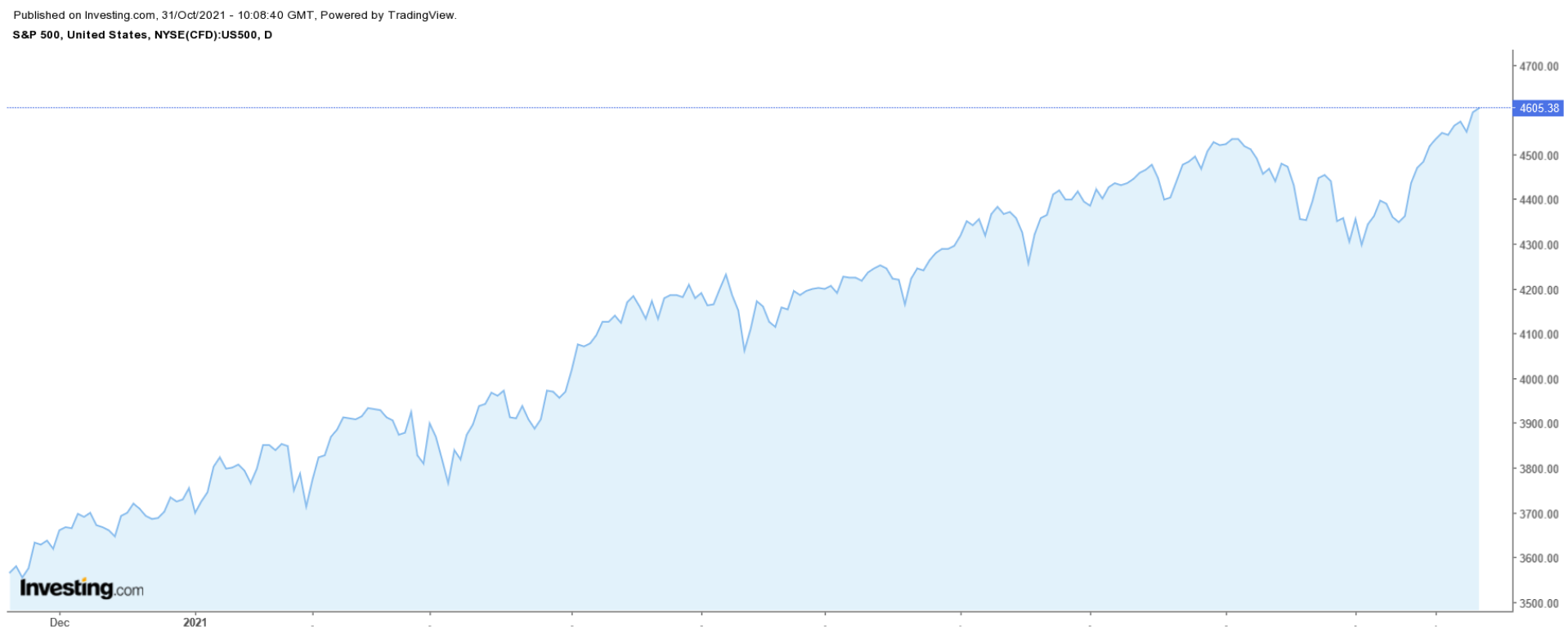

Stocks on Wall Street ended higher on Friday, with the benchmark S&P 500 closing at a new record peak amid optimism over the ongoing corporate earnings season.

The week ahead is expected to be a busy one with another batch of notable earnings reports scheduled for release from companies like Roku (NASDAQ:ROKU), Square (NYSE:SQ), Coinbase Global (NASDAQ:COIN), Uber (NYSE:UBER), Pfizer (NYSE:PFE), and Moderna (NASDAQ:MRNA).

In addition to earnings, there is also a key Federal Reserve monetary policy meeting this week, as well as important economic data, including the latest U.S. employment report.

Regardless of which direction the market goes however, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Microsoft

Microsoft—which dethroned Apple (NASDAQ:AAPL) last week as the world’s most valuable company—will be in focus in the days ahead as it holds its second annual ‘Ignite’ digital event. The three-day conference kicks off on Tuesday, Nov. 2 and will be live-streamed on Microsoft's (NASDAQ:MSFT) website, starting at 11:00AM ET, when Chief Executive Officer Satya Nadella is due to deliver his highly anticipated keynote speech.

According to Microsoft, Nadella will talk about “emerging technology trends and innovations across the Microsoft Cloud that will transform every business and industry going forward,” as the economy undergoes a sea change of digitization.

In addition to Nadella, other members of Microsoft’s leadership team are expected to reveal fresh details on the tech behemoth’s new products and features, with most of the focus on the Windows 11 operating system. The online event will also include sessions on Microsoft Azure, Teams, and several other Microsoft services.

MSFT stock ended at a new all-time high of $331.62 on Friday. With a market cap of $2.49 trillion, right now, Microsoft is the most valuable company listed on the U.S. stock exchange.

The Redmond, Washington-based tech titan has seen its stock gain roughly 49% since the start of the year, benefitting from robust demand for its cloud-based offerings. Investor sentiment was lifted further last week, when Microsoft reported blowout profit and booming revenue growth for its fiscal first quarter, thanks once again to strong demand for its cloud-computing services.

Earnings jumped nearly 25% from the year-ago period to $2.27 per share, while revenue soared 22% to a record $45.3 billion to record its fastest growth in sales since 2018.

Stock To Dump: Clorox

Shares of Clorox (NYSE:CLX) are expected to suffer a volatile week as investors brace for disappointing financial results from one of America’s most well-known household products maker.

Consensus expectations call for the consumer products giant—which was one of the big pandemic winners of 2020—to post earnings per share of $1.03 when it reports fiscal first-quarter numbers after the U.S. market close on Monday, Nov. 1, tumbling about 68% from EPS of $3.22 in the year-ago period.

Revenue, meanwhile, is forecast to fall around 11.5% year-over-year to $1.70 billion, as receding fears surrounding the COVID health crisis reduced demand for pandemic-era essentials, such as hand sanitizer, cleaning wipes, and other disinfectant products.

Clorox’s bleach and disinfectant wipes account for approximately 25% of its sales. Perhaps even more important, Clorox’s Cleaning segment, which includes these products—as well as other brands such as Pine-Sol and Green Works—generates 53% of Clorox’s overall earnings.

Beyond the top-and-bottom line numbers, Clorox’s update regarding its outlook for the rest of the year and beyond will be in focus as it deals with the negative impact of higher commodity costs and supply chain issues, possibly hurting margins.

When the company reported fiscal Q4 earnings on Aug. 3, it warned that raw material inflation and rising manufacturing and logistics costs, most notably in transportation, will weigh on its full-year performance.

Investors sold the stock in response, sending shares down by almost 10%.

CLX stock, which fell to its lowest level since February 2020 at $156.23 on Oct. 19, closed Friday’s session at $163.01. At current levels, the Oakland, California-based company has a market cap of roughly $20 billion.

Clorox has seen its shares steadily drop to new lows in recent weeks even as the broader market rebounds from its recent bout of volatility to scale new record highs. Year-to-date, CLX shares have lost 19.2%, compared to the S&P 500’s 22.6% gain over the same timeframe.