- Wall Street’s second-quarter earnings season draws to a close next week.

- As the dust settles, it’s time to look back and identify which companies failed to release results that impressed investors.

- Below is a list of five notable losers from the Q2 earnings season and what to expect from them going forward.

In sharp contrast to last week’s article, in which I highlighted the five biggest earnings season winners on Wall Street, this week I will take a look at five of the biggest losers as the dust settles on the Q2 reporting season.

Using the InvestingPro stock screener, I also examined the potential upside and downside for each name based on their Investing Pro ‘Fair Value’ models.

Without further ado, let's dig in!

1. Apple

- Year-To-Date Performance: +33.9%

- Market Cap: $2.72 Trillion

Apple (NASDAQ:AAPL) delivered its third consecutive quarter of declining annual revenue when it released its fiscal Q3 update on August 3 as disappointing sales of the company’s iPhones and iPads offset a strong performance from its services business.

Furthermore, the consumer electronics giant warned that the sales slump would continue into the fiscal fourth quarter ending in September, reflecting waning growth in the smartphone market.

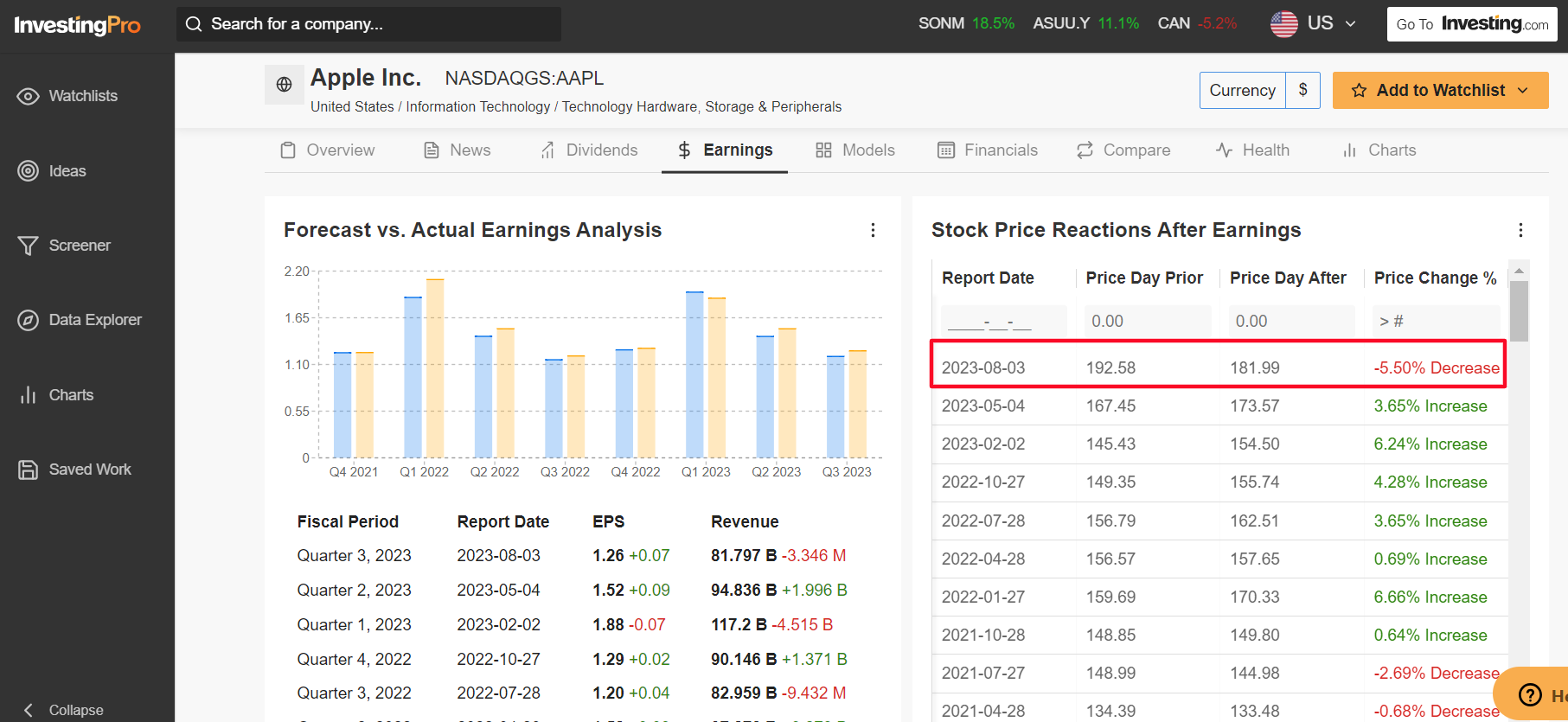

On Apple’s earnings call, CEO Tim Cook said the company continued to see an “uneven macroeconomic environment.” Source: InvestingPro

Source: InvestingPro

AAPL stock tumbled 5.5% in response to the downbeat results and weak outlook to suffer its first negative earnings-day reaction since FQ3 2021.

