- Wall Street’s Q3 earnings season gathers momentum as the biggest names in the world get set to report their latest results.

- While most of the focus will be on the mega-cap tech stocks, there are several companies poised to trounce their earnings expectations.

- As such, investors should consider adding Caterpillar, Fortinet, TJX Companies, Salesforce, and Workday to their portfolio ahead of their respective results.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of Investing Pro get exclusive ideas and guidance to navigate any climate. Learn More »

The third quarter earnings season on Wall Street gathers momentum this week, with some of the biggest names in the world set to report their latest financial results.

While most of the focus will be on the mega-cap technology stocks, like Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Meta Platforms (NASDAQ:META), Amazon (NASDAQ:AMZN), and Apple (NASDAQ:AAPL), there are several fast-growing names set to enjoy robust earnings and sales growth thanks to swelling demand for their products and services.

As such, here are five stocks worth owning ahead of their quarterly reports in the days and weeks ahead.

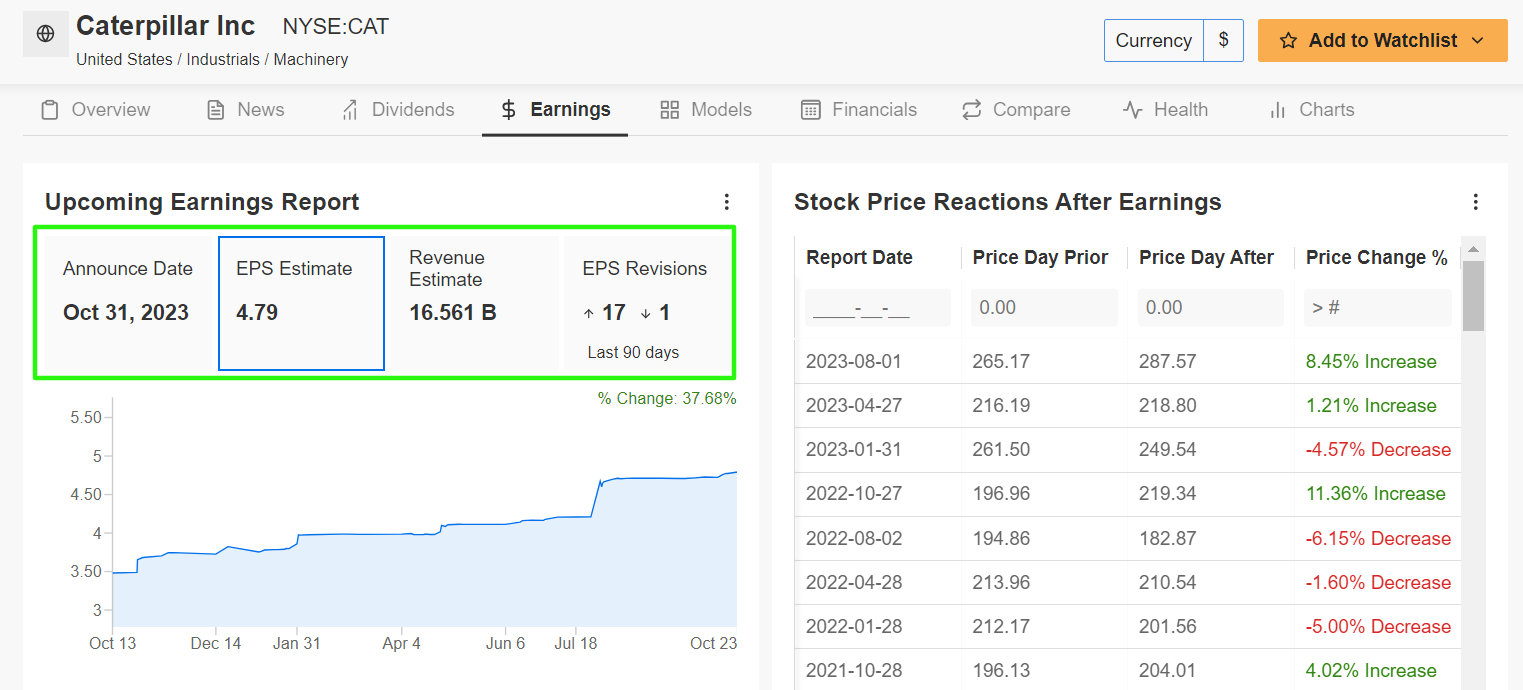

1. Caterpillar

- Earnings Date: Tuesday, Oct. 31

Between its attractive valuation, encouraging fundamentals, and dependably profitable business model, I believe that shares of Caterpillar (NYSE:CAT) are well worth buying amid the current market backdrop.

