- The demand for stocks with an attractive dividend yield has increased lately

- So, in this piece, we will take a look at three dividend stocks that offer a yield greater than 6%

- Out of the many qualifying stocks, the ones we'll analyze also exhibit notable upside potential

Moving into the second quarter, S&P 500 companies saw a 2.3% decline in dividend payments in contrast to the first quarter.

Today, our attention pivots toward stocks that offer investors compelling dividend yields, surpassing the 6% threshold. To enhance our analysis, we'll leverage the insights offered by InvestingPro.

It's worth noting that while we'll delve into three of these stocks, they are by no means the only contenders. However, their standout feature lies in the upside potential in the medium term.

Additionally, several other notable contenders showcasing high dividend yields are as follows:

- Devon Energy (NYSE:DVN) boasts a robust +8.1% yield.

- Altria Group (NYSE:MO) demonstrates an impressive +8% yield.

- Verizon Communications (NYSE:VZ) illustrates a commendable +7.5% yield.

- AT&T (NYSE:T) presents a notable +7.4% yield.

- KeyCorp (NYSE:KEY) reports a solid +7.4% yield.

- Lincoln National (NYSE:LNC) delivers a commendable +6.5% yield.

Buying individual stocks isn't the only way to bag dividends, as there are several benchmark indexes and ETFs present, each serving as a valuable reference point:

- The Dow Jones Select Dividend Index was established in 2003. This index meticulously tracks the performance of 100 companies that are carefully chosen based on criteria like dividend growth and payout. The companies' weighting within the index is determined by their dividend yield.

- The ProShares S&P 500 Dividend Aristocrats ETF (NYSE:NOBL) comprises companies that have consistently elevated their dividends for a minimum of 25 consecutive years.

- The NASDAQ US Broad Dividend Achievers index, introduced in 2000, is composed of companies boasting a distinguished track record of dividend payments spanning at least 10 years.

So here are three stocks with dividend yields exceeding 6% and great upside potential in the medium term:

1. Pioneer Natural Resources

Pioneer Natural Resources (NYSE:PXD), headquartered in Irving, Texas, is a company dedicated to hydrocarbon exploration. It was formed in 1997 through the merger of Parker & Parsley Petroleum Company and MESA.

The company presented strong results on August 1. The next earnings release is scheduled for November 7.

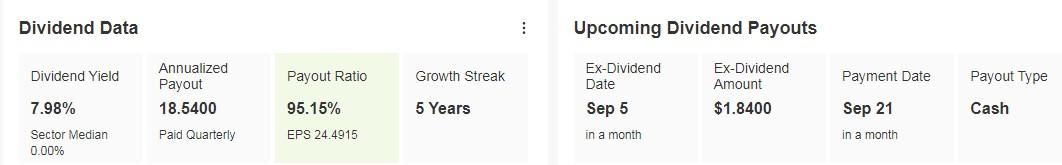

Standing as the top performer in the energy sector within the S&P 500 will distribute dividends on September 21, requiring shareholders to possess shares before September 5 to be eligible.

The dividend yield is nearly 8%, with a payout (the percentage of profits distributed among shareholders) of 95.15%. Source: InvestingPro

Source: InvestingPro

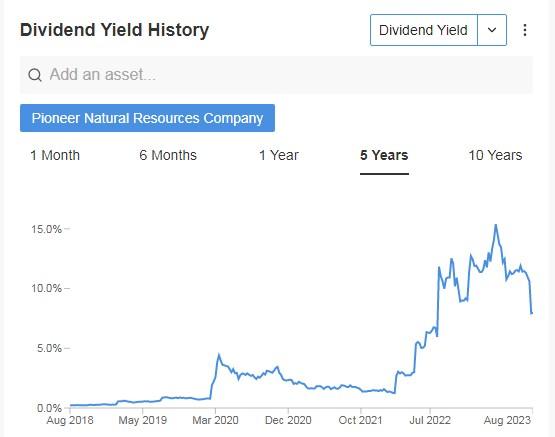

In recent years, the oil and gas exploration company has experienced a notable surge in its dividend yield.

Source: InvestingPro

It has a total of 32 ratings, with 16 indicating a "buy," 13 suggesting a "hold," and 3 advising a "sell." As of Monday's closing, over the past month, it has surged by +12.56%. Looking back over the last three months, it has gained +11.20%, and in the past year, it has seen a growth of +18.48%.

As of Monday's closing, over the past month, it has surged by +12.56%. Looking back over the last three months, it has gained +11.20%, and in the past year, it has seen a growth of +18.48%.

The stock's upward momentum remains intact, staying above its benchmark level as well as the 50-day and 200-day moving averages. The next challenge on its horizon is the $242 resistance.

2. Coterra Energy

Coterra Energy (NYSE:CTRA) stands as a hydrocarbon exploration company headquartered in Houston, Texas. Originally established as Cabot Oil & Gas Corporation, the company transitioned to full public ownership in March 1991.