The Cupertino, California-based tech conglomerate has seen sales of its flagship iPhone device decline amid the challenging operating environment that has weighed on demand for its pricey smartphone models.

Meanwhile, Apple’s next big product release - the Vision Pro mixed-reality headset announced in June - is only scheduled to debut in early 2024. At its current valuation, Apple has a market cap of $2.72 trillion, making it the most valuable company trading on the U.S. stock exchange, ahead of Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Berkshire Hathaway (NYSE:BRKa), and Meta Platforms (NASDAQ:META).

At its current valuation, Apple has a market cap of $2.72 trillion, making it the most valuable company trading on the U.S. stock exchange, ahead of Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), Nvidia (NASDAQ:NVDA), Berkshire Hathaway (NYSE:BRKa), and Meta Platforms (NASDAQ:META).

Shares are up 33.9% in 2023, outperforming the broader market by a wide margin over the same period amid the year-to-date rally in mega-cap tech stocks.

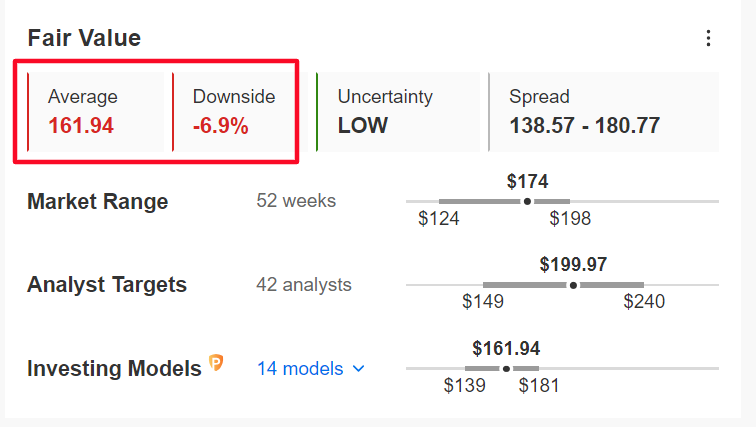

Source: InvestingPro

While Apple remains a favorite amongst Wall Street analysts, shares appear to be somewhat overvalued, as per the quantitative models in InvestingPro, which point to a potential downside of 6.9% from current levels.

2. Tesla

- Year-To-Date Performance: +77.9%

- Market Cap: $693.6 Billion

Tesla (NASDAQ:TSLA) posted underwhelming Q2 earnings on July 19 as the electric vehicle maker’s automotive gross margins fell more than expected amid the negative impact of its ongoing price-slashing strategy.

The Elon Musk-led EV giant said operating margin fell to 9.6%, the lowest in 16 quarters. Total gross margin came in at 18.2%, also a low for the same period.