The industrial giant, which is widely viewed as a proxy for global economic activity, is one of the world’s leading manufacturers of construction, mining, and energy equipment.

Shares - which climbed to an all-time peak of around $298 in early August - are up 4.2% in 2023 amid optimism over the resilience of the global economy as well as signs of increased infrastructure spending in the U.S.

As such, it shouldn’t come as a surprise that Caterpillar is forecast to deliver strong profit and sales growth when it reports third quarter earnings before the U.S. market opens on Tuesday, October 31 at 6:30AM EST.

In a sign of increasing optimism, EPS estimates have seen 17 upward revisions in the past 90 days, according to InvestingPro, as it benefits from favorable industry demand trends given the promising outlook for construction and mining machinery sales.

Source: InvestingPro

Source: InvestingPro

Consensus estimates call for Caterpillar to report a profit of $4.79 per share, jumping 21.3% from EPS of $3.95 in the same quarter a year earlier. Revenue is forecast to rise 10.4% from the year-ago period to $16.56 billion, reflecting robust demand for its wide array of construction, mining, and energy equipment.

If those figures are confirmed, it would mark Caterpillar’s third highest quarterly profit and sales totals in its 98-year history, demonstrating the strength and resilience of its operating business.

Source: InvestingPro

Source: InvestingPro

CAT stock - which is one of the 30 components of the Dow Jones Industrial Average - closed at $249.55 on Tuesday. At current levels, the Deerfield, Illinois-based heavy machinery maker has a market cap of $127.3 billion.

As per InvestingPro, investors have the chance to buy Caterpillar at a discounted price. The average ‘Fair Value’ price estimate for CAT stands at $311.32/share, implying potential upside of roughly 25%.

