- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 Roblox Trades In Light Of The Game Stock's Recent Decline

- Mobile game company Roblox shares are up around 60% since going public in March.

- Robust Q3 figures pushed the share price to record levels in late November. However, since then, RBLX stock has come under significant pressure.

- Long-term investors could consider buying the dips in RBLX shares, especially if they decline toward $90.

Investors in the mobile gaming company Roblox (NYSE:RBLX) have seen solid double-digit gains since its initial public offering (IPO) earlier this year. On Mar. 10, RBLX stock started trading at an opening price of $64.50. Now, it's at $102.77 as of Wednesday's close, up around 60%.

On Nov. 22, RBLX shares went over $141 and hit a record high. But since that peak, the share price has dropped about 25%. The stock’s 52-week range has been $60.50 - $141.60, while the market capitalization stands at $61.7 billion.

The company released Q3 financials on Nov. 8. Revenue hit $509.3 million, a year-over-year increase of 102%. Average Daily Active Users (DAUs) hit 47.3 million, up 31% YOY. Diluted loss per share came in at 13 cents versus a loss of 26 cents per share in Q3 2020.

On the results, CFO Michael Guthrie said:

“Growth in all of our core metrics – DAUs, hours and bookings – displayed strong year-over-year growth despite lapping COVID-impacted periods and back-to-school seasonality…. Based on our October results, we appear to be having a great start to the last quarter of the year.”

Prior to the release of the quarterly results, RBLX stock was around $77. Then, on Nov. 15, Roblox issued key metrics for November. DAU came in at 49.4 million, up 35% YOY. Also, revenue was estimated to be between $184 million and $187 million, up around 85% YOY. Then, on Nov. 22, it saw an all-time high of $141.60. The increase in price was, in part, due to the strength in quarterly and November metrics.

But another key reason was the tailwind provided by the growing interest in the metaverse. Roblox bulls believe the platform will grow beyond gaming to offer more virtual and 3D experiences that will capitalize on the growth of the metaverse—a market that is likely to go over $800 billion in 2028, showing a compound annual growth rate (CAGR) of more than 43%.

However, since Nov. 22 profit-taking has kicked in. Coupled with the volatility in broader markets due to the Omicron variant, as well as the expectancy that the Fed might soon tighten its monetary policy, RBLX shares have come under significant pressure. On Dec. 22, the stock closed just under $103.

What To Expect From Roblox Stock

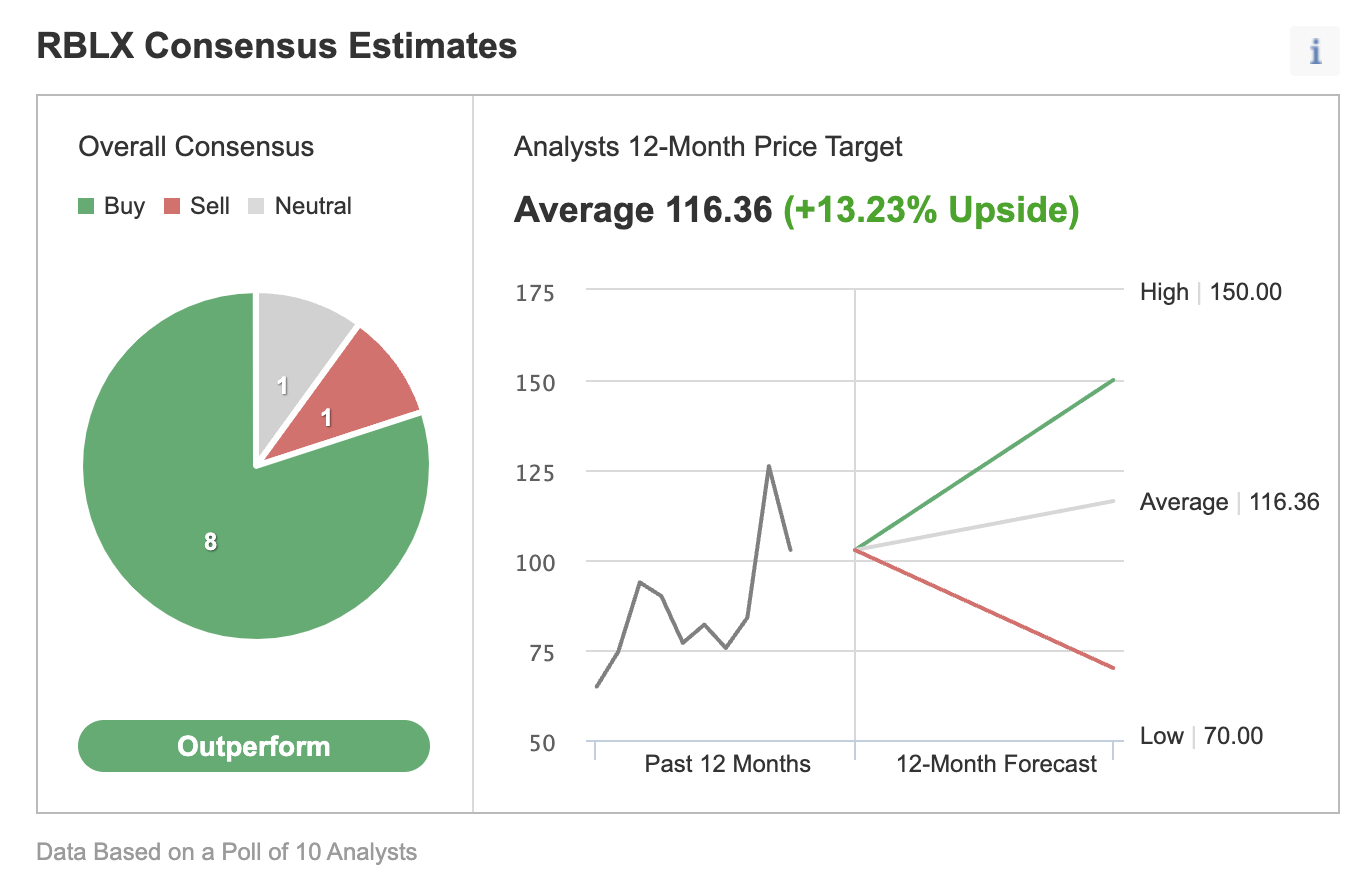

Among 10 analysts polled via Investing.com, Roblox stock has an “outperform" rating.

Chart: Investing.com

Analysts also have a 12-month median price target of $116.36 on the stock, implying an increase of about 10% from current levels. The 12-month price range currently stands between $70 and $150.

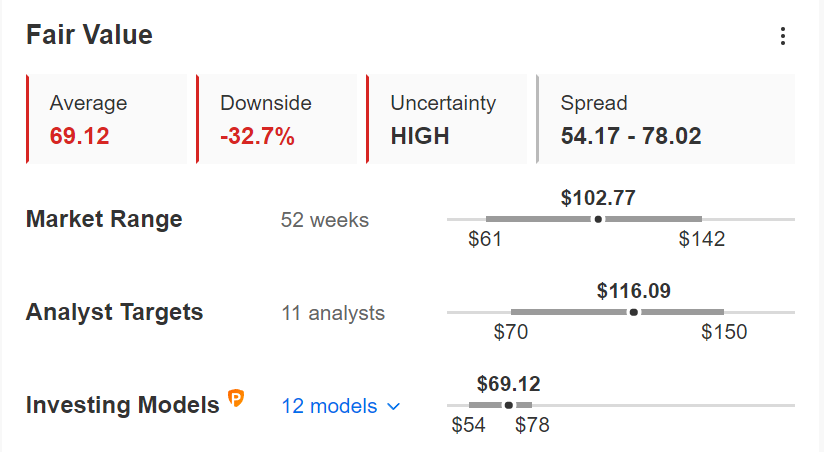

However, according to a number of valuation models, like those that might consider P/E or P/S multiples, the average fair value for RBLX stock via InvestingPro stands at $69.12, implying a potential decline of about 35%.

