- Wall Street’s major averages are on track to close out 2023 near their all-time highs.

- It’s been an incredible year for stocks, with many companies recording blowout year-to-date gains.

- In this article, I look at some of the year’s biggest winners and examine their prospects on whether they can continue soaring in 2024.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

With Wall Street closing the curtains on a remarkable year, the five stocks discussed in this article have experienced a strong surge in their value as investors turned bullish on their prospects.

These stocks' substantial rise in 2023 was propelled by specific catalysts, and a closer look reveals compelling reasons why these stocks are poised for further gains in 2024.

Looking ahead, the drivers that fueled their rise remain strong, setting the stage for continued growth in 2024.

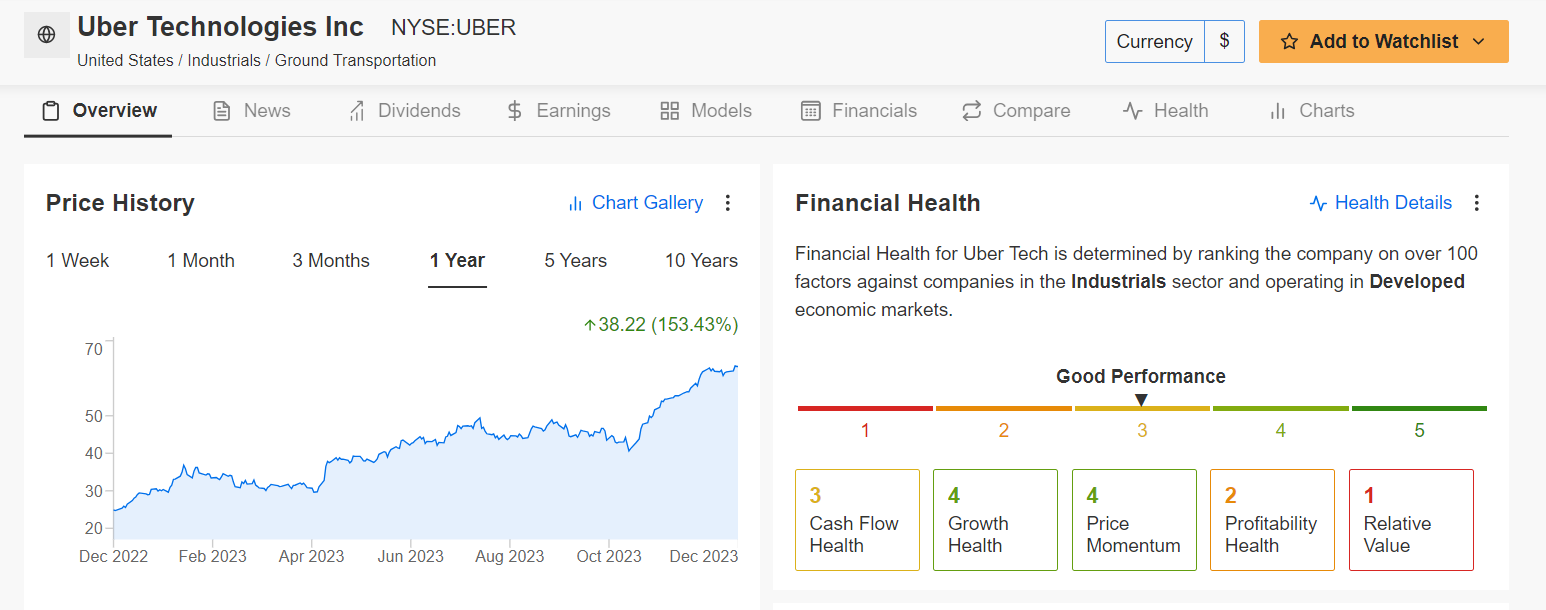

1. Uber

- 2023 Year-To-Date Gain: +155.3%

- Market Cap: $129.9 Billion

2023 Surge: Uber (NYSE:UBER)'s ascent in 2023 was fueled by multiple factors. The mobility-as-a-service company’s diversification beyond ride-hailing services into food delivery and freight logistics contributed significantly to revenue growth.

Moreover, the gradual recovery from pandemic-induced restrictions boosted demand for its transportation and food delivery services.

UBER stock - which began trading at $25.37 on January 3 and rose all the way to a 2023 peak of $63.53 on December 15 - has gained 155.3% in 2023.

