The final group of companies scheduled to report third quarter financial results are major U.S. retailers, which are currently gearing up for a busy holiday shopping season. The sector—which is perhaps the most sensitive to economic conditions and consumer spending—has thrived this year as receding fears surrounding the COVID-19 pandemic gave consumers greater confidence to head back to brick-and-mortar retail stores.

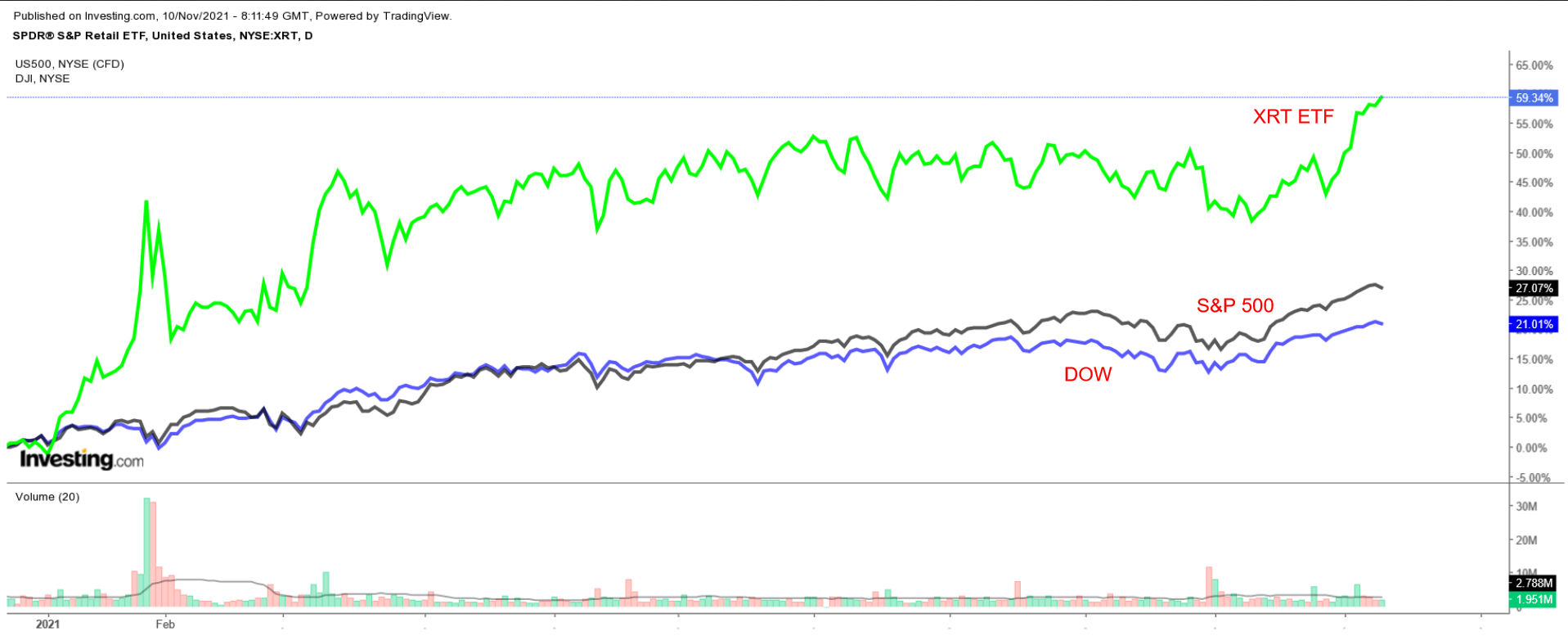

Not surprisingly, one of the retail sector’s main ETFs—the SPDR® S&P Retail ETF (NYSE:XRT)—has rallied almost 60% in 2021, far outpacing the comparable returns of both the Dow and the S&P 500.

Below we highlight three leading retailers which are expected to enjoy robust profit and sales growth when they deliver their latest quarterly reports in the days and weeks ahead, despite issues with supply chains and rising cost of goods.

1. Target

- Earnings Date: Wednesday, Nov. 17 before the bell

- EPS Growth Estimate: +0.4% YoY

- Revenue Growth Estimate: +8.1% YoY

- Year-To-Date Performance: +44.5%

- Market Cap: $124.5 Billion

Target's (NYSE:TGT), financial results have beaten Wall Street estimates for six consecutive quarters. And in keeping with the positive trajectory, consensus calls for the big-box retailer to post earnings per share of $2.80 for the third quarter, which would be a slight improvement from EPS of $2.79 in the year-ago period.

Revenue is expected to climb roughly 8% year-over-year to $24.5 billion, benefitting from higher consumer spending, robust growth in its private and exclusive brands, as well as continuing efforts to add faster order pickup and shipping options.