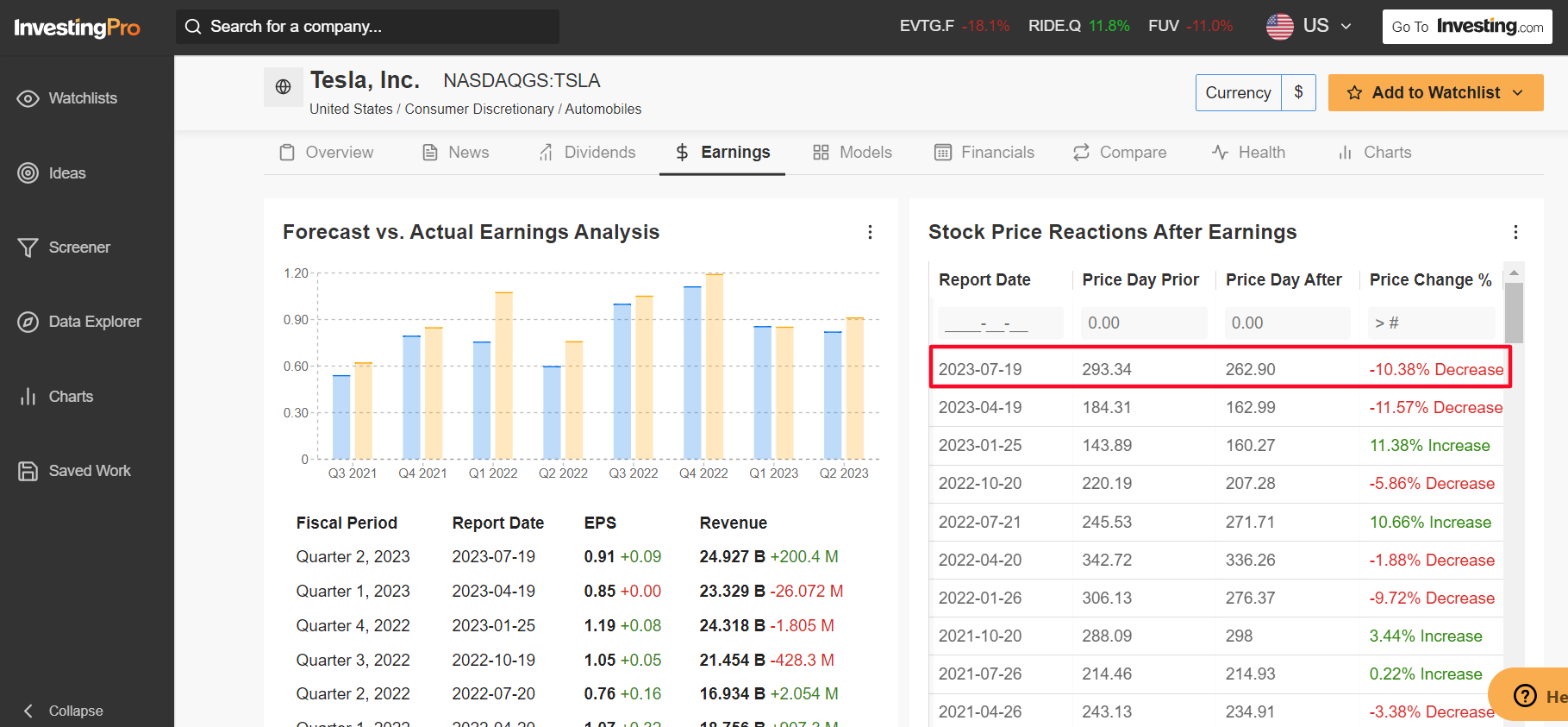

On the earnings call, Musk signaled he would cut prices again to shield against a “turbulent” macroeconomic environment that could impact people’s car-shopping plans. Source: InvestingPro

Source: InvestingPro

TSLA shares sank 10.4% following the disappointing update to log their second straight earnings-reaction-day selloff of at least 10%.

Tesla’s continuing price cuts have fueled concerns that it is having to offer discounts on its vehicles in the face of weakening demand and growing competition from traditional legacy automakers as well as Chinese EV startups.

Tesla is still the market leader in North America with about 65% of the EV industry in 2022, but that is down from 70% in 2021 and 79% in 2020. After losing nearly two-thirds of their value in 2022, shares of the EV pioneer have rebounded sharply in 2023, surging 77.9% year-to-date.

After losing nearly two-thirds of their value in 2022, shares of the EV pioneer have rebounded sharply in 2023, surging 77.9% year-to-date.

At its current valuation, the Austin, Texas-based EV company has a market cap of $696.3 billion, making it the world’s largest automaker.