Source: InvestingPro

2024 Potential: Uber's expansion into new markets and continued innovation in services, including its focus on electric vehicles and autonomous driving technology, positions it favorably for growth.

Additionally, the ride-hailing and delivery specialist’s relentless focus on achieving profitability through cost-cutting measures and strategic acquisitions sets the stage for another strong performance in 2024.

It is worth mentioning that Uber currently has an above-average InvestingPro ‘Financial Health’ score due to strong earnings and sales growth prospects.

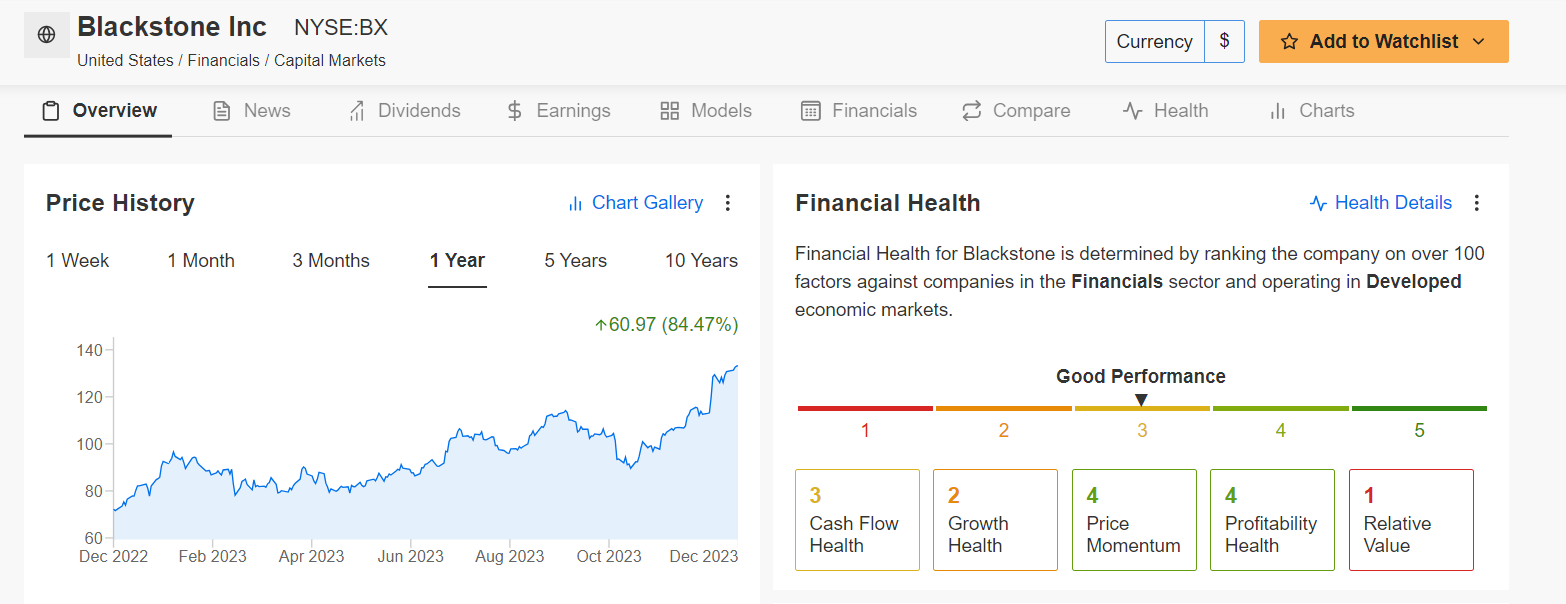

2. Blackstone

- 2023 Year-To-Date Gain: +79.4%

- Market Cap: $155.8 Billion

2023 Surge: Blackstone (NYSE:BX)'s stellar performance in 2023 was underpinned by the strength of its alternative asset management business amid a robust investment landscape.

The financial services firm capitalized on strong market conditions, driving substantial gains in private equity, real estate, and credit segments.

BX stock, which rose to a 2023 high of $133.52 on Thursday after starting the year at $76.80, is up 79.4% year-to-date.

Source: InvestingPro

2024 Potential: Given the persistent demand for alternative investments, Blackstone remains poised to benefit from a continued appetite for its offerings.

Its strategic investments across technology, infrastructure, and sustainable ventures position it favorably for sustained growth in 2024, leveraging emerging opportunities in evolving markets.