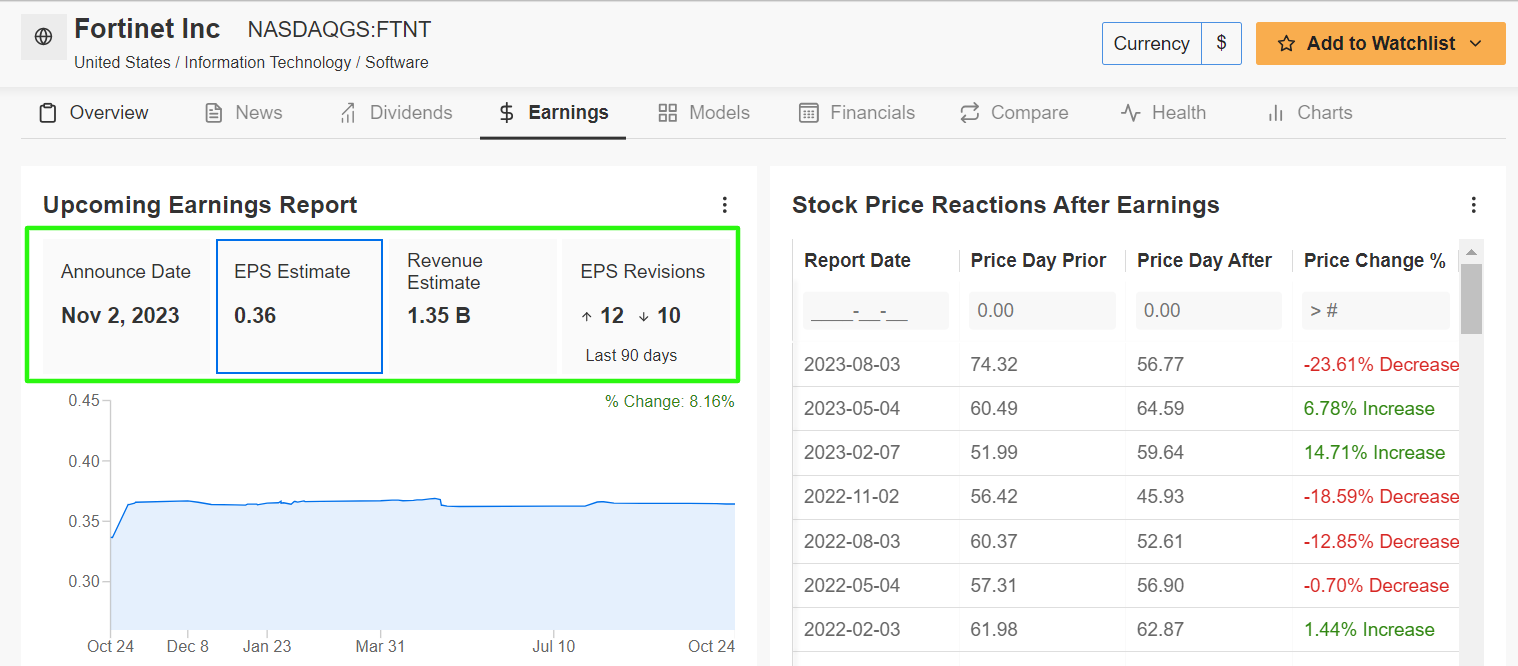

2. Fortinet

- Earnings Date: Thursday, Nov. 2

Widely considered as one of the most prominent names in the cloud-based cybersecurity industry, Fortinet (NASDAQ:FTNT) has had excellent momentum this year and should continue appreciating as it grows profits, making the cybersecurity specialist a buy ahead of its upcoming earnings report.

Fortinet, which develops and sells cybersecurity solutions, such as intrusion prevention systems and endpoint security components, is well-placed to reap the benefits of ongoing growth in cybersecurity spending due to the current hostile geopolitical backdrop.

Not surprisingly, an InvestingPro survey of analyst earnings revisions points to mounting optimism ahead of the information-security firm’s Q3 update, which is due on Thursday, November 2, at 4:05PM EST.

Profit estimates have been revised upward 12 times in the past 90 days, while 25 analysts have a Buy-equivalent rating on the stock vs. 13 Hold-equivalent ratings and zero Sell-equivalent ratings.

Source: InvestingPro

Source: InvestingPro

Consensus calls for earnings per share of $0.36, increasing 9% from EPS of $0.33 in the year-ago period. Underlining the resilience of its business, Fortinet has topped Wall Street’s profit expectations for 22 consecutive quarters, dating back to Q4 2017.

Meanwhile, revenue is expected to climb roughly 18% year-over-year to $1.35 billion. If confirmed, that would mark Fortinet’s best quarterly sales tally on record thanks to robust demand for its cloud-based security solutions from large enterprises.

Source: InvestingPro

Source: InvestingPro

FTNT stock ended at $57.54 yesterday, earning the Sunnyvale, California-based network-security firm a valuation of $45.2 billion. Shares are up 17.7% year-to-date, a tad higher than the Global X Cybersecurity ETF's (NASDAQ:BUG) 14.2% annual gain.

It its worth mentioning that Fortinet’s stock appears to be undervalued heading into its earnings print according to a number of valuation models on InvestingPro: the average Fair Value for FTNT stands at $69.40 a potential upside of 20.6% from current levels.

