- SVB failed due to higher interest rates and a liquidity problem

- Despite the failure, today's situation is different from 2008, with lower bank leverage, safer investments, and Fed support

- This, in turn, ensures that one bank's crisis does not become a systemic risk

In today's analysis, as we can guess from the title, I'll try to explain in simple terms (as much as possible) why the two situations (the subprime crisis and Lehman bankruptcy in 2008 and SVB Financial Group's current situation) are very different.

Why Did SVB Fail?

During the post-pandemic period (late 2020 and 2021 in market terms), liquidity flowed like wildfire, supported by government support programs and extremely accommodative central banks. Asset prices tend to inflate (and vice versa) when there is so much liquidity.

So, a bank like SVB, which had Silicon Valley startups as its main customers, received a flood of money, mainly deposited by its customers. This money represents a liability for the bank (it is the customers' money). What did the bank do with this money?

It took the money and invested it in US government bonds, one of the safest investments in the world. Since it was also a time of extremely low-interest rates, the customers received zero percent interest by depositing their money in the bank.

In contrast, the SVB, by investing this money precisely in US government bonds, could count on a return of more than 1 percent.

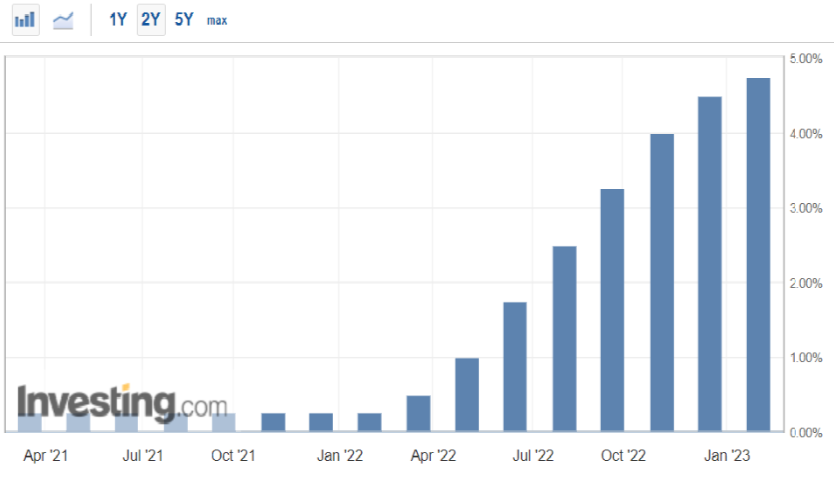

So, what was the problem? Starting in 2022, the US Federal Reserve (the Fed) began one of the fastest and strongest interest rate hikes ever (to fight inflation), going from 0.25% to 4.75% in just over a year.

As an investor, if I have a United States 10-Year Treasury bond in my portfolio, purchased in 2021 that was yielding, say, 1.5 percent today (after this rate hike), bonds with the same maturity and characteristics are yielding more than twice as much, the value of my investment will have to decline in price to match the market (see below).

This is exactly what happened to SVB's investments (the well-known assets), which fell by 20-30%.

Now, in a normal situation, this would be nothing strange since these government bonds (assets with "almost" no risk) are classified on the bank's balance sheets as "held to maturity."

This means that once purchased, and if prices fall, no real losses (caused precisely by the fall in prices) show up on the balance sheets because it is assumed that the bank will hold this investment until maturity (and at maturity, you know that the value is always 100).

So, what was the fuse that blew the whole thing up? As always, the liquidity problem...

We went from a situation where mountains of money flowed around at almost no cost to one where money is scarce and expensive. Many startups, especially those that weren't making money, needed to raise money in this new environment, and what did they do? Simple, they went to the bank to get it.

And here comes another problem, that of fractional reserve. When a bank receives a deposit of $100, it is required by law to keep only a small fraction of that deposit on hand.

Right now, banks have about $3 trillion in cash versus $17.6 trillion in deposits. But most of that cash is just a webpage with an amount written on it. In fact, only about $100 billion (0.1 trillion) is held by banks in the form of physical notes in vaults and ATMs. Thus, the $17.6 trillion in deposits is supported by only $3 trillion in cash, of which perhaps $0.1 trillion is physical cash. The rest is backed by less liquid securities and loans.

So, when people rush to the bank to get their money back, the bank has to sell its investments, as did the SVB, which sold many of its government bonds (at a loss of about $2B). Since it didn't have much liquidity left, it tried to raise more money, which caused a bank run, and as the demand for cash increased even more, it all blew up.

Why 2023 Is Not 2008

It isn't for several reasons...

In 2008, banks had $23 of deposit liabilities for every $1 of liquidity, an absurd level of leverage. Today, in light of that financial tragedy, the ratio is 5x or 6x.

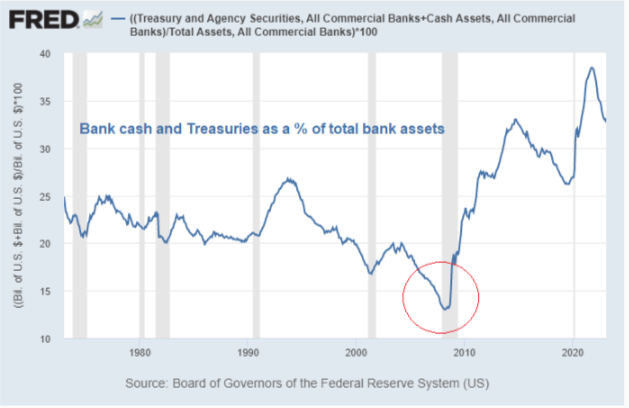

Back in 2008, banks as a whole also had a credit problem, and they were not investing in US Treasuries (as they are now), but (to quote a famous movie) in "dog shit wrapped in cat shit."

This chart shows banks' holdings of cash and Treasuries (the safest assets in terms of credit risk) as a percentage of total bank assets:

When you put it all together and consider the timely intervention of the Fed to provide liquidity to the banks when needed, the situation is very different. Yesterday, for example, I made initial entries in stocks such as Credem and BPER, which are good companies with little to do with small US banks.

At these prices, good buying opportunities have been created (and I have prepared further entries in the event of a further decline).

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, consultation, or recommendation to invest and, as such, is not intended to induce the purchase of any assets. I would like to remind you that any type of investment is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.