- Asana shares have lost two-thirds of their value in 2022.

- Although not yet profitable, hybrid working could bring significant top line growth.

- Long-term investors could consider buying ASAN stock at these levels.

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

San Francisco, California-based work-management software platform, Asana (NYSE:ASAN) is a software-as-a-service (SaaS) company offering a task and project management platform for teams. Shareholders of ASAN stock have seen the value of their investment drop more than 42% over the past year and 68% year-to-date (YTD).

By comparison, the Dow Jones Software is down roughly 23% YTD and the tech-heavy NASDAQ 100 has slid 22% so far this year.

On Nov.15, 2021, ASAN shares went over $145, hitting a record high but since then it has declined roughly 83%. Its 52-week range has been $17.87 - $145.79, while the market capitalization (cap) currently stands at $4.5 billion.

Recent metrics suggest Asana has a market share of over 3%. However, it is not yet profitable and continues to burn through significant cash—typical for an early-stage tech company that spends aggressively on expanding its customer base. The risk-off mood on Wall Street means investors are not willing to pay for high multiples in businesses with no clear path to profitability.

Recent Metrics

Asana issued Q1 figures of fiscal 2023 on June 2. Revenue grew 57% year-over-year (YoY) to $120.6 million. Adjusted loss was 30 cents per share, compared to an adjusted loss of 21 cents in the prior-year quarter.

Cash and equivalents ended the period at $197.3 million. Investors scratched their heads when they noted Asana spent around 80% of its revenue on sales and marketing.

On the results, CEO Dustin Moskovitz commented:

“We reported strong revenue growth in the first quarter… We are closing bigger net new customers, our largest customers are expanding at a fast pace and our revenue mix from our Enterprise and Business tier continues to climb.”

The software company ended the quarter with more than 126,000 paying customers, up from 119,000 at the end of the previous quarter. Customers who spent at least $50,000 also increased 102% YoY.

Management expects Q2 revenue to be $127 million-128 million, implying growth of 42%-43% YoY. Adjusted loss per share is expected to come in between 39 cents and 38 cents.

Prior to the release of the Q1 results, ASAN stock was around $24. At the time of writing on June 8, it trades at $23.60.

What To Expect From Asana Stock

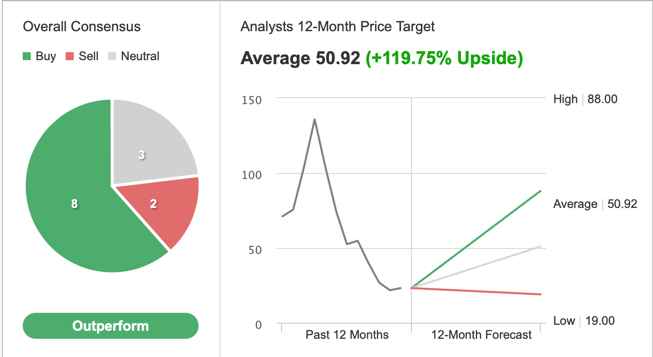

Among 13 analysts polled via Investing.com, ASAN stock has an "outperform" rating. Wall Street has a 12-month median price target of $50.92 for the stock, suggesting an increase of more than 119% from the current price.

Source: Investing.com

The 12-month price range currently stands between $88 and $19.

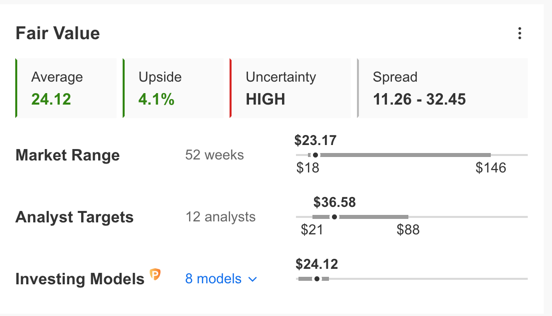

However, according to a number of valuation models, such as P/E or P/S multiples or terminal values, the average fair value for the stock on InvestingPro is $24.12.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase by a mere 2%.

Our expectation is for ASAN stock to build a base between $22 and $24 in the coming weeks. Afterwards, shares could potentially start a new leg up.

Adding ASAN Stock To Portfolios

Asana bulls who are not concerned about short-term volatility could consider investing now. Their initial target price would be $24.12, as per the target provided by analysts. And if Wall Street analysts are correct, then the price could reach $50.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has ASAN stock as a holding. Examples include:

- Direxion Moonshot Innovators ETF (NYSE:MOON)

- O'Shares Global Internet Giants (NYSE:OGIG)

- Franklin Exponential Data ETF (NYSE:XDAT)

- iShares Virtual Work and Life Multisector ETF (NYSE:IWFH)

Finally, those experienced with options could also consider selling a cash-secured put option in ASAN stock—a strategy we regularly cover.

Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own ASAN shares for less than their current market price of $23.60

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on ASAN stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Cash-Secured Puts on ASAN

Price Now: $23.60

Let's assume an investor wants to buy ASAN stock, but does not want to pay the full price of $23.60 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for ASAN stock to fall further, which it might or might not do. The other possibility is to sell one contract of a cash-secured ASAN put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's also assume the trader is putting in this trade until the option expiry date of Aug. 19. As the stock is $23.60 at the time of writing, an OTM put option would have a strike of $22.50.

The ASAN Aug 19 22.50-strike put option is currently offered at a price (or premium) of $3.30.

An option buyer would have to pay $3.30 X 100, or $330, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future and also it is the seller’s maximum gain. This put option will stop trading on Friday, Aug. 19.

If the put option is in the money (meaning the market price of ASAN stock is lower than the strike price of $22.50) any time before or at expiration on Aug.19, this put option can be assigned. The seller would then be obligated to buy 100 shares of ASAN stock at the put option's strike price of $22.50 (i.e. at a total of $2,250).

The break-even point for our example is the strike price ($22.50) less the option premium received ($3.30), i.e., $19.20. This is the price at which the seller would start to incur a loss.

Bottom Line

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on the likely choppiness in ASAN stock in the coming weeks.

Investors who end up owning ASAN shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in Asana stock ownership.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More.