- June is expected to be another eventful month on Wall Street.

- Identifying undervalued stocks with strong upside potential becomes paramount in the current environment.

- As such, investors should consider adding the stocks discussed in this article to their portfolios in June.

- Looking for a helping hand in the market? Unlock access to InvestingPro’s AI-selected stock winners for just 60 cents a day!

June is expected to be another eventful month for investors eyeing potential opportunities in the market amid lingering uncertainty over the timing of the first Federal Reserve rate cut and indications of elevated inflation.

As we delve into the new month, several stocks are poised to capture attention, including Adobe (NASDAQ:ADBE), FedEx (NYSE:FDX), and DocuSign (NASDAQ:DOCU).

These companies not only have earnings reports scheduled for the month but also boast promising fundamentals and tailwinds that could propel their stocks higher.

Do you want to outperform in June?

Get the market's top set of AI-powered stock picks for less than $9 a month using this link.

The next update is out already, with a fresh selection of 90+ AI-powered stock picks set to beat the market! Subscribe now and don't miss out on this chance to garnish hefty profits.

Now, coming back to the picks to be discussed in this article, let's delve deeper into what makes these three undervalued stocks compelling opportunities for investors as we step into June.

1. Adobe

- 2024 Year-To-Date: -24.8%

- Market Cap: $200.9 Billion

Adobe stock ended Tuesday’s session at $448.37, not far from a recent 52-week low of $433.97 reached on May 31. At current levels, the San Jose, California-based software-as-a-service powerhouse has a market cap of about $201 billion.