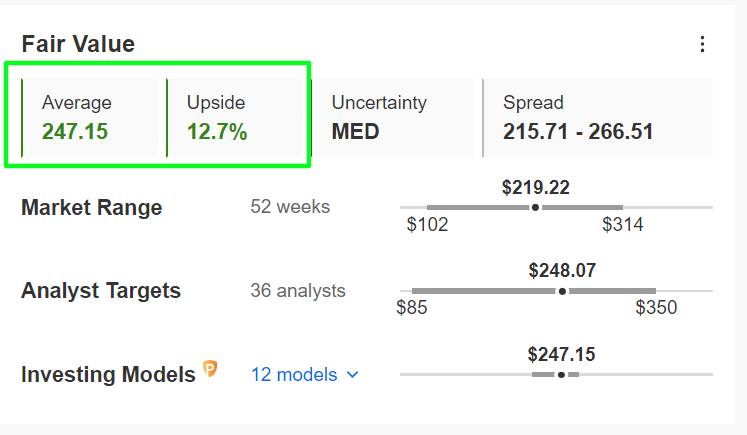

Source: InvestingPro

With that being noted, TSLA stock is still cheap according to a number of valuation models on InvestingPro, with the average ‘Fair Value’ price target pointing to a potential upside of 12.7% from the current market value.

