(Bloomberg) -- The stomach-turning ride in global financial markets showed no signs of easing in Asia after U.S. stocks plunged the most since 1987 as President Donald Trump warned the economic disruption from the virus could last into summer.

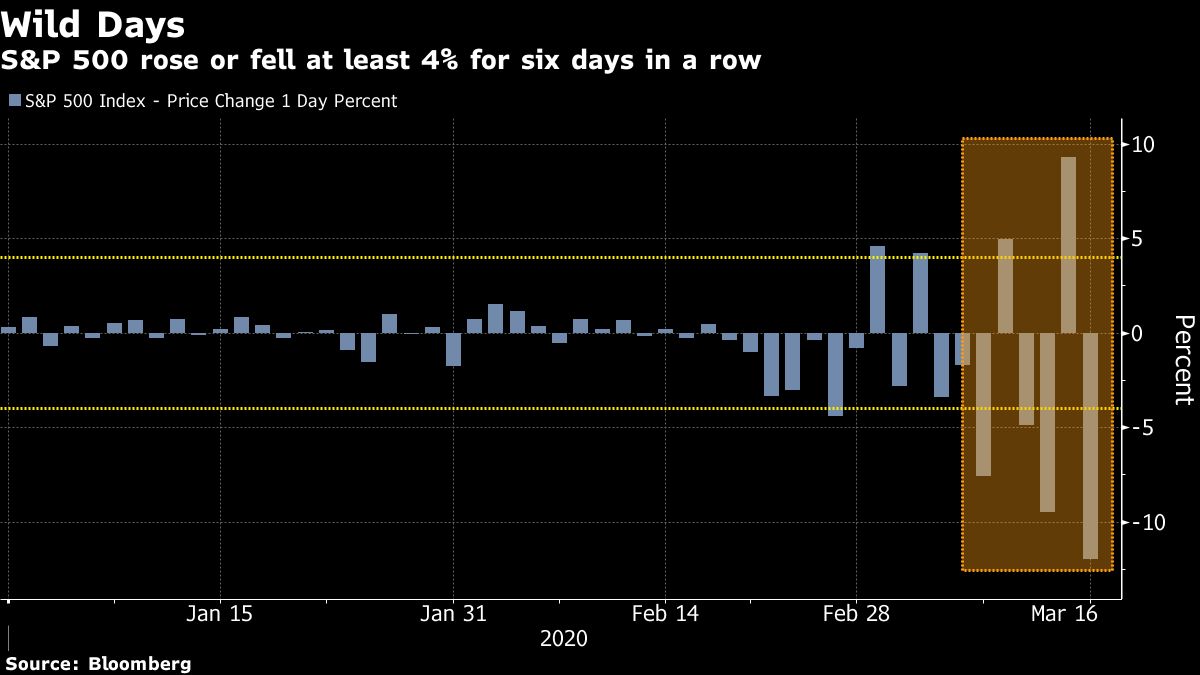

Futures pointed to declines of as much as 4% in Tokyo and Sydney, with Hong Kong contracts also lower after the S&P 500 Index sank 12% and erased its gain for 2019. U.S. stocks extended losses as Trump said the economy could fall into a recession. Central bank stimulus around the world failed to mollify investors worried about the damage the coronavirus is inflicting on economies. Treasuries rallied, crude oil plunged almost 10% and the yen climbed.

“This is different. The thing that is scarier about it is you’ve never been in a scenario where you shut down the entire economy,” said Steve Chiavarone, a portfolio manager with Federated Investors. “You get a sense in your stomach that we don’t know how to price this and that markets could fall more.

The Federal Reserve and other central banks have dramatically stepped up efforts to stabilize capital markets and liquidity, yet the moves have so far failed to boost sentiment or improve the rapidly deteriorating global economic outlook. An International Monetary Fund pledge to mobilize its $1 trillion lending capacity also had little impact in markets.

Investors continue to clamor for massive spending packages by governments around the world to offset the pain from closures of schools, restaurants, cinemas and sporting events. Companies around the world have scaled back activity to accommodate government demands to limit social interaction.

In the latest attempts to stem the spread of the virus, Trump said Americans should avoid gathering in groups of more than 10 people and stop eating out at restaurants and bars. The San Francisco Bay Area is requiring people to stay home except for essential needs. Canada shut its border to most foreigners as cases worldwide top 169,000 worldwide and deaths exceed 6,600.

These are the main moves in markets:

Stocks

- The S&P 500 fell 12%.

- Nikkei 225 futures slipped 4.2% in Singapore.

- Australia’s S&P/ASX 200 contracts dropped 4.1%.

- Hong Kong’s Hang Seng Index futures fell 2%.

- The MSCI Emerging Market Index declined 6.3%.

- The MSCI Asia Pacific Index decreased 3.7%.

- The Japanese yen traded at 105.94 per dollar after strengthening 1.7%.

- The offshore yuan was at 7.0102 per dollar.

- The Bloomberg Dollar Spot Index rose 0.2%.

- The euro fell 0.1% to $1.1167.

- The yield on two-year Treasuries sank 13 basis points to 0.36%.

- The yield on 10-year Treasuries declined 24 basis points to 0.72%.

- West Texas Intermediate crude fell 9.6% to $28.69 a barrel.

- Gold was at $1,513.49 an ounce after falling 1%.