Perhaps of greater importance, investors will monitor growth in Target’s comparable sales, which include sales both online and at stores open for at least a year. Target said the key metric rose by 8.9% in Q2, with physical comparable store sales increasing 8.7%, and digital comparable sales growing 10%.

In addition, market players will scrutinize overall comments from executives on the post-earnings conference call regarding the economy, inflation, supply chain issues, and labor shortages as Target enters the key holiday shopping season.

TGT stock—which reached an all-time high of $267.06 on Aug. 11—ended Tuesday’s session at $255.16, earning the Minneapolis, Minnesota-based discount retailer a valuation of $124.5 billion.

Target has been one of the leading performers in the retail space in 2021, with shares up 44.5% year-to-date, as it benefits from both the reopening economy and ongoing strength in e-commerce and online sales.

2. Kohl’s

- Earnings Date: Thursday, Nov. 18 before the bell

- EPS Growth Estimate: +6,300% YoY

- Revenue Growth Estimate: +12.1% YoY

- Year-To-Date Performance: +46.4%

- Market Cap: $9.0 Billion

Kohl's (NYSE:KSS) easily topped expectations for earnings and revenue in the last quarter and provided upbeat guidance for the full-year. Analyst estimates call for the department store retailer—which owns over 1,100 outlets across the country—to post earnings of $0.64 per share for the third quarter. That's a breathtaking 6,300% rise from the year-ago quarter when EPS came in at a paltry $0.01, the result of COVID-related closures and lockdowns when Kohl's had to shutter most of its stores. At that time the chain was forced to limit sales operations to its app and website.

Revenue is forecast to rise nearly 12% from the same period a year earlier to $4.24 billion, thanks to ongoing strength in e-commerce sales and as shoppers flocked back to its stores in greater numbers amid easing COVID restrictions. As such, Kohl’s same-store sales and e-commerce sales figures will be in focus, after growing by 25.0% and 35.0%, respectively, in the previous quarter, as it continues to introduce initiatives to improve in-store pickup options and online sales.

In addition, market participants will pay close attention to the department store retailer’s guidance for the end of this year and early 2022 as it finds new ways to win over shoppers amid the current environment.

KSS stock—which rose to $60.51 on Tuesday to reach its best level since May 19—ended at $59.56 last night, earning the Menomonee Falls, Wisconsin-based retailer a valuation of around $9.0 billion.

Shares of Kohl’s have made an impressive recovery from last year’s pandemic-driven sell-off, climbing around 46% in 2021, as consumers head back to malls and shopping centers as the economy reopens.

3. Academy Sports + Outdoors

- Earnings Date: Thursday, Dec. 9 before the bell

- EPS Growth Estimate: +15.4% YoY

- Revenue Growth Estimate: +9.6% YoY

- Year-To-Date Performance: +128.5%

- Market Cap: $4.2 Billion

Academy Sports + Outdoors (NASDAQ:ASO) has either beaten or matched Wall Street expectations for earnings and revenue in every quarter since going public in October 2020. For its third quarter, the Katy, Texas-based sporting goods store chain—which operates 259 stores located across 16 states, mostly in the U.S. Southeast and Midwest—is anticipated to report earnings of $1.05 per share, rising about 15% from EPS of $0.91 in the same quarter last year.

Revenue is forecast to increase roughly 10% year-over-year to $1.48 billion, reflecting strong consumer demand across all its product categories. In addition to selling sports apparel, footwear, and exercise gear, the popular Texas chain also offers a wide assortment of products and equipment for the outdoors, such as hunting, fishing, boating, and kayaking.

Beyond the top- and bottom-line numbers, growth in Academy’s same-store sales, which climbed by 11.4% in Q2 to mark the eighth straight quarter of positive comparable sales, will be eyed. E-commerce sales, which dipped 0.9% in the previous quarter due to tough year-over-year comparisons, will also be of importance.

Additionally, investors are hoping Academy’s management will maintain its upbeat view regarding its outlook for the end of the year and beyond as the sporting goods retailer benefits from favorable consumer trends and customer demand.

ASO stock closed at $47.37 yesterday, a tad below its all-time high of $48.17 reached on Nov. 4. At current levels, the athletic-gear retailer has a market cap of around $4.2 billion.

Academy Sports has thrived this year amid robust demand for sports and recreation clothing and equipment. Year-to-date, ASO stock has gained 128.5%, easily making it one of the biggest retail-industry winners of 2021.

Honorable mentions: Walmart (NYSE:WMT), Dick’s Sporting Goods (NYSE:DKS), and Macy’s (NYSE:M)