(Bloomberg) -- The next U.S. jobs report is more likely to embolden the Federal Reserve to keep this round of interest-rate cuts short and sweet, rather than validate investor views that the economy needs significantly more monetary easing.

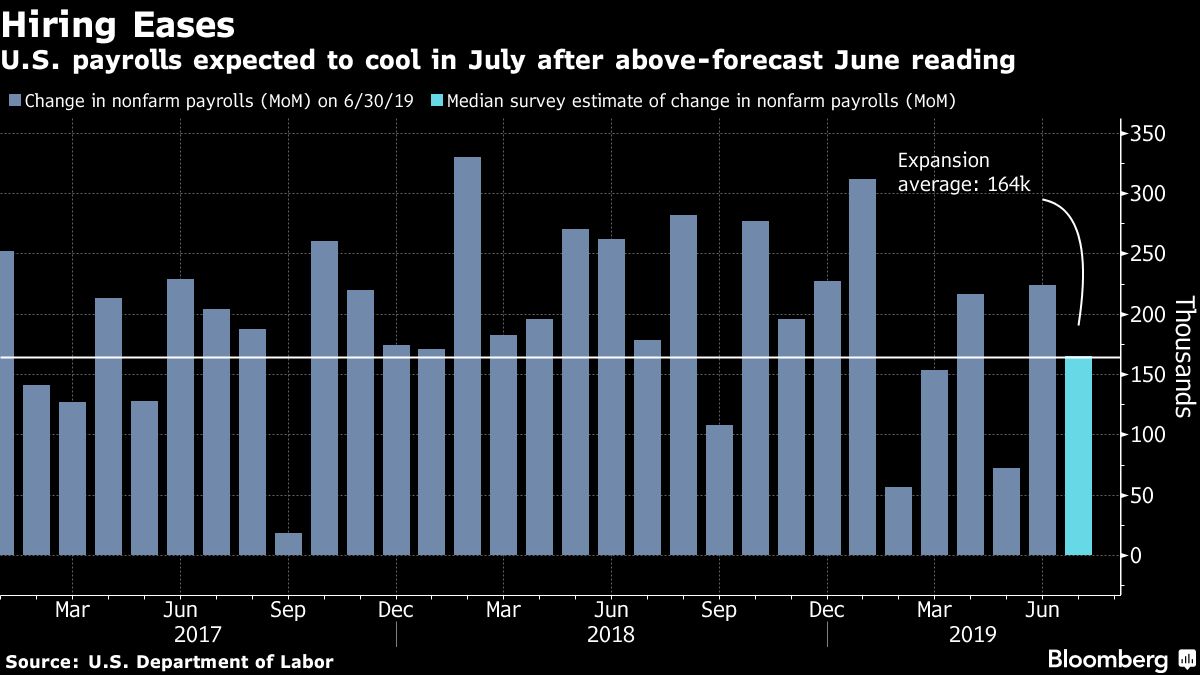

The Labor Department figures Friday are expected to show payroll gains moderated to a still-solid 165,000 in July, according to the median estimate in a Bloomberg survey. Unemployment probably ticked down to a half-century low of 3.6% and wages remained solid, albeit without accelerating.

Such numbers -- arriving two days after Fed policy makers lowered interest rates for the first time in a decade while disappointing investors by failing to signal a sustained series of cuts -- would suggest consumer spending will keep growth on a healthy trajectory. Less prospect for rate cuts could prove bearish for stocks and short-dated Treasuries.

Fed Chairman Jerome Powell stressed on Wednesday that the economy remains in good shape and said the reduction in borrowing costs will help insure against weak global growth and uncertainty over trade policy, while helping to boost inflation closer to the central bank’s goal.

What Bloomberg’s Economists Say

The July jobs report will set the tone for the pace of economic activity in the second half of the year. The breadth of job gains will signal whether dormant components of the economy are beginning to re-engage. Even more importantly, aggregate-income gains will signal the propensity for consumers to prop up growth in the interim.

-- Carl Riccadonna and Yelena Shulyatyeva

Read the full report here

“At this stage, the economy is still quite strong,” said Gregory Daco, chief U.S. economist at Oxford Economics. The employment report will help determine “whether further rate cuts are needed down the road, and a strong report would be an indication that perhaps we need to do less rate cuts than anticipated.”

If the payrolls number syncs with the Fed’s view that the U.S. economy needs only a little help to keep expanding, that could push up yields on shorter-dated Treasuries in particular, said John Lovito, co-chief investment officer for global bonds at American Century Investments.

“A strong number will reinforce the notion that the Fed easing cycle may not be as aggressive as previously thought,” Lovito said.

On Thursday, traders of fed funds futures boosted the amount of easing they expect from the central bank this year after President Donald Trump abruptly escalated his trade war with China by announcing new tariffs. More than half a percentage point of reductions is now priced in.

For U.S. stocks, which on Wednesday posted the biggest decline in two months and headed Thursday for the lowest close since June on the tariff news, a more robust jobs number could hurt equities by reducing chances of deeper Fed easing. Stocks may rise on a poor figure, as long as it’s not so terrible that it suggests the Fed would be powerless to stop a recession.

“There’s an environment of, good news is going to be bad for the markets,” said Chris Gaffney, president of world markets at TIAA Bank. “If we see a big miss, you could see investors look to increase the odds of additional Fed cuts and that would be positive for the markets at this point.”

Despite a few stumbles this year, the labor market has remained broadly solid -- a point the Fed reiterated in Wednesday’s statement. A separate Labor Department report Thursday showed filings for unemployment benefits remained low last week. The July forecast for job gains is in line with expectations for a gradual moderation, rather than a sharp slowdown.

Wages may get some more attention this time. They’ve decelerated slightly since February, when earnings growth hit the best pace of the expansion, and the tight labor market has failed to meaningfully push inflation toward the Fed’s 2% goal.

But if wage gains accelerate once again, it may limit the case for the Fed to aggressively lower borrowing costs.

Also in focus: Manufacturing has shown increasing signs of weakness amid softer global demand, lingering trade disputes and bloated inventories. A gauge of factory employment released Thursday fell to the lowest level since 2016. Powell noted that manufacturing output has declined for two straight quarters -- which fits the technical definition of a recession.

Economists project a significant pullback in manufacturing hiring in July with 5,000 new jobs, following 17,000 in the prior month. The July data can be tricky though, as automakers have traditionally shut down plants this time of year.

The jobs report will be far from the last word before the Fed’s next decision on Sept. 18. Policy makers will have a slew of other data including another employment report, along with potential new trade developments like another meeting between U.S. and Chinese trade negotiators.

“We know that they’re very worried about the risks stemming from the global environment,” said Sarah House, senior economist at Wells Fargo (NYSE:WFC) & Co. “So this is really going to be a report card in how the domestic economy is holding up.”

(Updates to add new tariffs in ninth paragraph.)