As InvestingPro points out, Blackstone is in great financial health condition, thanks to robust earnings prospects, and a healthy profitability outlook. Additionally, it should be noted that the company has raised its dividend payout for 17 consecutive years.

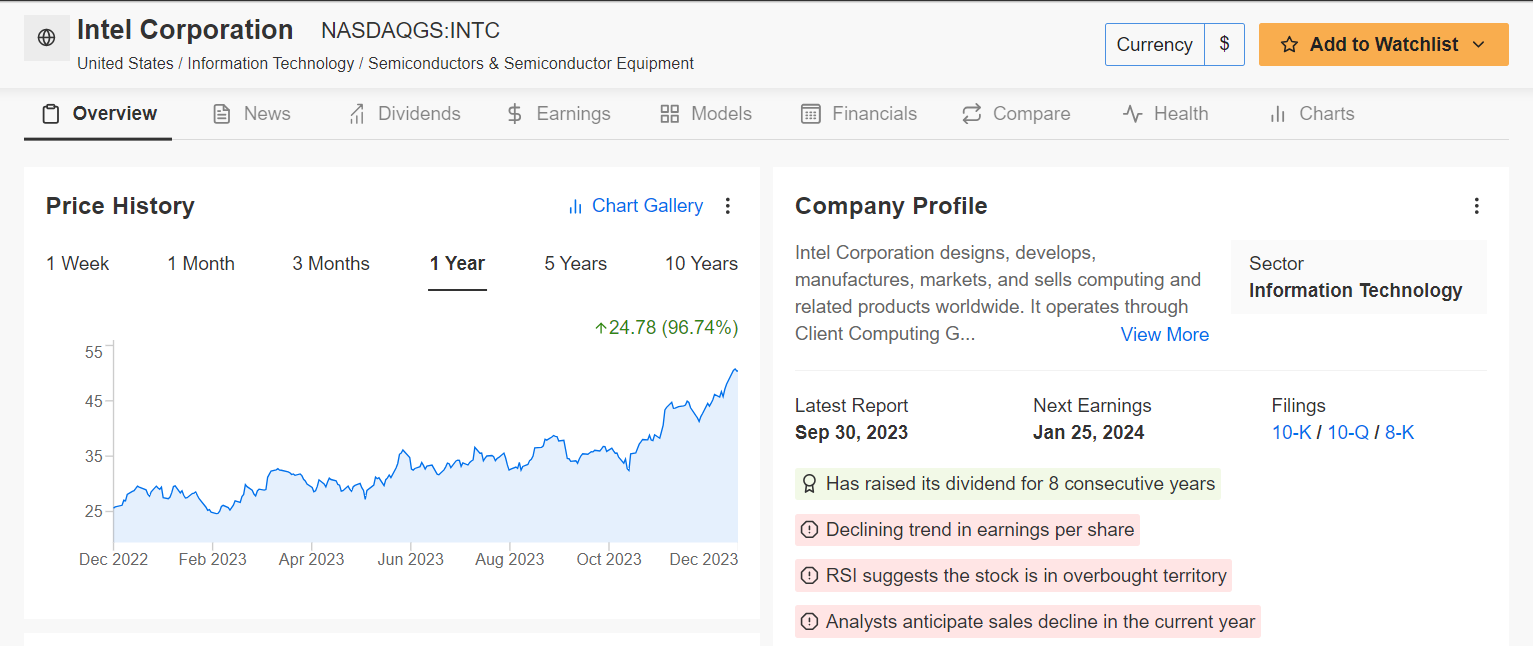

3. Intel

- 2023 Year-To-Date Gain: +90.6%

- Market Cap: $212.4 Billion

2023 Surge: Intel (NASDAQ:INTC)'s resurgence in 2023 was fueled by the market's positive reception to its new product launches and advancements in semiconductor technology and artificial intelligence initiatives.

The global semiconductor shortage further propelled demand for its products, contributing to its impressive performance.

INTC began the year at $27.05 and closed at a 2023 high of $50.39 last night, representing a year-to-date gain of 90.6%.

Source: InvestingPro

2024 Potential: Intel's strategic emphasis on expanding its manufacturing capabilities, coupled with ongoing technological advancements in chip production sets the stage for continued growth.

The Santa Clara, California-based chipmaker's investments in areas such as AI, 5G technology, and high-performance computing position it as a key player in an increasingly digital world, promising further gains in 2024.

