- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

3 High-Risk Undervalued Stocks for Aggressive Investors Targeting 35%+ Upside

- Today, let's take a look at some high-risk, high-reward plays in the market.

- These stocks are suitable for those with a high-risk tolerance.

- Below, we'll delve deep into each of these picks.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Today, we delve into three stocks currently trading below their intrinsic value, as assessed by fundamental analysis. These companies offer significant upside potential but also carry higher risk.

It's crucial to emphasize that these are speculative investments suitable only for aggressive investors with a high-risk tolerance.

This analysis aims to shed light on potential opportunities, not provide investment advice about stocks that Wall Street analysts expect to rise by more than 35% if all goes well.

So without further adieu, Let's explore these high-risk, high-reward stocks in detail.

1. Intellia Therapeutics

Intellia Therapeutics (NASDAQ:NTLA) is a small-cap biotech company with the main objective being to create treatments for genetic diseases.

It generated $28.9 million in revenue in the first quarter from collaborations and licensing agreements.

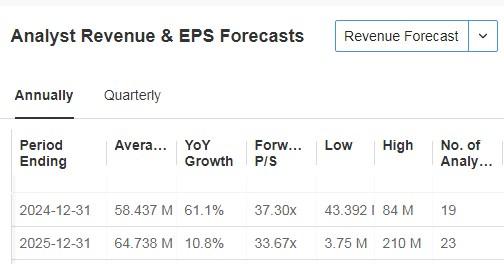

It will report its next results on October 31 and is expected to report a 61.1% increase in revenue by 2024.

Source: InvestingPro

It plans to initiate a trial later this year to test NTLA 2001 for the treatment of amyloidosis and has a collaboration with Regeneron (NASDAQ:REGN) to develop and commercialize NTLA-2001 once it is approved.

Intellia Therapeutics' future as a biotechnology company depends on obtaining regulatory approval for its clinical candidates. Once approved, these therapies have the potential to address important medical needs while capturing substantial market share.

The commercial success of its lead candidates (if and when they are approved) will have a significant impact on the company's financials.

Investors should understand the risks associated with clinical-stage biotech stocks, which include clinical trial failure, regulatory risks and other market uncertainties.

In addition, developing a successful therapy takes time. As a result, Intellia represents a high-risk, potentially high-reward investment opportunity.

The market is very bullish; of the 26 ratings, 20 are buy, six are hold and none are sell.

The market sees potential at $69.84% based on the price of $21.46 at the close of the week.

Source: InvestingPro

2. ChargePoint Holdings

ChargePoint Holdings (NYSE:CHPT) has built a comprehensive network of charging stations in North America and Europe. The company's business model is to sell energy hardware and services.

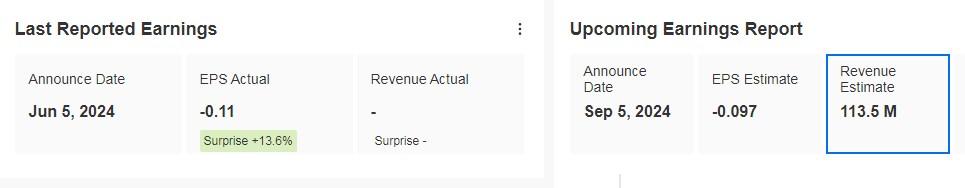

It reports its next quarterly results on September 5. The previous ones on June 5 achieved a 13.6% increase in EPS over forecasts. Revenue is expected to increase 3.5% in fiscal 2025.

Source: InvestingPro

The company has partnered with Porsche (OTC:POAHY) Cars North America to increase the number of chargers available to all Porsche customers in North America.

In addition, it has collaborated with LG Electronics (KS:066570) to utilize its advanced electric vehicle charging hardware.

It also announced ChargePoint Omni Port, a connector solution that ensures that any electric vehicle can be charged in any parking space, regardless of its connector type, and without an additional costly cable.

This eliminates the hassle of carrying an adapter and avoids the need to dedicate parking spaces exclusively to one type of connector.

There are more than 5.5 million electric vehicles on the road in North America, more than half of which are equipped with J1772 or CCS1 charging ports. These vehicles will continue to need access to public chargers for years to come.

As automakers try to align on a single connector type for the future, these 5.5 million drivers need the assurance that they will be able to charge when they need to.

That's where Omni Port comes in, giving drivers peace of mind by combining these most common connector types into a single solution.

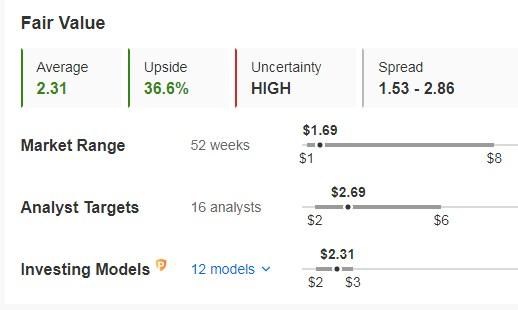

It has 18 ratings, of which 8 are buy, 9 are hold and 1 is a sell. Its fundamental fair value price is 36.6% above the share price, at $2.31. The market gives it a potential at $2.69 from its Friday close at $1.69.

Source: InvestingPro

3. Blink Charging

Blink Charging (NASDAQ:BLNK) focuses on providing electric vehicle charging solutions in various locations, including residential, commercial and public sectors.

The company's extensive network spans across the United States and several international markets.

Its quarterly financial statements will be released on November 7. EPS is expected to increase by 61.23% and on a year-over-year revenue basis by 10%.

Source: InvestingPro

Achieved a 73% increase in first-quarter revenue to a record $37.6 million, with gross profit up 195% to $13.4 million.

This growth was attributed to the deployment of 4,555 shippers worldwide. Of note, it has more cash than debt on its balance sheet, which could provide some financial flexibility in the near term.

It has partnered with EVSTAR to provide comprehensive protection against a variety of potential problems, including accidental damage and power surges.

It has also secured a contract to be the official electric vehicle charging provider for the state of New York.

Its other 2023 agreements with Mitsubishi Motors Corp. (OTC:MMTOF) North America, Hertz (NYSE:HRI) can continue to help drive revenue and earnings.

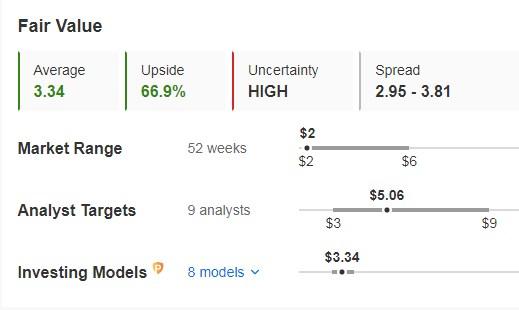

Its fundamental fair value price is 66.9% above price, at $3.34. The market gives it potential at $5.06 from its Friday close at $2.00.

Source: InvestingPro

Its Beta indicates that its shares are moving in the same direction as the market but with much more volatility.

Source: InvestingPro

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month.

Try InvestingPro today and take your investing game to the next level.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

In a striking reversal of fortunes, equities in developed markets ex-US are now leading the major asset classes in 2025 while US shares are posting a modest loss year to date,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.