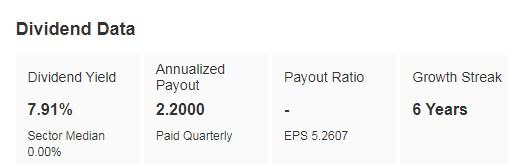

Notably, its dividend boasts a yield of +7.91%.

Source: InvestingPro

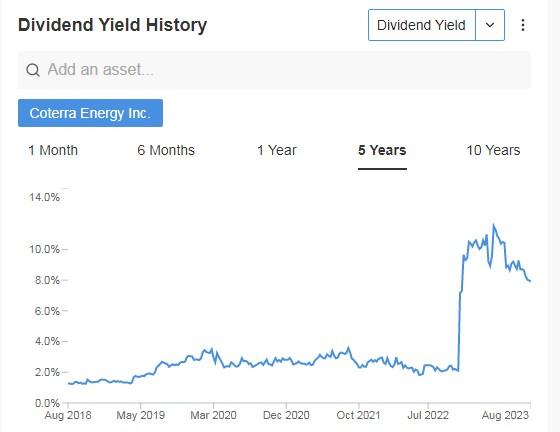

Lately, the dividend yield has seen a significant uptick.

Source: InvestingPro

Source: InvestingPro

The upcoming results for Coterra Energy are scheduled for November 2, and analysts anticipate a strong rebound in earnings by +23% in 2024, following a decline this year.

This stock has garnered a total of 28 ratings, including 9 "buy" recommendations, 19 "hold" suggestions, and no "sell" indications.

Over the last month, its shares have advanced by +8.89%, showing a solid performance. Additionally, looking back over the past three months, the stock has surged by +12.67%, and in the previous year, it has shown an increase of +8%.

Taking into account InvestingPro's models, the stock displays a potential target of $37.83.

Source: InvestingPro

Source: InvestingPro

The stock continues to ride its upward trend, staying within an ascending channel and consistently staying above the 50-day and 200-day moving averages.

3. VF Corporation

VF Corporation (NYSE:VFC), established in 1899 is a clothing and footwear company. The Greensboro, North Carolina-based company commands a significant 55% share of the U.S. backpack market and boasts prominent brands like Timberland in its portfolio.

In terms of financial outlook, the company predicts that its annual revenues will remain steady throughout the year.

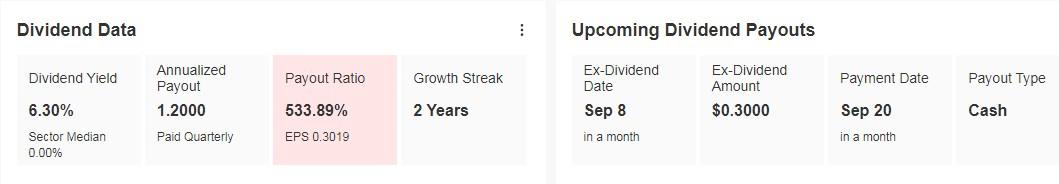

Mark your calendars for September 20, as VF Corporation has scheduled a dividend payment of $0.30. To be eligible for this dividend, it's important to hold shares before September 8.

The dividend yield for this payment is an appealing +6.30%, making it an enticing prospect for investors.

Source: InvestingPro

Source: InvestingPro

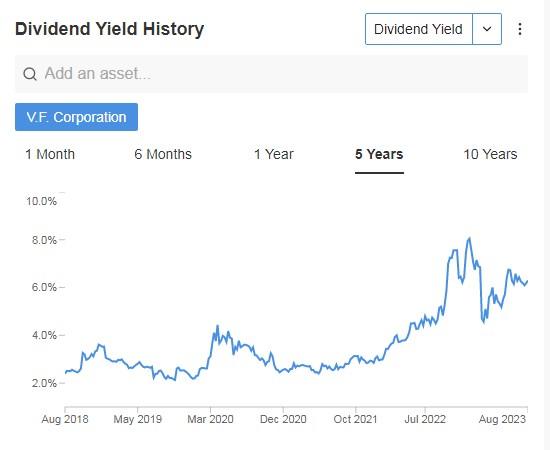

For the past two years, the dividend yield has been increasing significantly.

Source: InvestingPro

Source: InvestingPro

The stock has received a total of 23 ratings, comprising 9 "buy" recommendations, 12 "hold" suggestions, and 2 "sell" opinions.

Over the past month, the stock has exhibited an increase of +2.42% in its share value. However, in the last three months, it has faced a decline of -12.85%.

According to the market, the stock holds potential at $25.43, while InvestingPro models project a higher potential at $28.78.

Source: InvestingPro

Source: InvestingPro

Currently, the stock is trading close to its support level at $17.

*** Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's own.

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling, or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's own.