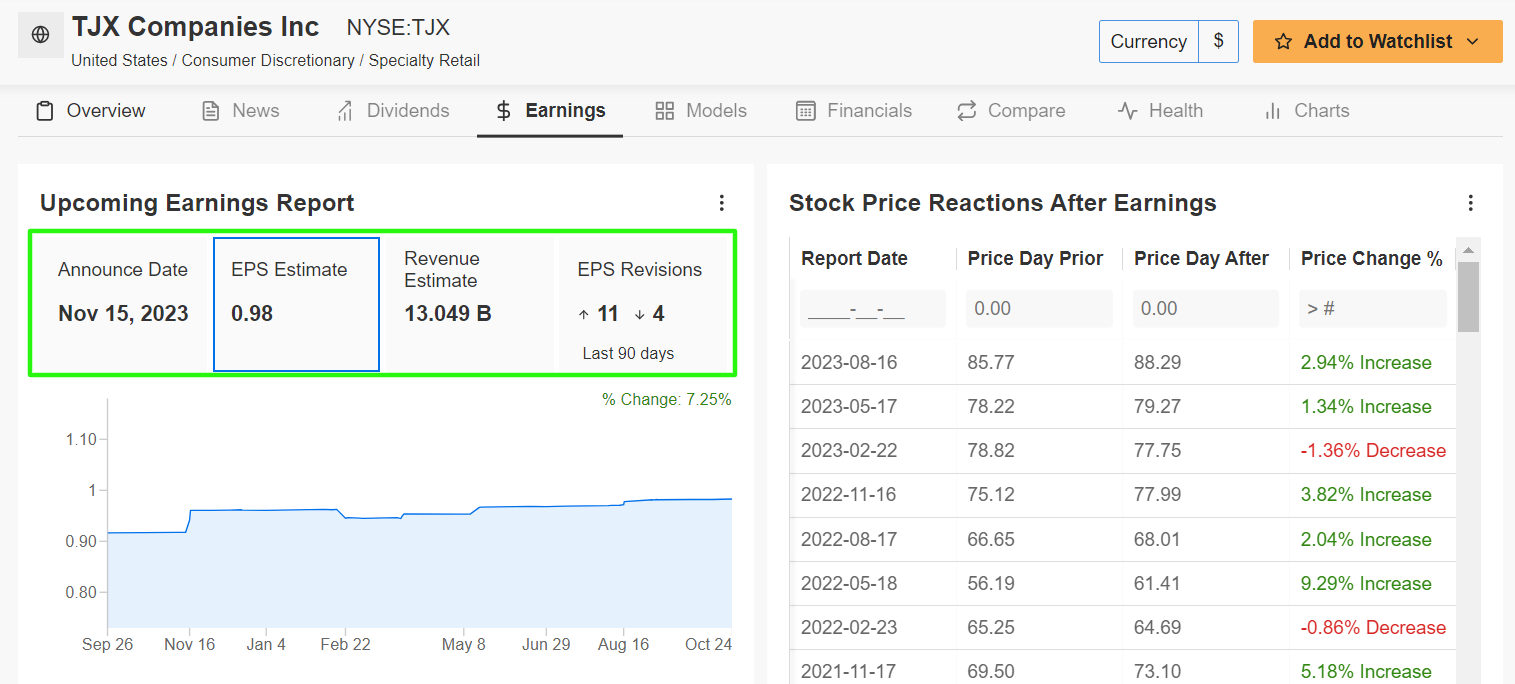

3. TJX Companies

- Earnings Date: Wednesday, Nov. 15

TJX Companies (NYSE:TJX), best known for its T.J. Maxx, Marshalls, and HomeGoods stores, remains one of the best names to own in the retail space thanks to its off-price business model, which has enabled it to weather the current economic climate better than most of its peers.

While most retailers have struggled in the face of a gloomy macro backdrop, TJX has thrived amid the existing environment as it benefits from ongoing changes in consumer behavior due to lingering inflationary pressures that is causing disposable income to shrink.

The price-conscious clothing and home decor chain is scheduled to deliver its third quarter update before the U.S. market opens on Wednesday, November 15 at 7:35AM EST.

Analysts have become increasingly bullish on the discount retailer ahead of the print, according to an InvestingPro survey: of the 15 analysts surveyed, 11 upwardly revised their earnings forecast in the last 90 days, while only four made a downward revision.

Source: InvestingPro

Source: InvestingPro

TJX is expected to post earnings per share of $0.98, improving 14% from EPS of $0.86 in the year-ago period. Despite several macro challenges, TJX’s Q3 revenue is forecast to climb 7% year-over-year to $13.04 billion as consumers migrate to off-price chains in search of cost-saving deals.

If that is in fact reality, it would mark TJX’s third consecutive quarter of accelerating profit and sales. This speaks to the consistency and fundamental strength of the bargain retailer’s treasure-hunt shopping experience through many types of retail and economic environments.

Source: InvestingPro

Source: InvestingPro

TJX stock closed Tuesday’s session at $89.46, within sight of its recent record high of $93.78 reached on September 14. At current levels, the Framingham, Mass.-based company has a market cap of $102.3 billion.