3. Qualcomm

- Year-To-Date Performance: +0.1%

- Market Cap: $122.8 Billion

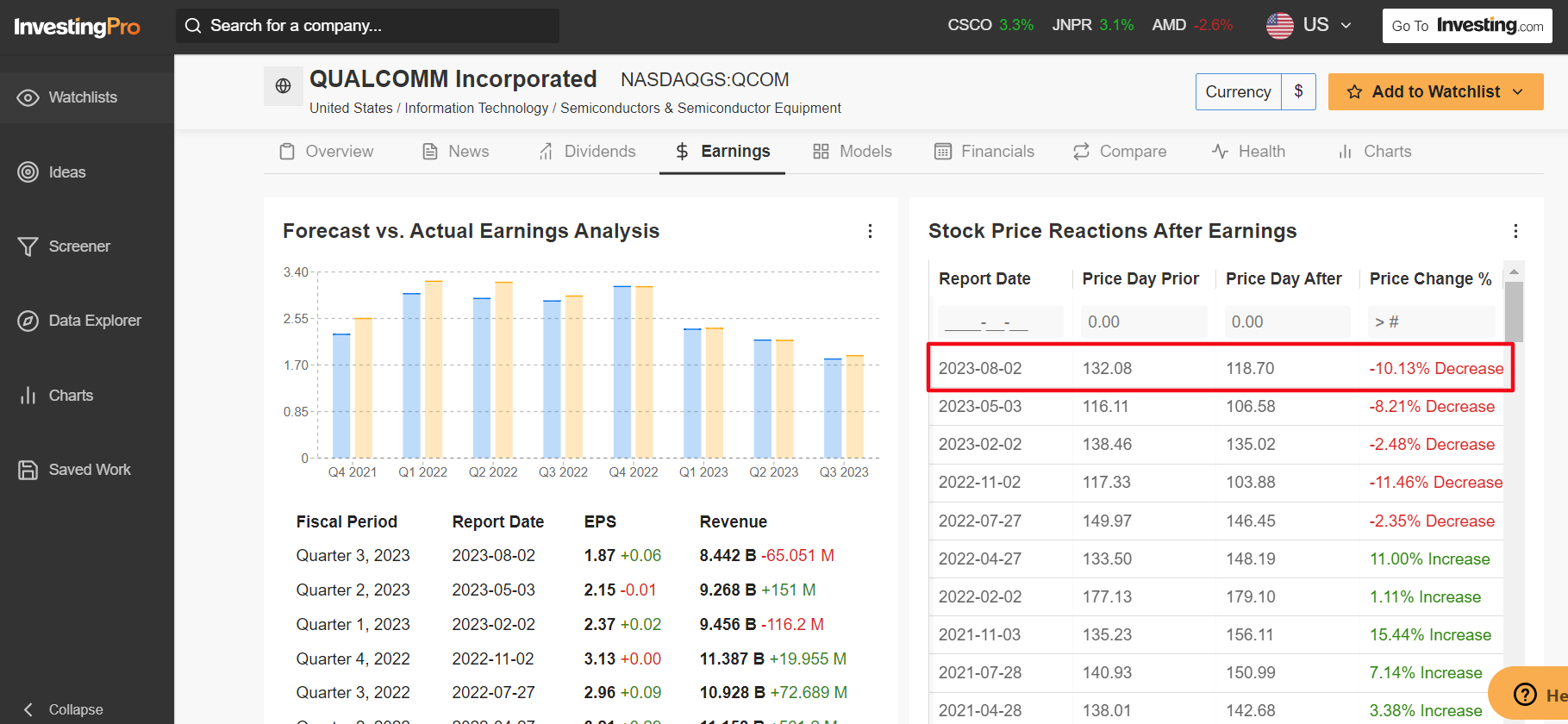

Qualcomm (NASDAQ:QCOM) reported worrying Q3 financial results on August 2, revealing a sharp slowdown in both profit and sales growth due to softening demand for smartphones amid the challenging global economic climate.

Revenue at Qualcomm's mainstay handset chip business tumbled 25% year-over-year to $5.26 billion, while adjusted overall revenue of $8.44 billion missed estimates of $8.50 billion.

In addition, the chipmaker forecast fourth-quarter sales below market expectations, citing the impact of macroeconomic headwinds, weaker global handset units and the fact that phone makers are using existing inventory rather than putting in fresh chip orders. Source: InvestingPro

Source: InvestingPro

Qualcomm’s shares plunged 10.1% to suffer their fifth earnings-reaction-day selloff in a row as investors dumped the stock in response to the quarterly sales miss and weak guidance.

The San Diego, California-based semiconductor giant - which makes the processors at the heart of most high-end Android devices - has struggled this year due to its large exposure to the slumping smartphone industry. At its current valuation, Qualcomm has a market cap of $122.8 billion, making it the largest communications equipment supplier in the market.

At its current valuation, Qualcomm has a market cap of $122.8 billion, making it the largest communications equipment supplier in the market.

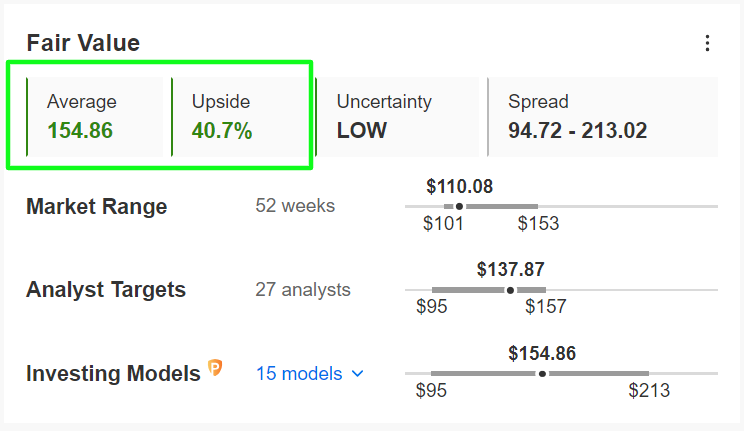

Shares are up just 0.1% in 2023, severely underperforming the year-to-date return of the Philadelphia Semiconductor Index, which is up 36.8%.

Source: InvestingPro

According to the InvestingPro model, Qualcomm’s stock is still very undervalued and could see an increase of 40.7% from current levels, bringing it closer to its fair value of $154.86 per share.

