- Earnings season has unveiled some concerns about certain companies facing grim forecasts and shaky fundamentals.

- In this piece, we will discuss a selection of stocks to avoid, backed by a consensus of sell ratings and expected financial difficulties.

- Using the InvestingPro tool, we delve deep into these why these stocks are scaring away potential investors.

It's Halloween day, which provides the perfect backdrop to explore the stocks that are currently spooking investors, especially in light of the gloomy forecasts.

In the market, there seems to be a collective agreement on which stocks should be avoided for various reasons. Typically, when a company garners ratings from major agencies and entities, a crucial metric is the number of "sell" ratings it accumulates.

The higher this count, the graver the situation, particularly if it surpasses the number of "buy" ratings.

In this analysis, we'll scrutinize five stocks that have spooked investors due to the nearly unanimous agreement that these are not opportune investments, a theme fitting for Halloween day.

The primary culprits are their shaky fundamentals and the less-than-stellar financial reports expected both for the quarter and the year ahead.

To facilitate this evaluation, we will utilize the InvestingPro tool, accessing a trove of pertinent data and information.

1. Franklin Resources

Franklin Resources (NYSE:BEN) is an asset management company that provides its services to individuals and institutions and has equity and fixed-income funds. It was founded in 1947 and is headquartered in San Mateo, California.

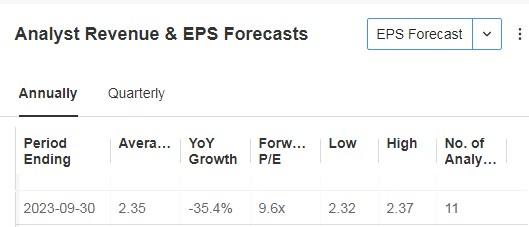

Today, it presents its results, and earnings per share are expected to fall -15.44% and for the year -35.4%.

Source: InvestingPro

It presents 11 ratings, of which 1 is buy, 4 are hold and 6 are sell.

Its shares have fallen by -22.97% in the last 3 months.

2. Expeditors International

Expeditors (NASDAQ:EXPD) offers logistics services in America, Asia, Europe, Africa, and India, specifically airfreight and ocean freight services. It was created in 1979 and is based in Seattle, Washington.

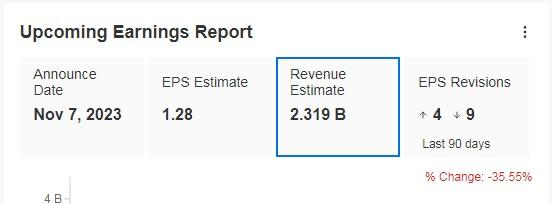

On November 7, it will present its results and is expected to report a drop in earnings per share of -11.41% and for the full year of -36.2%. In terms of actual revenues, the expected quarterly drop is -35.55% and for the year -43.8%.

Source: InvestingPro

It presents 19 ratings, of which none are buy, 10 are hold, and 9 are sell.

Its shares have fallen -15.55% in the last 3 months.

The market consensus puts its price target below its current price, specifically at $106.59.

