- Companies with good fundamentals and high dividend yield, Stocks trading below their intrinsic value - It's all at your fingertips with InvestingPro.

- Filters allow you to specify criteria that we can use to search for companies. Find everything you need on one page.

- In this piece, we will go through the step-by-step process of using InvestingPro's filters to find good stocks to buy.

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

Markets are constantly moving up and down during uncertain times. Be it pivotal macroeconomic indicators, companies' earnings, or influential statements from central bankers, each factor is capable of steering the stock market in unpredictable directions.

With so much information coming at us on a daily basis, how do you filter out the really important information amidst all the noise?

Enter InvestingPro, the professional tool from Investing.com. Its filter section acts as your compass in this sea of data, helping you pinpoint the information that matters most.

Seeking a curated list of companies with robust dividend yields and solid fundamentals? Find it effortlessly in the filters section.

Interested in stocks trading below their intrinsic value? That's another gem you can uncover with InvestingPro.

Filters allow you to specify criteria that we can use to search for companies.

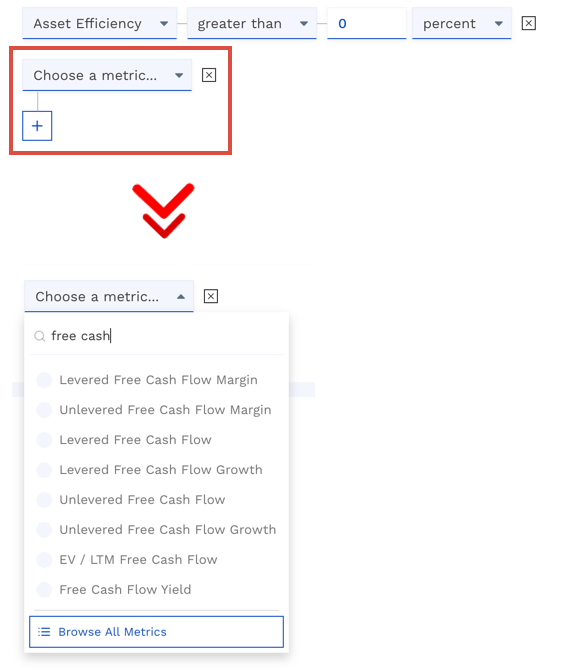

Here's how to add a filter step by step:

Step 1: Choose the Metric

The first step is to identify the metric you want to use to filter out stocks.

Source: InvestingPro

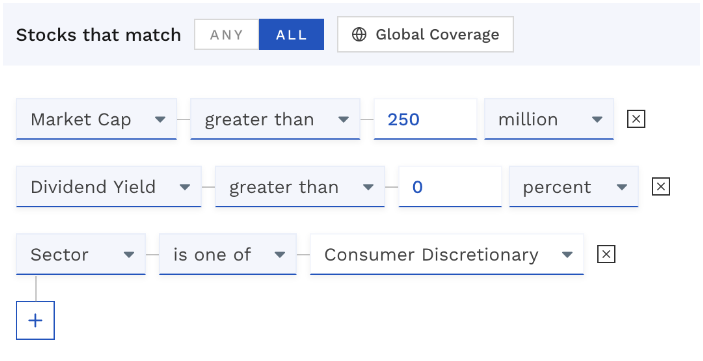

Step 2: Enter Values

Once you have selected the filters you want to use, the next step is to specify the limits.

For example, to search for companies with a market capitalization greater than $250 million, with a dividend yield greater than 0%, and belonging to the consumer discretionary sector, this would be the result:

Source: InvestingPro

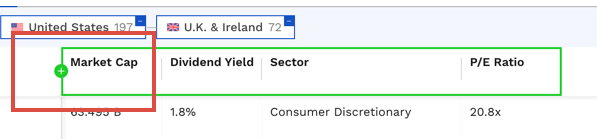

Step 3: Add Columns

To get more information about the results that match your search criteria, you can add columns. Any of the metrics we discussed above can be used as a column.

