- In times of market turbulence, stable insurance companies are great investment options

- Some of them offer stability to portfolios during volatile times, along with decent long-term returns

- Let's delve into the technicals and fundamentals of three such stocks

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

The insurance industry is predominantly associated with value companies with the potential for stable long-term returns and increased resistance to market turbulence. As we seek defensive positions for our investment portfolios, directing attention toward the insurance sector becomes worthwhile.

Among the notable contenders is Primerica (NYSE:PRI), an established brand operating in both the US and Canadian markets. The company's core operations revolve around selling policies and insurance products through a network of full-time and part-time agents. Over the past year, Primerica's stock price has shown an upward trajectory, reaching historic highs of around $196 per share.

Aside from Primerica, two other companies that appear intriguing in the insurance industry are UnitedHealth Group (NYSE:UNH) and Markel (NYSE:MKL). These companies exhibit favorable conditions for growth from both technical and fundamental perspectives. Let's take a look at the three companies, one by one:

1. Primerica

Primerica, in particular, demonstrates the potential to surpass the $200 mark and establish new all-time highs. Over the past few weeks, the company has been actively testing historical peak levels, laying the groundwork for a potential breakthrough. The fair value index further supports this upward momentum, suggesting a favorable scenario of surpassing the $200 barrier and reaching new milestones around $230 per share.

Source: InvestingPro

Analyzing the comprehensive summary of fundamental highlights, it becomes evident that the bullish perspective holds numerous compelling arguments in its favor.

Source: InvestingPro

Long-term investors should find it particularly significant that the company has consistently maintained a record of dividend payments for 13 years. This and its solid earnings performance suggest a promising outlook for Primerica.

2. UnitedHealth Group

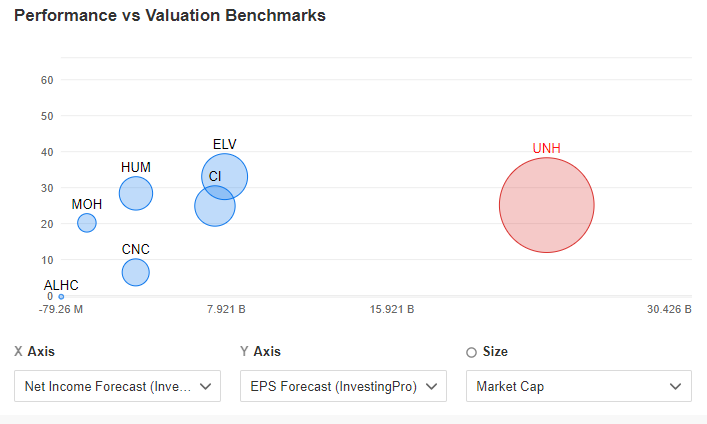

UnitedHealth Group emerges with an attractive outlook amidst competition. As a US-based company operating in the medical services sector, including insurance sales, it distinguishes itself in terms of capitalization and projected profit growth. The company is anticipated to surpass $23 billion in net profit annually, compared to $20.63 billion in 2022.

Source: InvestingPro

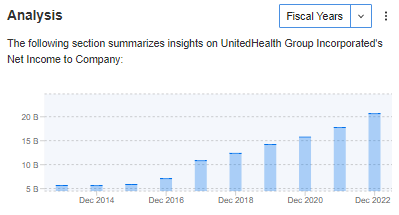

Should these forecasts materialize, it would signify the continuation of the positive trend that has persisted since 2014. From a technical standpoint, a pivotal factor would be successfully breaching the significant resistance level around the $500 range. Such a breakthrough could potentially pave the way for a test of this year's record highs.

Source: InvestingPro

3. Markel

As an insurance company, Markel offers specialized policies in areas such as professional liability, marine safety, and natural disasters. With geographical diversification spanning North America, Europe, Asia, and the Middle East, the company benefits from a broad market reach. Markel Group has successfully established its niche and aims to expand its business operations further.

Amidst a prolonged consolidation phase that has persisted for over two months, there appears to be a discernible triangle formation. In theory, such a formation often signals a potential continuation of the upward trend, suggesting more gains could be in the cards for the stock.

A breakout to the upside will serve as the catalyst for subsequent upward movement, potentially leading to a gradual ascent toward the price levels achieved earlier this year in January.

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by visiting the link and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. So, get ready to boost your investment strategy with our exclusive summer discounts!

As of 06/20/2023, InvestingPro is on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.