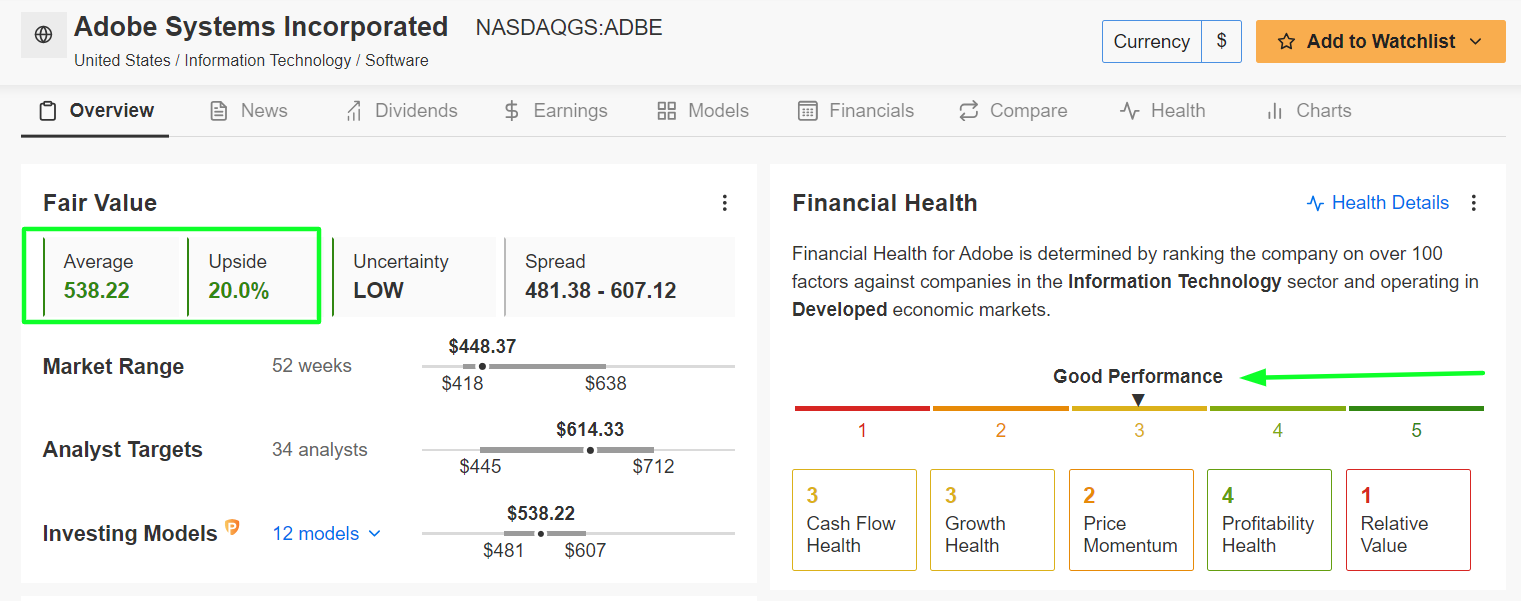

Shares are down 24.8% year-to-date, making it one of the worst performers in the S&P 500 in 2024. Nevertheless, this drop presents investors with a potential buying opportunity given the tech company's substantial Fair Value upside of 20%, as suggested by InvestingPro's AI models.

Source: InvestingPro

Additionally, Adobe boasts an above-average Financial Health Score of 3/5 thanks to its strong fundamental indicators. ProTips highlights several tailwinds, including impressive gross profit margins that underscore its strong business model.

Catalysts for June: Adobe is scheduled to deliver its second-quarter earnings update after the U.S. market closes on Thursday, June 13 at 4:05 PM ET.

It is worth mentioning that 14 of the last 24 revisions from analysts have been to the upside, while 35 out of the 39 analysts covering ADBE have either a Buy-equivalent or Hold-rating on the stock.

Adobe is seen earning $4.39 a share in Q2, rising 12.3% from $3.91 in the year-ago period thanks to ongoing cost-cutting measures.

Meanwhile, revenue is forecast to increase by 9.8% to $5.29 billion, driven by continued subscriber growth and increasing adoption of its digital experience platform.

Despite worries over an increasingly competitive landscape, Adobe continues to benefit from the surging demand for digital content creation and design tools. Its robust suite of creative software, including Photoshop, Illustrator, and Premiere Pro, remains the industry standard.

2. FedEx

- 2024 Year-To-Date: -2.8%

- Market Cap: $60.5 Billion

FedEx shares closed at $245.95 last night, well off their 2024 peak of $291.27 touched on March 22. The Memphis, Tennessee-based shipping giant has a market cap of $60.5 billion at its current valuation, making it the second most valuable integrated freight & logistics company in the world, trailing only United Parcel Service (NYSE:UPS).