Just click the 'Columns' button to open the Column Editor and select the fields you want to add. It would look like this:

Source: InvestingPro

Step 4: Set the Period

Once you have added the column, you can also specify the period in which you want to search for the data. If you do not specify a specific period, the column displays the information for the last default period.

For example: Stock price information ("asset_price_close_adj") is displayed on a daily frequency. If you want to know what price a certain stock had 30 days ago, you must specify the period as "D-30".

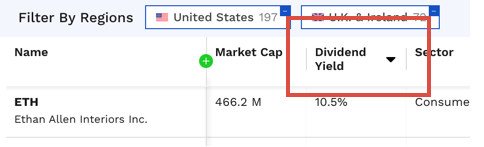

Step 5: Sort the Results

To have the results that matter most to you appear first, you can sort them by clicking on the column header where you want to sort them:

Source: InvestingPro

Step 6: Save the Results

This is crucial: you can save everything you search for. Don't miss any details of important information for your investment decisions.

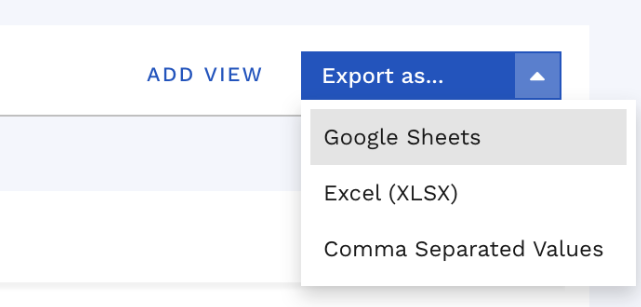

InvestingPro offers you the possibility to download your results to a spreadsheet so that you can check them whenever you want.

Source: InvestingPro

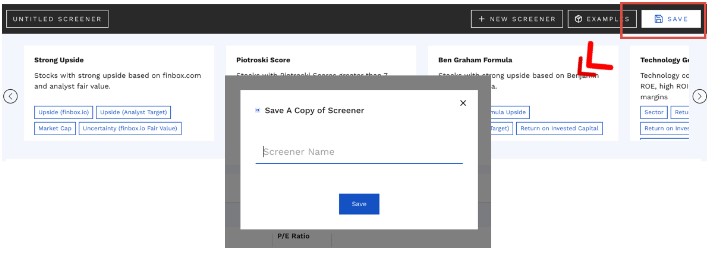

Once you have created a filter, you can save the criteria to run them again later. Click the Save button in the upper right corner and a pop-up window will prompt you for a name.

Source: InvestingPro

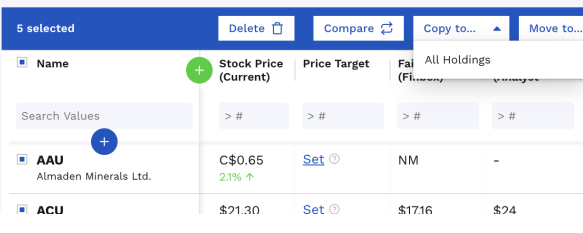

Step 7: Import Assets

Last but not least: You can import assets directly into a watch list by selecting the relevant results and copying them from the action bar.

Source: InvestingPro

In a volatile environment, having the best market information that can affect your portfolio is essential. Try now all the possibilities InvestingPro offers you.

***

Buy or sell a stock? Get the answer with InvestingPro at half price this Black Friday!

The keys to maximizing profits are real-time information and well-informed decisions. This Black Friday, make the smartest investment decision in the market and save up to 55% on your InvestingPro subscription.

Whether you're a seasoned trader or just getting started in the world of investing, this offer is designed to provide you with the wisdom you need for smarter, more profitable trading.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice or recommendation to invest as such and is in no way intended to encourage the purchase of assets. I would like to remind you that any asset class is evaluated from multiple points of view and is highly risky. Therefore, any investment decision and the associated risk remains with the investor.