4. PayPal

- Year-To-Date Performance: -17.7%

- Market Cap: $64.3 Billion

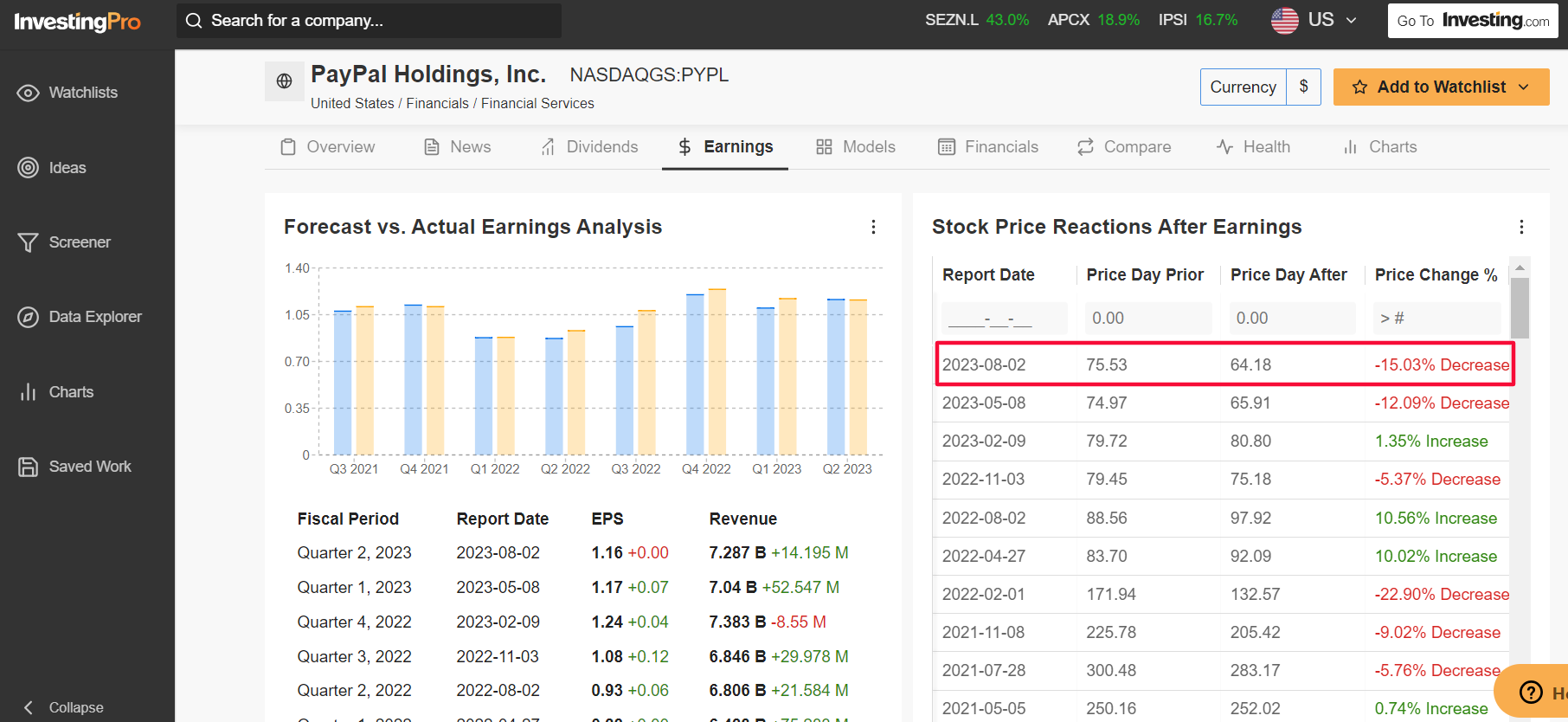

PayPal (NASDAQ:PYPL), which has seen its stock steadily collapse to new lows in recent sessions, delivered second-quarter earnings and revenue that failed to impress Wall Street on August 2, while higher provisions at its credit portfolio hit margins.

PayPal's adjusted operating margin for the quarter came in at 21.4%, down from 22.7% in the first quarter.

Underwhelming margins at PayPal have come under scrutiny in recent quarters as growth in its high-margin branded products business has slowed due to increased pressure from competitors like Apple, Google, and Amazon. Source: InvestingPro

Source: InvestingPro

The report was poorly received by investors, with PayPal’s shares suffering an earnings-day decline of 15%. It was the stock’s second straight earnings-reaction-day drop of at least 12% and its worst earnings-day reaction since Q4 2021, when it plunged 22.9%.