Source: InvestingPro

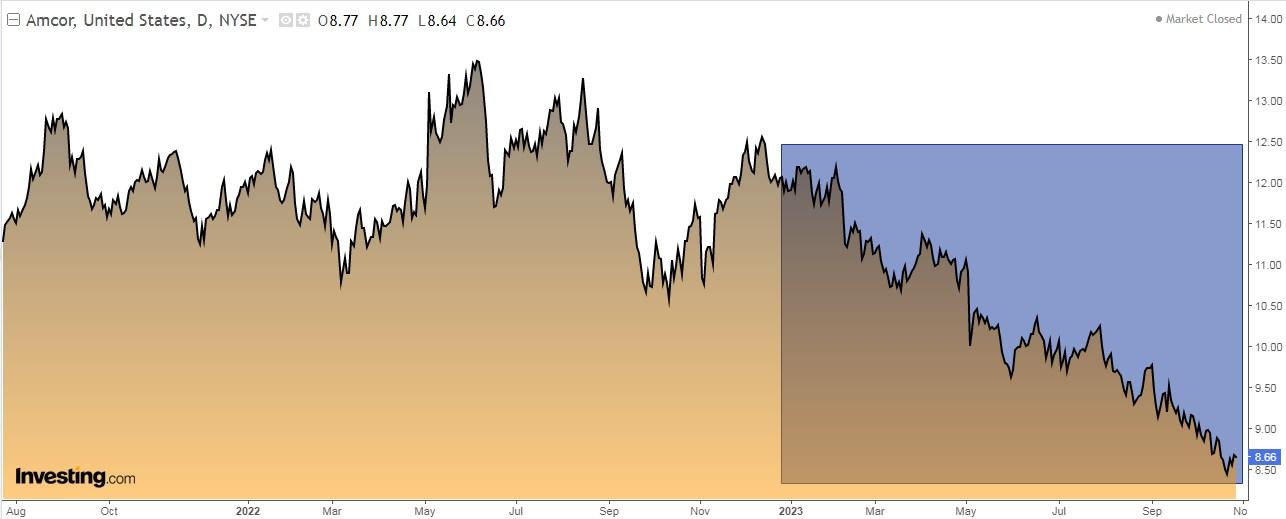

3. Amcor

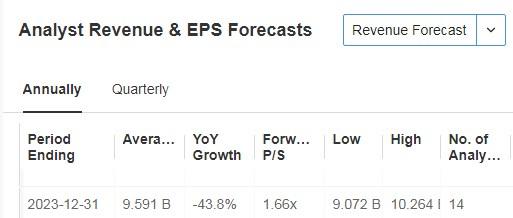

Amcor (NYSE:AMCR) produces, develops, and sells packaging products in Europe, Americas, Africa, and Asia Pacific regions offering packaging products for food and beverage, medicine, fresh produce, personal care, and other industries. It was established in 2018 and is headquartered in Zurich, Switzerland.

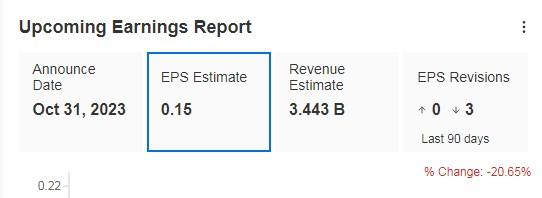

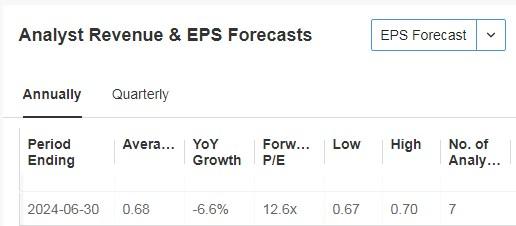

It reports its accounts today and earnings per share are expected to fall -20.65% and for the full year -6.6%.

Source: InvestingPro

It has 11 ratings of which 2 are buy, 5 are hold and 4 are sell.

Its shares have fallen by -14.15% in the last 3 months.

4. Whirlpool

Whirlpool (NYSE:WHR) manufactures and markets home appliances in America, Europe and Asia.

The main products are refrigerators, freezers, ice machines, laundry appliances, dishwashers, etc. It was born in 1911 and is headquartered in Benton Harbor, Michigan.

