- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AUD Backs Off 5-Month Highs Ahead of RBA

After falling sharply in the month of July, the U.S. dollar kicked off the new month with a nice broad-based rally. The greenback traded higher against all of the major currencies despite mixed manufacturing data.

According to ISM, manufacturing activity accelerated in the month of July, but a separate measure by Markit Economics showed a smaller-than-expected improvement. The dollar, which had traded strongly prior to the release came off intraday highs on the back of these reports, which tells us that investors are worried about the outlook for the economy and currency. This may be nothing more than a relief rally, but with the dollar deeply oversold, we could see a multi-day recovery. This week’s economic reports should show improvements in the economy because even with the surge in cases in July, more businesses reopened, ushering people back to work.

Congress is hard at work on a new stimulus package, and with each passing day, scientists are moving closer to developing an effective vaccine. Although all of the factors pressuring the dollar in July are still with us today, we will most likely see positive developments on both fronts in the coming weeks. U.S. Treasury yields also rebounded after last week’s sharp slide, while stocks resumed their rise.

The best performing currency was sterling, which shrugged off a downward revision to manufacturing PMI. The euro ended the day lower despite upward PMI revisions. The lack of market-moving reports for any country aside from Australia means currencies will take their cues from the market’s appetite for U.S. dollars tomorrow.

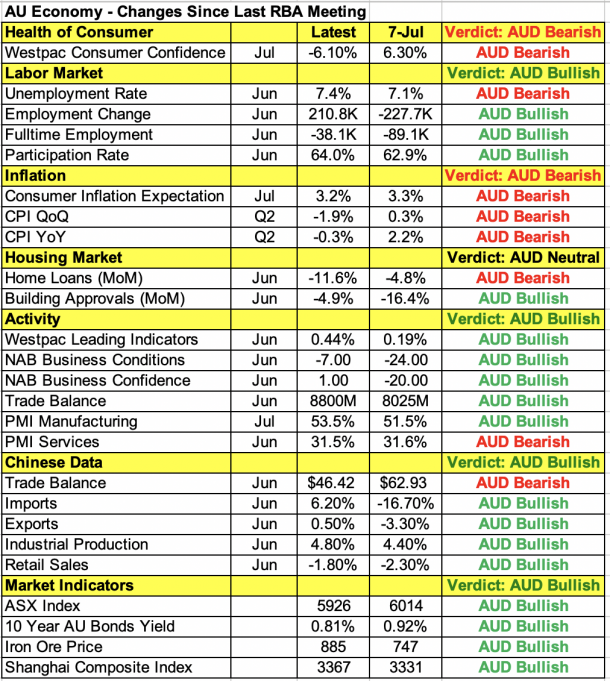

Tonight, the focus will turn to the Australian dollar. AUD trade numbers are scheduled for release along with retail sales and the Reserve Bank of Australia’s monetary policy announcement. While the following table shows the economy recovering further in July, the recent flareup in virus cases should leave the central bank cautious. The state of Victoria just announced fresh restrictions that could affect the central bank’s projections. Having traded to a five-month high last week versus the U.S. dollar, the Australian dollar is particularly vulnerable to a correction.

Related Articles

The US dollar fell last week due to Trump's inconsistent trade policies and signs of a slowing economy. February's non-farm payroll data disappointed, with unemployment...

After a week when FX markets were very much dominated by events in Europe, focus this weeks shift to China. Chinese retaliatory trade measures against US agricultural goods have...

The US Dollar Index rallied sharply into inauguration day. Since then, it’s been very weak. Could things get worse for King Dollar? Today, we share a “weekly” chart highlighting a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.