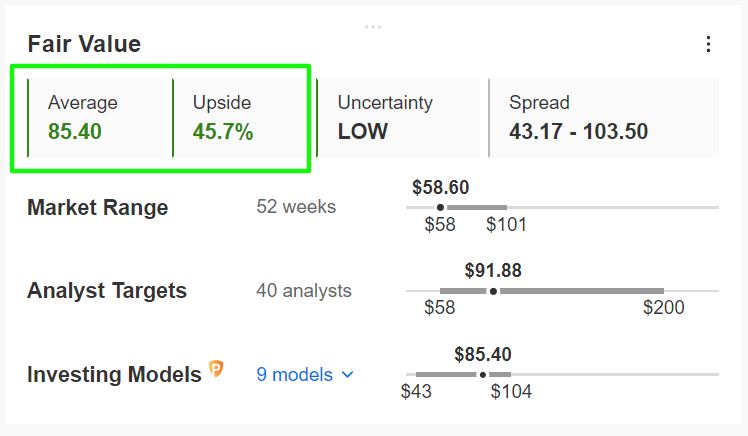

Investors have become increasingly concerned about the company’s long-term prospects amid rising competition in the mobile payments processing industry from tech giants, such as Apple's Apple Pay and Block’s Cash App. Shares of the embattled digital payments provider have tumbled nearly 18% so far this year, with PYPL stock recently touching a six-year low.

Shares of the embattled digital payments provider have tumbled nearly 18% so far this year, with PYPL stock recently touching a six-year low.

At current valuations, PayPal has a market cap of $64.3 billion.

Source: InvestingPro

In spite of its massive downtrend, the average ‘Fair Value’ price target for PayPal’s stock on InvestingPro implies potential upside of 45.7% from the current market value.