According to insights from InvestingPro, the chipmaking giant is also a quality dividend stock. INTC currently offers a quarterly payout of $0.125 per share, which implies an annualized dividend of $0.50 at a yield of 1.31%.

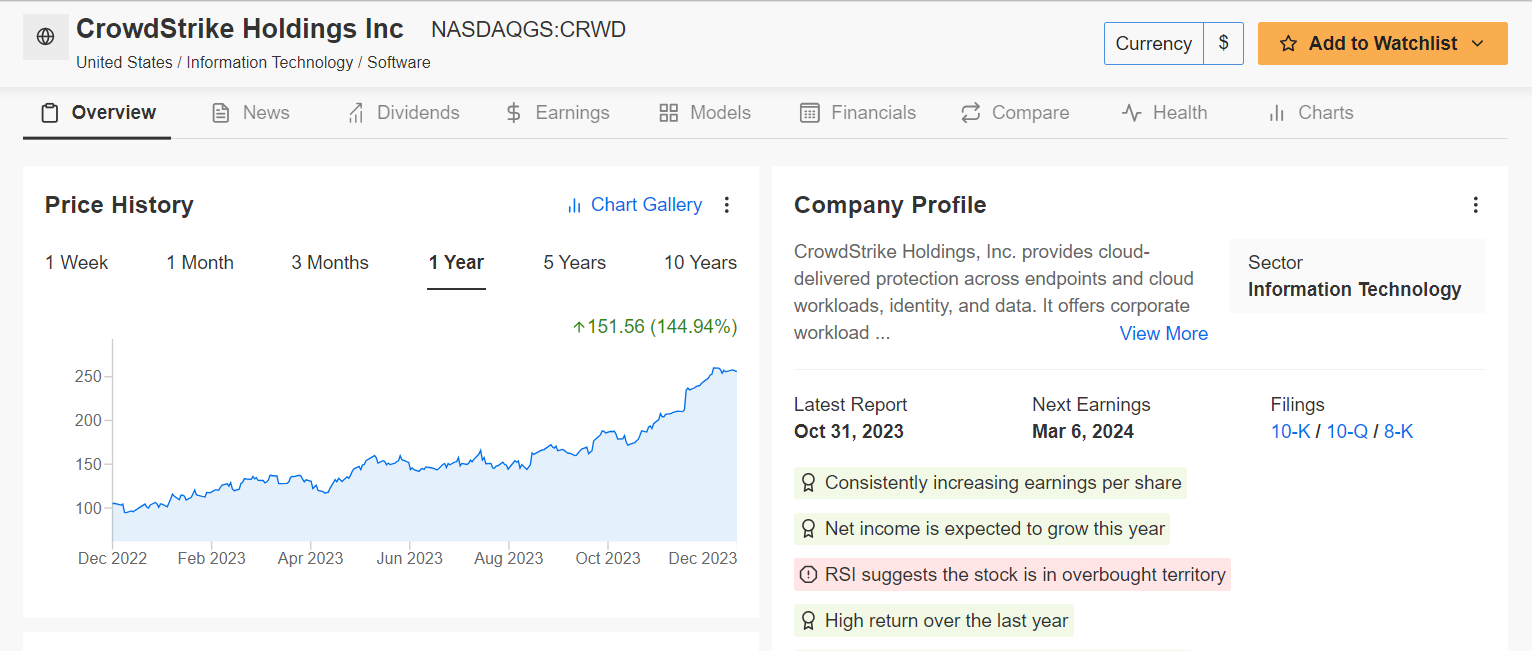

4. Crowdstrike

- 2023 Year-To-Date Gain: +143.2%

- Market Cap: $61.5 Billion

2023 Surge: CrowdStrike's (NASDAQ:CRWD) remarkable performance in 2023 stemmed from the growing significance of cybersecurity amid escalating cyber threats globally.

The information security specialist’s innovative cloud-native security solutions and a surge in cyber spending from corporations and governments around the world bolstered its performance as it responded to growing digital security threats.

CRWD stock is up 143.2% year-to-date, reflecting the endpoint security leader’s strong fundamentals and long-term growth prospects.

Source: InvestingPro

2024 Potential: As cybersecurity remains a top priority for businesses worldwide, Crowdstrike's cutting-edge technology and robust growth trajectory are likely to persist amid the uncertain geopolitical climate.

Its consistent focus on research and development, customer acquisition, and the expansion of its cybersecurity suite positions it well for ongoing success in 2024 amid favorable cybersecurity demand trends.