Shares are up 12.4% year-to-date, compared with a decline of roughly 3% for the S&P 500 Retail Select Sector SPDR ETF (NYSE:XRT). Even with the recent upswing, TJX stock could see an increase of 9.4%, according to InvestingPro, bringing shares closer to their ‘Fair Value’ of $97.86.

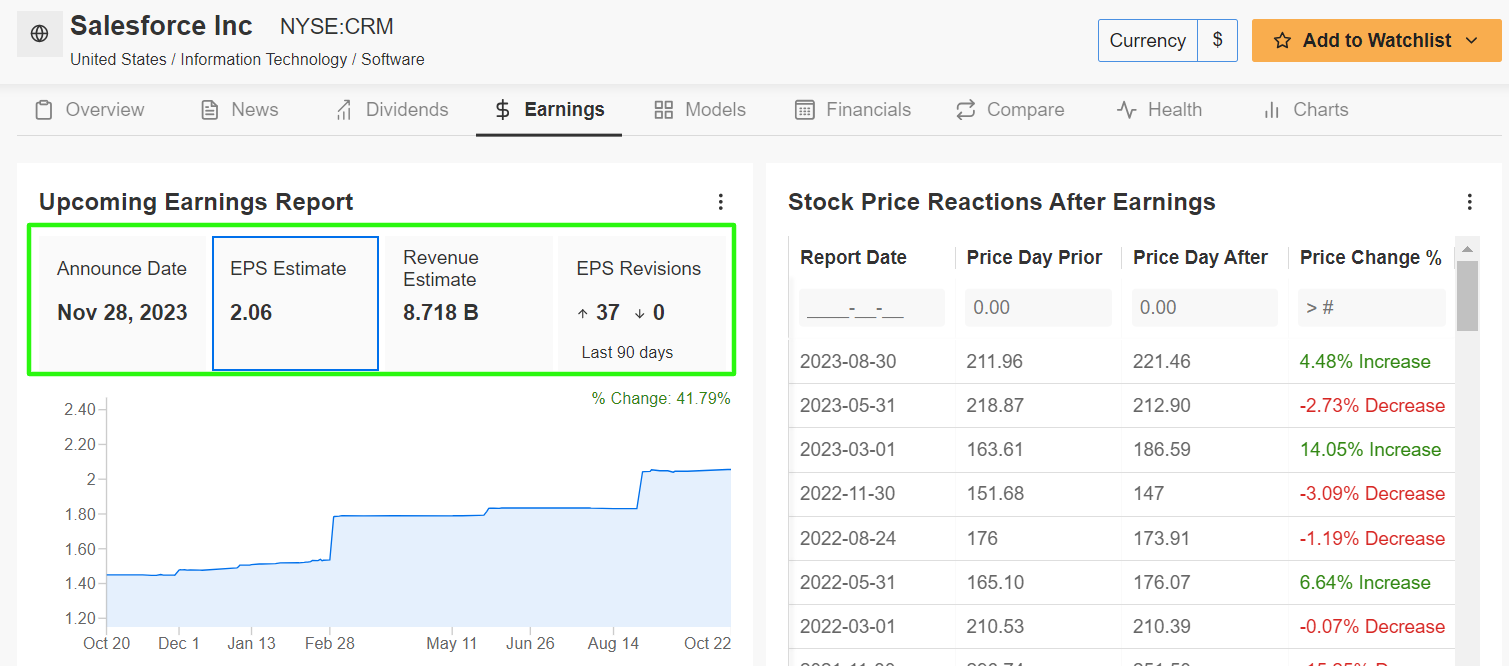

4. Salesforce

- Earnings Date: Wednesday, Nov. 29

As a leader in the customer relationship management (CRM) sector, Salesforce (NYSE:CRM) has consistently displayed robust growth potential. Its innovative cloud-based software solutions have propelled the enterprise software giant to the forefront of its industry.

Keeping that in mind, Salesforce is well positioned to grow its profit and revenue thanks to resilient demand from businesses and organizations for its CRM tools.

Salesforce is scheduled to deliver its third quarter update after the U.S. market closes on Wednesday, November 29, with both analysts and investors growing increasingly bullish on the CRM software provider.

Profit estimates have been revised upward 37 times in the last 90 days, according to an InvestingPro survey, compared to zero downward revisions. Source: InvestingPro

Source: InvestingPro

The San Francisco, California-based company is seen earning $2.06 per share in the September quarter, jumping 47.1% from the year-ago period due to the positive impact of ongoing cost-cutting measures.

