend in 2022, with grain, oilseed, and biofuel prices at the highest level in years.

A Respectable Dividend And Booming Market For ADM’s Products

A survey of 12 analysts on Yahoo Finance has an average price target of $95.58 for ADM shares, with forecasts ranging from $67 to $111 per share.

ADM is an 800-pound gorilla in the worldwide agricultural markets. The highest prices in years and rising potential of shortages caused by the war in Ukraine mean the demand for ADM products will continue to soar. The most recent price dip in the shares could be a golden buying opportunity as I expect the stock to rise beyond the top end of analysts’ anticipated range at the $111 per share level.

However, the rocky stock market could cause further weakness for ADM shares. ADM pays shareholders a $1.60 dividend, translating to a 1.83% yield at $87.20 per share. The stock has a 0.80 Beta, meaning it is less tied to the overall stock market than companies with a 1.0 Beta.

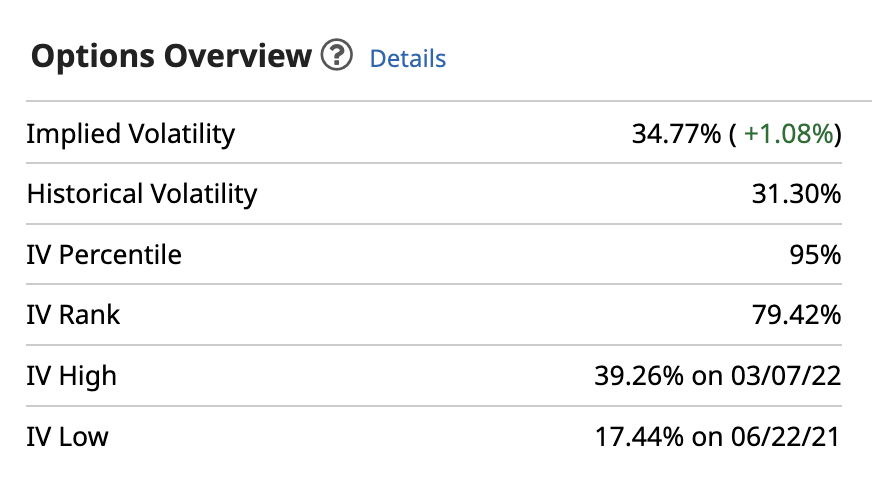

Implied And Historical Volatility - Option Spreads Could Be Attractive For Risk Positions

As of May 16, implied volatility on ADM put and call options was higher than the historical volatility level. Implied volatility measures the market’s price variance expectations, while the historical metric reflects the past.

Source: Barchart

The chart shows the higher implied versus historical volatility levels on at-the-money options. Out-of-the-money options tend to trade at even higher implied volatility because of the speculative interest in the leveraged call and put options.

In the current environment, buying call spreads or selling put spreads on ADM shares could offer an advantage that limits risks. The call spread offers an upside potential of the difference in strike prices minus the debit. Purchasing a bull call spread for a debit limits the risk of a further fall to the premium paid for the spread and involves buying an at-the-money call option and selling an out-of-the-money call option for the same expiration date.

Selling a bull put spread involves selling an at-the-money put option and buying an out-of-the-money for the same expiration date. The potential profit is limited to the premium received, while the risk is the difference between the strike prices minus the credit of the premium received.

I favor the long side for ADM shares. The current level of implied volatility makes option spreads an alternative to outright purchases of ADM shares. If you choose to buy the stock, we advise you to leave plenty of room to add on as further declines in the current weak stock market environment may offer additional buying opportunities. ADM is a supermarket to the world, and global agricultural supplies are likely to suffer over the coming months and years. Higher prices are bullish for ADM and the other ABCD companies that dominate the sector.

Looking to get up to speed on your next idea? With InvestingPro+, you can find:

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »