- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Silver: 2.0 Breakout On The Way After Gold?

Yesterday, we examined whether gold was at the cusp of a breakout or fakeout.

Today, we’ll take a look at silver, which has exhibited some interesting upward moves too over the past week as it posted net gains of 5% over six sessions.

Most importantly, silver has crossed and held above $24 an ounce for five straight days now, reprising a position of strength shown in late October.

All charts courtesy skcharting.com

Based on the apparent turnaround in gold, could silver, which has typically labored in the shadows of bullion, be in Breakout 2.0 Mode? Could it reach the next important level of $25 that would set the course for it to spring toward the $30-$40 target long cherished by the metal bulls?

Or will it stay trapped below $25 and begin a descending cycle instead?

Let’s look at the different variables and ideas in play, to try and form a coherent picture.

First, A Recap of Silver’s Fundamentals

Silver has solid industrial-based fundamentals, but it has been playing second fiddle to gold in recent years, meaning a solo rally without the yellow metal seldom survives.

More than 50% of silver’s demand originates from industrial use. As a malleable metal, it is just as good as gold for jewelry making. It is also a good conductor of electricity, and used extensively in the manufacture of electronic components.

The transition to clean energy is expected to drive physical demand for silver in the coming years, particularly for connections in electric vehicles and for components in solar panels. The rollout of fifth generation (5G) telecom networks will also fuel demand. But these demand factors are likely to drive silver demand in the future, not right now.

For now, silver’s uses across a range of industrial applications have an effect on its price—when manufacturing activity rises, the price increases due to high demand, while a fall in activity, such as during a recession, pulls the price lower.

For that reason, monthly manufacturing PMI, or Purchasing Managers’ Index figures from around the world, are an important gauge of silver demand, as it provides an indication of industrial activity.

The global PMI compiled by JP Morgan and IHS Markit fell to a six-month low of 54.1 in August 2021 from 55.4 in July as output growth lost momentum in several major markets (a number above 50 indicates an expansion in manufacturing activity, while a figure below that figure points to a contraction). This significantly weighed on silver in recent months.

Adding to that bearish factor had been speculation since June on when the Federal Reserve will roll back its generous monthly stimulus of up to $120 billion that it has provided to the US economy since March 2020. That speculation weighed on gold and silver prices in earlier months.

But both these clouds have cleared now.

JP Morgan’s global PMI reading steadied at 54.1 in September.

On the stimulus end, the Fed announced last week it would conclude its asset purchases in mid 2022 by tapering $15 billion each month from the program over the next eight months. Fed Chair Jerome Powell also assured markets that the central bank will be “patient” in executing the first post-pandemic rate hike, which will likely take place at the end of next year. That has provided an additional layer of fiscal stability and certainty to investors across industry.

Silver traded on New York’s COMEX had its first positive month in October, ending four months in the red with an 8.63% rise that was the best since a 16.8% rally in December 2020.

Now, on to Silver’s Technicals

Precious metals strategist Taylor Dart thinks silver is on a roll, with little immediate risk for longs.

“Given that silver just came out of a multi-year bear market and has essentially gone nowhere since 2014, a change in character and the beginning of a bull market would point to significant gains ahead,” Taylor wrote in a post reproduced on the stocknews.com site.

He noted that silver’s break out of a multi-year base was the first hint of a new bull market beginning.

“For the time being, silver’s prior multi-year resistance ($22.00/oz) looks to be new support, more proof of a change in character. Assuming this is the case, we are likely in the first 2-3 innings of a new bull market, and a double in the silver price over the next couple of years would not be surprising, suggesting a rise above $40.00/oz.”

Notwithstanding the run-up of the past week, silver was still sitting at one of its most oversold readings in the past six years, with its 9-month rate of change dipping sharply into negative territory, added Taylor.

“This doesn’t mean that the metal has to bottom out here, but if history is any guide, the metal is likely much closer to a bottom than a top currently. Therefore, any pullbacks below $23.50/oz to re-test the recent downtrend line break should present low-risk buying opportunities.”

Anil Panchal, another precious metals analyst, concurs to an extent with Taylor, saying in a blog on FXStreet that silver’s studier Relative Strength Index now was likely to help it overcome immediate trend line hurdles surrounding $24.50 an ounce.

“However, September’s peak near $24.85 and the $25.00 threshold can challenge the XAG/USD bulls afterward,” Panchal said, using the symbol for the spot price of silver.

He adds:

“Should silver stay firmer past $25, June’s low of around $25.50 and the August peak near $26 will be in focus.”

“Alternatively, pullback moves remain less important until staying beyond 61.8% of the Fibonacci retracement of September month’s downside, at around $23.55.”

In the event of a downturn, the 200-Day Simple Moving Average of $23.30, the 50% Fibonacci retracement close to $23.15 and the $23.00 round figure should lure silver bears back, he cautioned.

Sunil Kumar Dixit of skcharting.com also worries that silver may have overshot its technically-enabled upside for now, though he doesn’t doubt it can continue running higher over time.

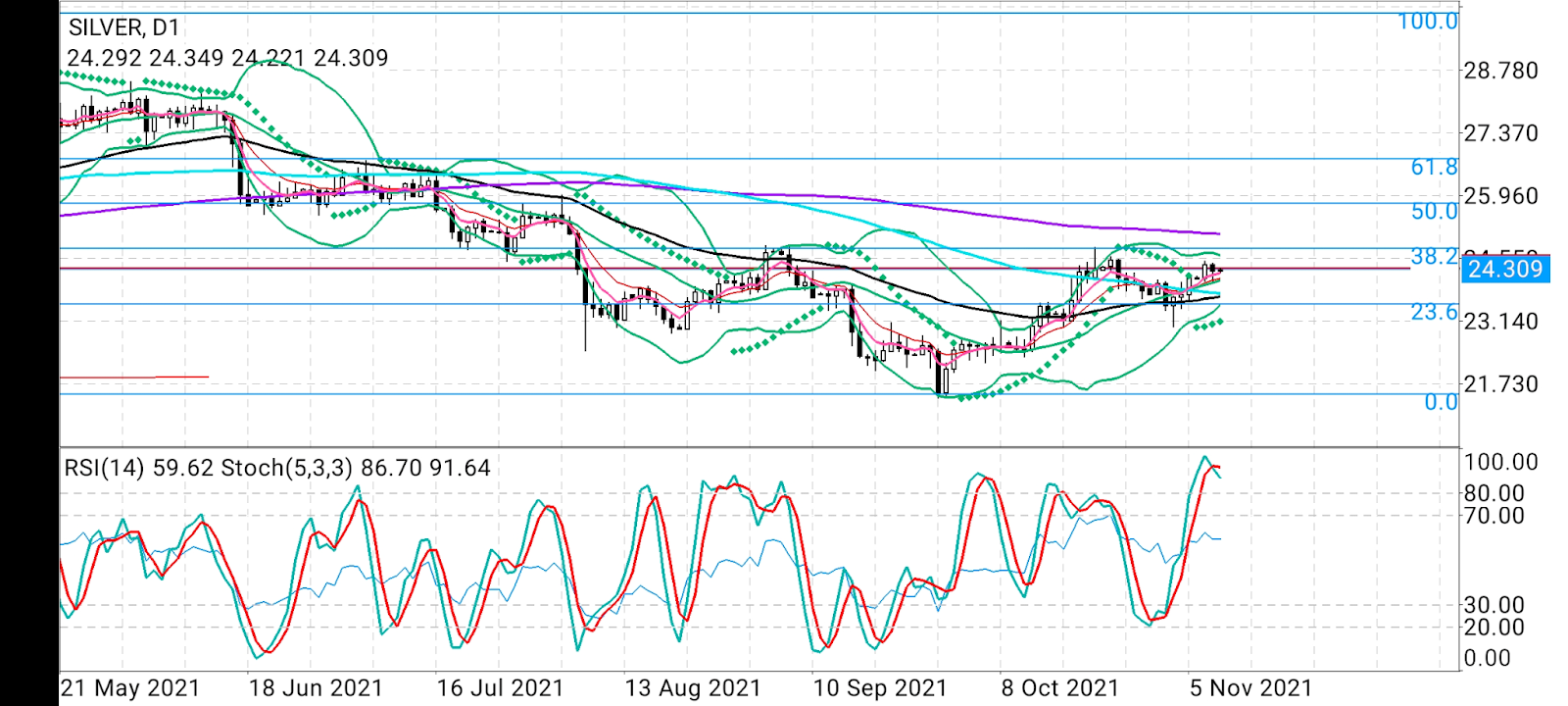

“Silver’s daily chart shows an overbought Stochastic Relative Strength Index with a 86/91 reading that gives a negative overlap aiming to retest the 100-Simple Moving Average of $23.77 and $23.50, which is a 23.6% Fibonacci level,” Dixit said.

He adds:

“Broadly speaking, silver looks trapped within two key Fibonacci levels: support at the 23.6% level of $23.50 and resistance at the 38.2% level of $24.80.”

Dixit said silver requires a powerful trigger to break out above or below either of the two trend keys to decide further course.

“A break above $24.80 will take silver to $25.80 straight, which is the 50% Fibonacci level,” he said.

“Breaking down below $23.50 will push silver to revisit the 100 week SMA of $22.70.”

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.

Related Articles

Geopolitical turmoil increases uncertainty about silver valuations even in the short term. The bullion continues to move sideways. Long-term silver outlook suggests a return to...

Commodities and risk assets in general are under pressure as trade policy uncertainty intensifies Energy- Venezuelan Oil Supply at Risk The oil market came under pressure again...

Analyzing the movements of the natural gas futures since I wrote my last analysis, I anticipate that the natural gas futures will likely start next week with a gap-down opening if...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.