- The healthcare sector could present hidden undervalued opportunities.

- These stocks may be oversold technically and could be ripe for a rebound.

- Below, we'll take a look a three such stocks primed for the biggest upside.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

The healthcare sector (NYSE:XLV) is often considered a defensive market; however, its diversity in services and products makes it less homogeneous compared to sectors like finance or public services.

In today's analysis, we focus on various healthcare companies, each with distinct business profiles.

What unites them is the common thread of being oversold, as indicated by the RSI oscillator, alongside a suggested growth potential of at least 20% based on the InvestingPro fair value indicator.

Additionally, the technical indicators suggest a possible reversal based on the developing pattern and tested support levels.

1. Humana: Growth Potential Ahead of the Presidential Election

Humana (NYSE:HUM) is a health insurance company operating in the U.S. market, which, unlike Europe, has a lower availability of insurance.

It is estimated that in the U.S., aside from public support, about 60% of adult citizens currently use private insurance, indicating further potential for expansion in this area.

The upcoming presidential election is crucial, where a victory for Kamala Harris could theoretically benefit insurance companies.

However, this remains highly uncertain, especially after the recent presidential debate, which lacked specific details regarding health policy.

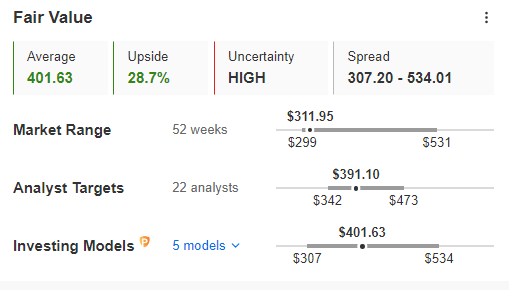

Fundamentally, Humana boasts a relatively high fair value ratio, which is the highest among the companies analyzed.

Source: InvestingPro

From a technical standpoint, in addition to the oversold condition, attention should be drawn to the critical support level at $300. This is where this year's lows are forming, which could again become a turning point for buyers.

2. McKesson Corporation: Navigating a 5-Wave Elliott Wave Pattern

McKesson Corporation (NYSE:MCK) has a broad range of operations in supplements and medical products.

Like Humana, McKesson's fair value index indicates over 28% potential growth, with the stock currently in a local downtrend, correcting a broader uptrend.

The focus is primarily on the structure of the movement in the southern direction, within which a 5-wave Elliott wave pattern is being formed.

A potential level to watch is the currently tested support of $465, where we see demand reactions, or slightly lower at the frequently tested level of $440.

The main signal for a return to growth would be a breakout above the forming price channel and an attempt to target $530.

3. Haemonetics Corporation: Financial Stability and Strong Performance

Haemonetics Corporation (NYSE:HAE) stands out as the most specialized company in this list, primarily engaged in devices for plasma and blood collection.

Its main advantages include a very good financial situation, confirmed by InvestingPro’s financial health indicator.

Source: InvestingPro

The financial stability of Haemonetics is further highlighted by its net profits over the past two years, which have shown significant stabilization compared to pre-2022 period.

After experiencing stock price declines in late July and August, the company’s shares entered a consolidation phase within the $71 to $79 per share range. It is worth monitoring this area, as a breakout above could signal a compelling buying opportunity.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.