Chart: InvestingPro

Moreover, we can look at the company’s financial health determined by ranking more than 100 factors against peers in the communication services sector. In terms of growth and cash flow health, Roblox scores 3 out of 5 (top score). Its overall performance is rated “fair.”

Trailing P/B and P/S ratios for RBLX stock are 102.7x and 36.7x. By comparison, those metrics for peers stand at 3.2x and 7.5x. This means even for a growth name, RBLX stock has a frothier valuation level than its peers.

In the coming weeks, we expect Roblox stock to trade in a wide range, possibly between $90 and $110. Once it establishes a base, it might start a new leg up.

Adding RBLX Stock To Portfolios

Roblox bulls with a two- to three-year horizon who are not concerned about short-term volatility could consider buying the stock around these levels for long-term portfolios. The target would be $116.36, the analysts’ consensus expectation.

Alternatively, investors could consider buying an exchange traded fund (ETF) that has RBLX as a holding. Examples would include: the Roundhill Ball Metaverse ETF (NYSE:META), the Invesco Dynamic Software ETF (NYSE:PSJ) or the VanEck Video Gaming and eSports ETF (NASDAQ:ESPO).

Finally, those who are experienced with options strategies and believe there could be further declines in RBLX shares might prefer to do a bear put spread.

Most option strategies are not suitable for most retail investors. Therefore, the following discussion is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Cash-Secured Put Selling

Investors who believe RBLX stock could continue to reach new highs in the weeks ahead might consider selling a cash-secured put option in Roblox stock—a strategy we regularly cover.

Let's assume an investor wants to buy Roblox stock, but does not want to pay the full price of $102.77 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for RBLX stock to fall, which it might or might not do. The other possibility is to sell one contract of a cash-secured Roblox put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting on this trade until the option expiry date of Jan. 21, 2022. As the stock is $102.77, an OTM put option would have a strike of $100.00.

Thus, the seller would have to buy 100 shares of RBLX at the strike of $100.00 if the option buyer were to exercise the option to assign it to the seller.

The RBLX Jan. 21, 2022, 100.00-strike put option is currently offered at a price (or premium) of $5.80.

An option buyer would have to pay $5.80 X 100, or $580, in a premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. The put option will stop trading on Friday, Jan. 21.

The seller's maximum gain is this premium amount if RBLX stock closes above the strike price of $100.00. Should that happen, the option expires worthless.

If the put option is in the money (meaning the market price of RBLX stock is lower than the strike price of $100.00) any time before or at expiration on Jan. 21, this put option can be assigned. The seller would then be obligated to buy 100 shares of Roblox stock at the put option's strike price of $100.00 (i.e., at a total of $10,000).

The break-even point for our example is the strike price ($100.00) less the option premium received ($5.80), i.e., $94.20. This is the price at which the seller would start to incur a loss.

Cash-secured put selling is a moderately more conservative strategy than buying shares of a company outright at the current market price. This can be a way to capitalize on any choppiness in Roblox stock in the coming weeks, especially around the earnings date.

Investors who end up owning RBLX shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership.

Related Articles

The Stock Market Vigilantes have spoken. They don't like tariffs, and they don't like mass firings of federal workers. That's because they don't like stagflation, and they fear...

Looking for the positives when there aren't many. The Russell 2000 (IWM) was able to recover some of its intraday losses, finishing on the measured move target derived from the...

It was a pretty rough day in the market. The S&P 500 finished down about 2.7%, but it could have been worse—we were trading as low as 5,560, about a 3.25% decline. The Nasdaq...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.