Meanwhile, revenue is forecast to rise 11.1% year-over-year to $8.71 billion thanks to solid demand for its customer relationship management tools.

The Marc Benioff-led company has beaten Wall Street’s sales estimates in every quarter dating back to at least Q2 2014, as per InvestingPro, highlighting the strength and resilience of its business. Source: InvestingPro

Source: InvestingPro

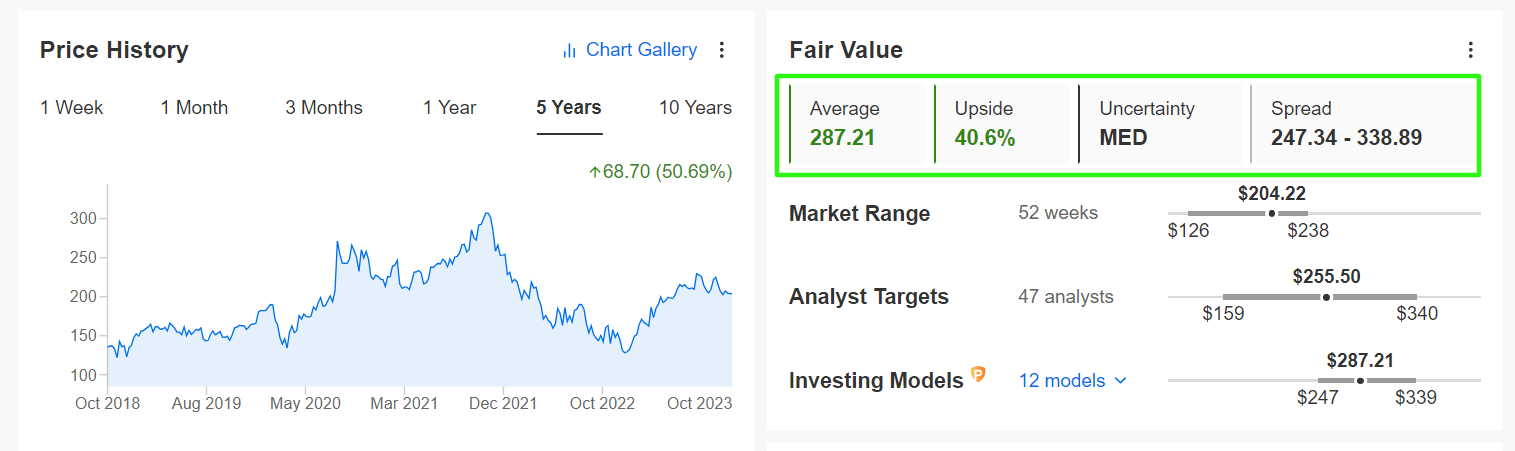

CRM stock - which rallied to a 2023 peak of $238.22 on July 19 - ended at $204.22 last night. At current levels, Salesforce has a market cap of $198.7 billion, earning it the status as the most valuable cloud-based software company in the world.

Shares have soared 54% year-to-date, rising alongside much of the tech sector. Despite its strong year-to-date performance, Salesforce's stock is still extremely undervalued according to the quantitative models in InvestingPro, and could see an increase of approximately 41% to its ‘Fair Value’ target of about $287.

5. Workday

- Earnings Date: Wednesday, Nov. 29

Workday (NASDAQ:WDAY) - which offers enterprise-level software solutions for financial management and human resources, such as payroll tools - is well positioned to achieve ongoing profit and sales growth as the economy undergoes a sea change of digitization.

Shares of the human resources software maker have run 26.9% higher in 2023, far outpacing the comparable returns of major industry peers, such as Automatic Data Processing (NASDAQ:ADP) (+0.7%), Paycom (NYSE:PAYC) (-15.7%), and Paylocity (NASDAQ:PCTY) (-4%), over the same timeframe.