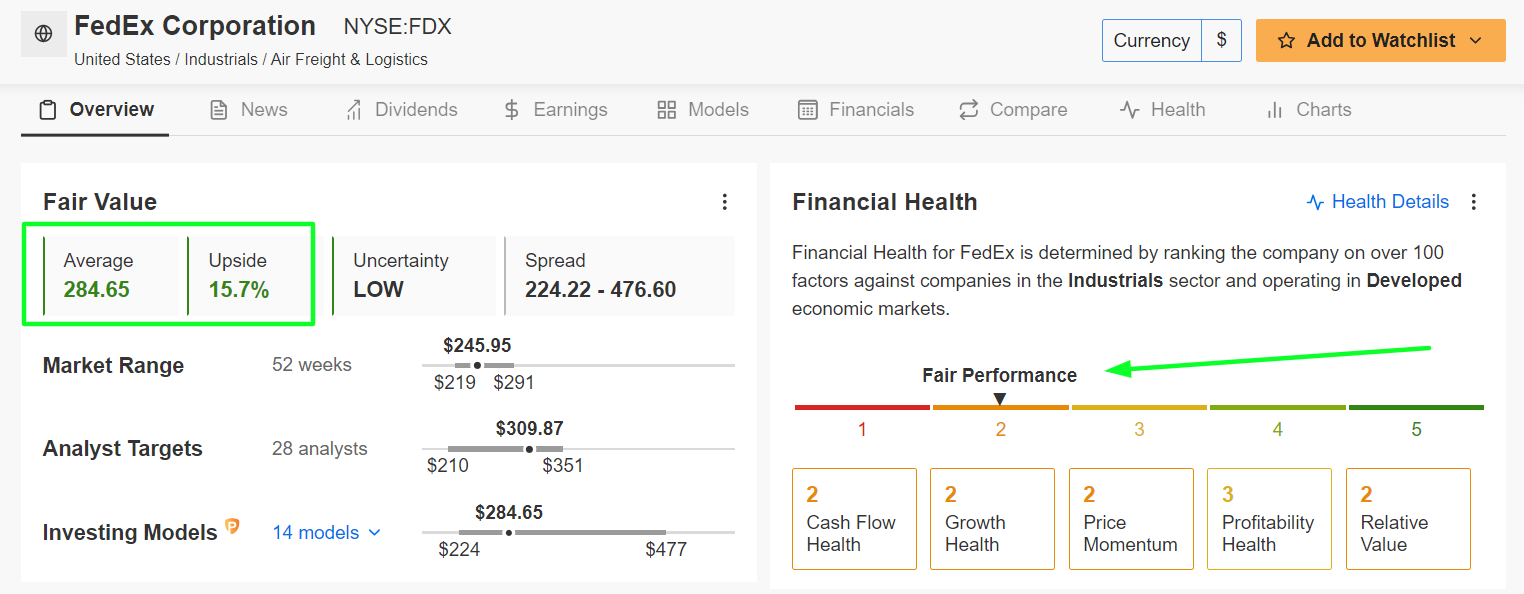

With its year-to-date decline of 2.8%, FedEx is another candidate with an impressive upside potential. InvestingPro's quantitative models anticipate a 15.7% Fair Value upside for FDX stock. That would bring shares closer to their price target of $284.65.

Source: InvestingPro

Furthermore, FedEx also has a fair Financial Health Score, reflecting the package delivery company’s solid fundamentals and long-term growth prospects. ProTips flags several favorable factors, including rising dividend payouts and a low P/E ratio.

Catalysts for June: FedEx is slated to deliver its financial results for the fiscal fourth quarter after the closing bell on Tuesday, June 25, at 4:10 PM ET.

An InvestingPro survey of analyst earnings revisions points to mounting optimism ahead of the results, with analysts growing increasingly bullish on the freight & logistics company.

FedEx is forecast to earn $5.38 per share, improving 8.9% from EPS of $4.94 in the year-ago period, as it reaps the benefits of its ongoing operational restructuring actions, strategic cost-saving initiatives, and portfolio adjustments.

Meanwhile, revenue is seen rising roughly 1% annually to $22.17 billion, amid higher shipping volumes.

FedEx has expanded its international shipping and delivery services to meet escalating global demand, setting the stage for positive net income growth. Additionally, the company’s ongoing investments in growing its network and enhancing operational efficiencies are expected to drive margin improvements.

3. DocuSign

- 2024 Year-To-Date: -10.5%

- Market Cap: $10.9 Billion

DocuSign’s stock ended at $53.20 on Tuesday, reapproaching its 2024 trough of $49.12 reached on February 21. At current valuations, the San Francisco, California-based digital signature software specialist has a market cap of $10.9 billion.