5. Snap

- Year-To-Date Performance: +1%

- Market Cap: $14.6 Billion

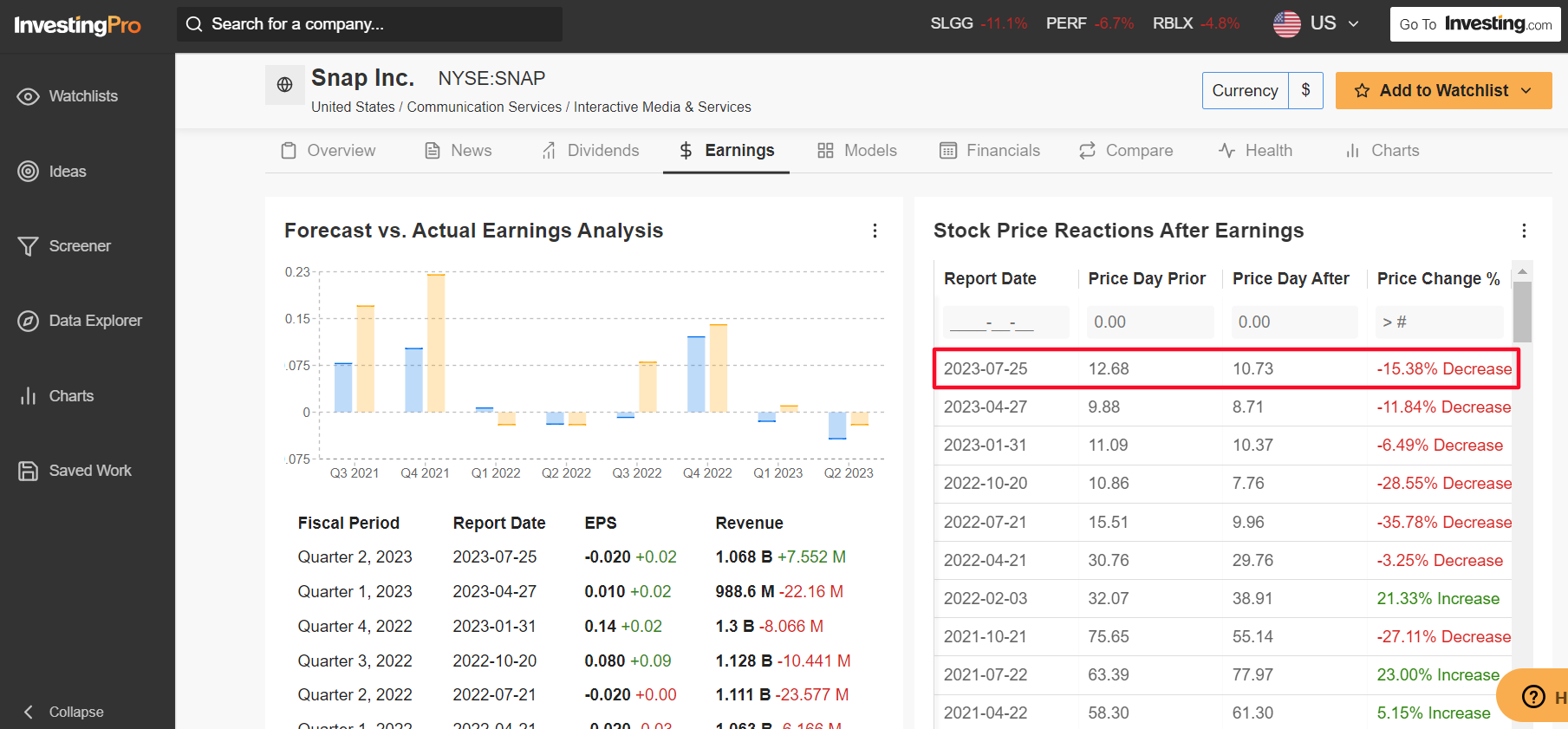

Snap (NYSE:SNAP) actually released Q2 results that topped consensus estimates on July 25, despite suffering its second straight period of declining annual revenue growth due to a weak performance in its core digital advertising business.

Brand advertising was down 8% in the quarter, the company noted, while direct-response ads fell 7%.

Underscoring several headwinds Snap faces amid the current backdrop, the ad-reliant social media firm provided a shockingly weak forecast for the September quarter that badly missed analysts’ expectations. Source: InvestingPro

Source: InvestingPro

The dismal outlook triggered a 15.4% plunge in SNAP stock, which marked its sixth earnings-day selloff in a row and the worst earnings-day-reaction since Q3 2022.

The parent company of social media messaging app Snapchat has been under constant pressure from the negative impact that privacy changes in Apple’s iOS have had on its business as it faces growing competition from Chinese video-sharing app TikTok.

At current levels, the Santa Monica, California-based social media firm has a valuation of $14.6 billion, well off its peak market cap of $130 billion reached in September 2021. As could be expected, SNAP stock has trailed the year-to-date performance of some of its most notable rivals by a wide margin, rising just 1% in 2023.

As could be expected, SNAP stock has trailed the year-to-date performance of some of its most notable rivals by a wide margin, rising just 1% in 2023.

Shares were trading near their 2023 high heading into the Q2 earnings report and were up by as much as 55% for the year at one point.

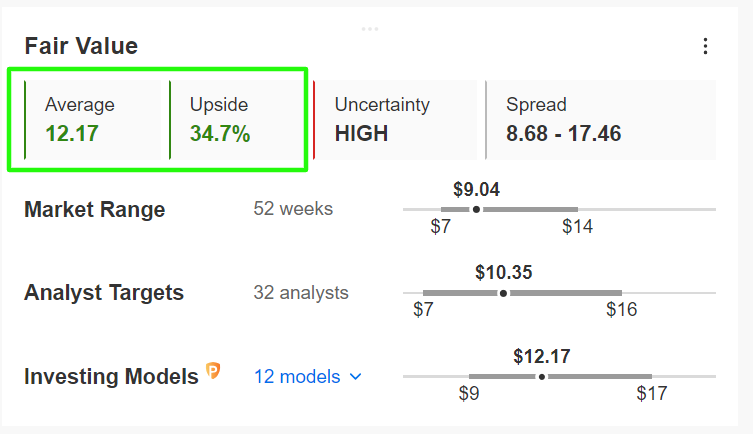

Source: InvestingPro

Despite the uncertain outlook, Snap’s shares are extremely undervalued at the moment, according to InvestingPro models, and could see an increase of 34.7% from Thursday’s closing price of $9.04.

***

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average via the SPDR Dow ETF (DIA). I also have a long position on the XLE) and the XLV. Additionally, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.