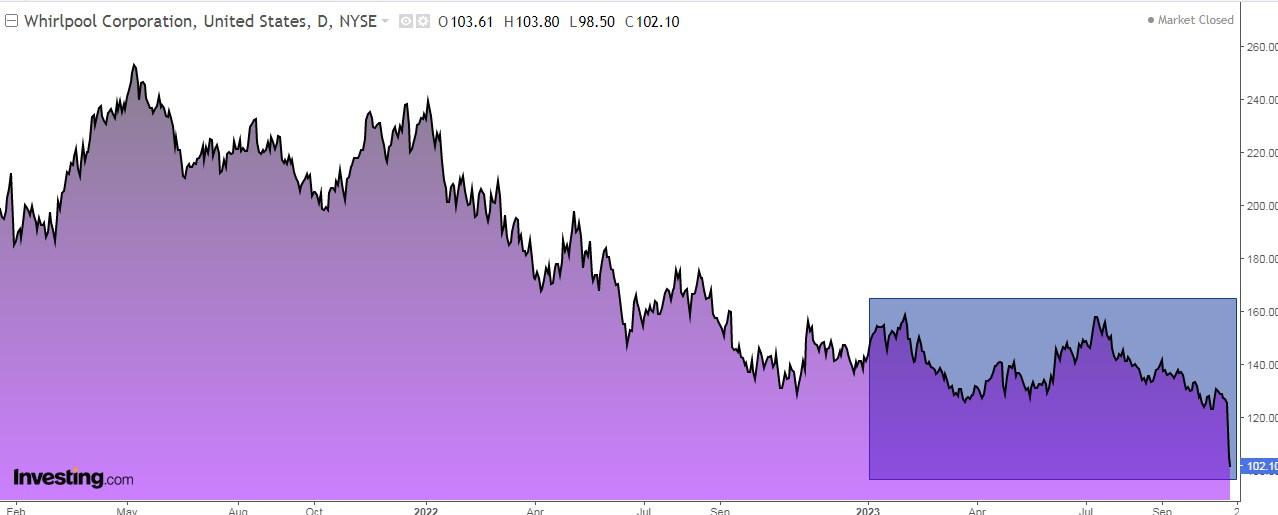

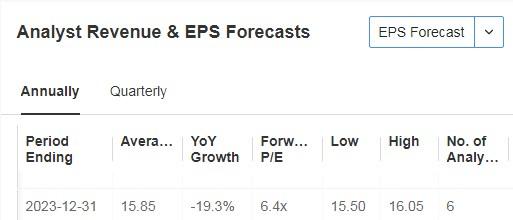

January 29 will be when it will be its turn to present its accounts and it is expected a fall in earnings per share of -18.83% and in 2023 of -19.3%.

Source: InvestingPro

It presents 10 ratings, of which 1 is buy, 5 are hold and 4 are sell.

The company acknowledged that the rising cost of living with interest rate hikes and high inflation is negatively affecting demand for its products, causing consumers to opt for cheaper products and in many cases delaying the renewal of appliances.

Its shares have fallen by -27.66% in the last 3 months.

5. Robert Half

Robert Half International Inc (NYSE:RHI) offers business consulting services in North America, South America, Europe, Asia and Australia.

The company was formerly known as Robert Half International and changed its name to Robert Half in July 2023. It was founded in 1948 and is headquartered in Menlo Park, California.

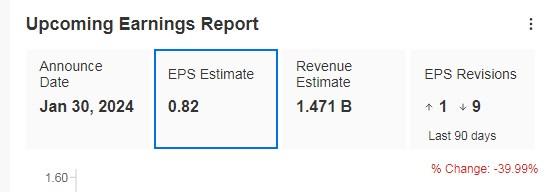

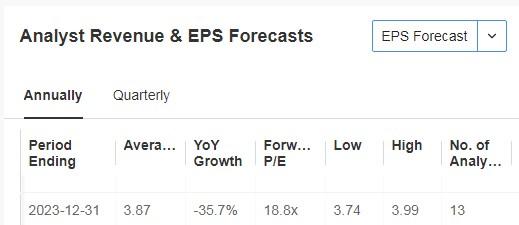

On January 30 is its turn to present quarterly accounts and the market expects a fall in earnings per share of -39.99% and for the year of -35.7%. As for its actual revenues, quarterly fall of -13.43% and for the year of -12%.

Source: InvestingPro

It has 12 ratings, of which 1 is buy, 5 are hold and 6 are sell.

Its shares have fallen by -1.50% in the last 3 months.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.