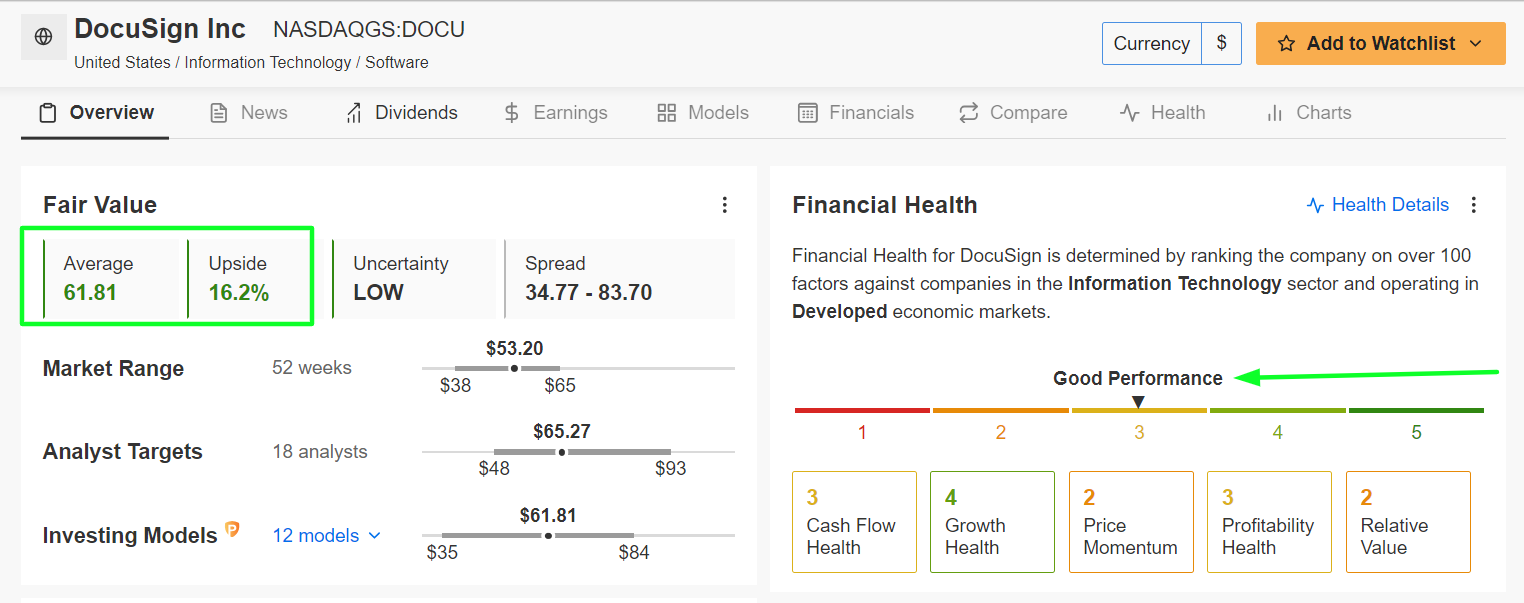

Shares have experienced a year-to-date decline of 10.5%. However, InvestingPro's AI models indicate that the present valuation of DOCU suggests it is a bargain. There's a possibility of a 16.2% increase from last night’s closing price, moving it closer to its 'Fair Value' set at $61.81 per share.

Source: InvestingPro

Demonstrating the strength of its business, the software-as-a-service company’s growing net income, impressive gross profit margins, and robust balance sheet metrics earn it a noteworthy Pro Financial Health Score of 3 out of 5.

In addition, ProTips highlights its healthy profitability outlook and attractive valuation as key strengths, supporting its long-term growth trajectory.

Catalysts for June: DocuSign is forecast to report strong profit and sales growth when it delivers fiscal Q1 results after the closing bell on Thursday, June 6, at 4:05 PM ET.

Wall Street is extremely optimistic on the e-signature company ahead of the print, as per an InvestingPro survey, with analysts increasing their EPS estimates 17 times in the past three months to reflect a gain of nearly 27% from their initial expectations.

DocuSign is forecast to earn $0.79 per share, increasing 9.7% from a profit of $0.72 a share in the year-ago period.

Meanwhile, revenue is seen rising 7% year-over-year to $707.7 million driven by higher customer retention and new client acquisitions.

As the workforce continues to operate remotely, the demand for DocuSign's offerings from large enterprises and small businesses is likely to keep surging, presenting a strong tailwind for the company.

Before investing in any stock, thorough research and consideration of your investment goals are highly recommended. It's crucial to consider the company's financial health, industry trends, and your own risk tolerance before making any investment decisions.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading amid the challenging backdrop of slowing economic growth, elevated inflation, high interest rates, and mounting geopolitical turmoil.

Readers of this article enjoy a limited-time discount of 40% OFF on the yearly and bi-yearly Pro plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.