InvestingPro also highlights several additional tailwinds Crowdstrike has going for it, including a robust earnings outlook, healthy profitability, and solid cash flow growth.

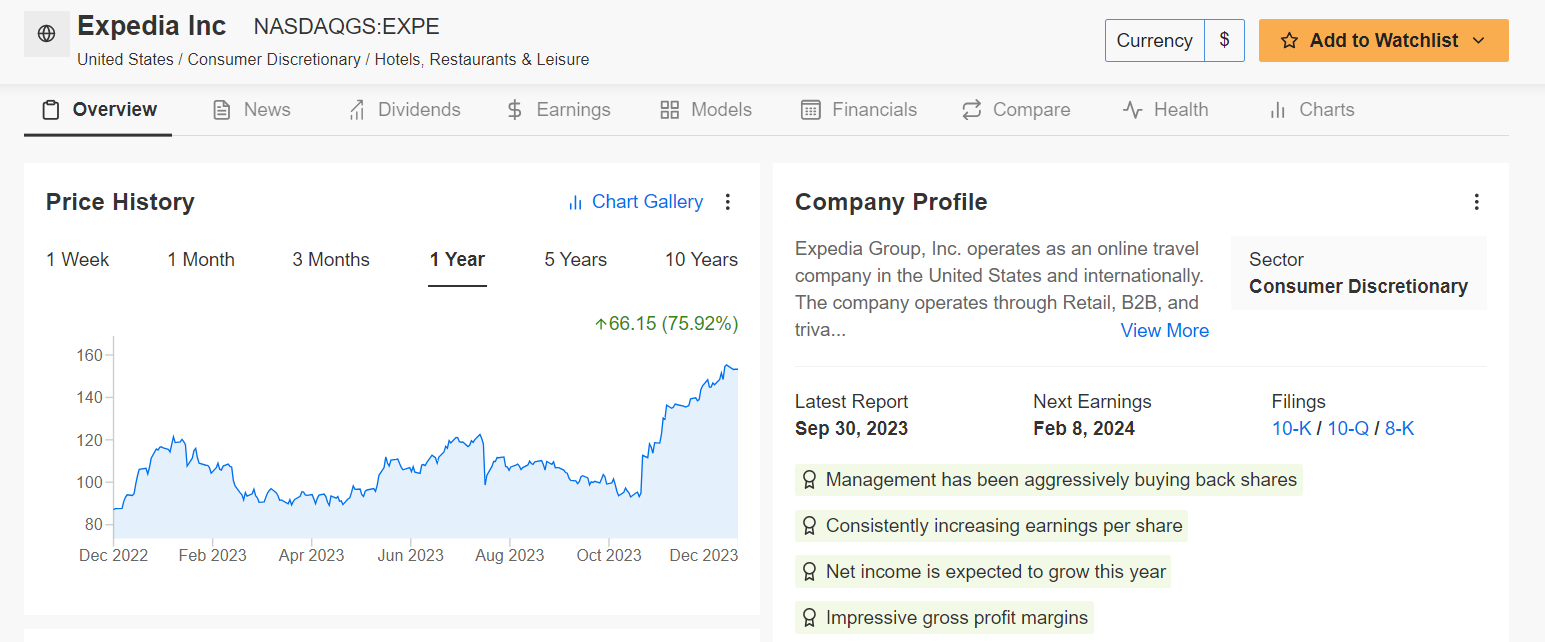

5. Expedia

- 2023 Year-To-Date Gain: +75%

- Market Cap: $21.3 Billion

2023 Surge: Expedia (NASDAQ:EXPE)'s resurgence in 2023 was driven by the gradual recovery in the travel industry as pandemic-related restrictions eased.

The pent-up demand for travel and leisure activities significantly boosted bookings and revenue for the online travel company despite fears of a global economic slowdown that have sparked concerns about consumer spending.

EXPE stock has been on a tear in 2023, scoring a year-to-date gain of 75% to easily outperform the broader market over the same timeframe.

Source: InvestingPro

2024 Potential: As the travel industry continues its recovery, Expedia stands to benefit from increased consumer confidence and a revival in travel demand.

The online vacation booking platform operator’s ongoing digital innovations, enhanced customer experiences, and strategic partnerships position it for further growth in 2024.

Demonstrating the strength and resilience of its business, Expedia sports a near-perfect InvestingPro ‘Financial Health’ score of 4 out of 5 and management has been aggressively buying back shares.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.