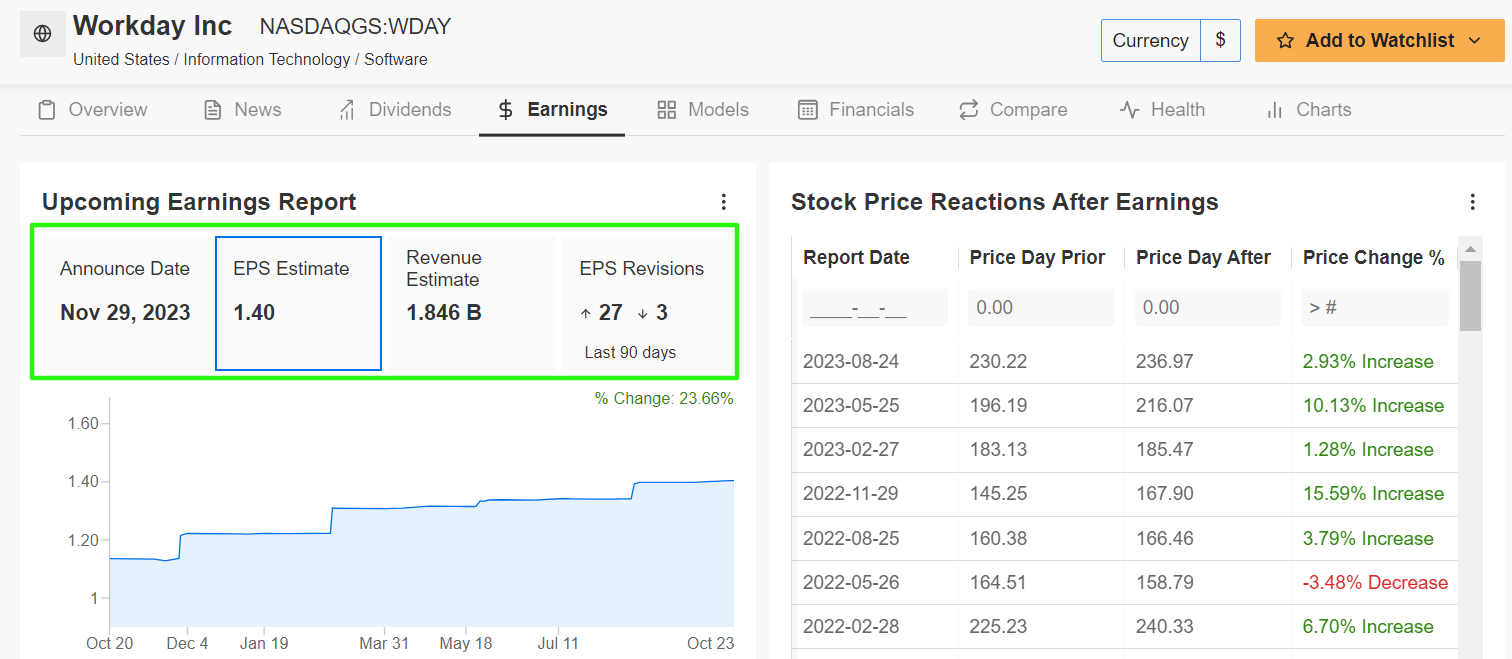

Workday is not expected to report earnings until late November, however sell-side confidence is brimming. Earnings estimates have been revised upward 27 times in the last 90 days, according to an InvestingPro survey, compared to just three downward revisions, as Wall Street grows increasingly bullish on the finance/HR software specialist.

Source: InvestingPro

Source: InvestingPro

The Pleasanton, California-based software company is projected to earn $1.40 a share in the third quarter, surging 41.4% from the year-ago period, due to the positive impact of ongoing operational restructuring actions and cost-cutting measures.

Meanwhile, revenue is anticipated to jump 15.6% annually to $1.84 billion, benefiting from solid demand for its cloud-based human capital management and financial management software solutions.

If that is in fact the reality, it would mark the highest quarterly sales total in Workday’s 18-year history, a testament to the strength and resilience of its underlying business as well as strong execution across the company.

Source: InvestingPro

Source: InvestingPro

WDAY stock ended Tuesday’s session at $212.37, earning the human capital management company a valuation of around $56 billion.

It should be noted that shares are still cheap according to a number of valuation models on InvestingPro, with the average ‘Fair Value’ price target pointing to a potential upside of 12.3% from the current market value.

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.

***

Disclosure: At the time of writing, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM). Additionally, I have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.