(Bloomberg Opinion) -- Like most people, I aim to avoid existential dread. I try not to think about the fragility of the vast interconnected global economy or the complicated infrastructure systems that we take for granted, or what would happen if the social contract broke down.

Usually, that’s not too difficult. Lately, however, American politicians’ reckless attitude toward the U.S. dollar has made me consider those uncomfortable thoughts. It appears that in an effort to score easy points, they’re putting at risk a policy that could bring the financial ecosystem to its knees.

That’s only slightly hyperbolic. The U.S. dollar is the reserve currency of the world and has been the cornerstone of the global financial system for decades. Since 1971, when President Richard Nixon instantly halted the convertibility of dollars to gold, faith in American leadership has held a worldwide system of fiat currencies together. Sure, the currencies, including the greenback, fluctuate in the $5.1-trillion-a-day foreign-exchange market. But since the 1990s, the U.S. has explicitly stated that a strong dollar was in the best interest of the nation. Except for a few extraordinary circumstances, elected officials have never stepped in to manage its value.

As is often the case during the presidency of Donald Trump, that longstanding tradition may no longer apply. As Katherine Greifeld wrote in Bloomberg Businessweek, it’s increasingly unclear whether the U.S. is still committed to that strong-dollar stance. Just last month, mere hours after White House economic adviser Larry Kudlow said the U.S. wouldn’t intervene in currency markets to weaken the dollar, Trump claimed he hadn’t ruled out such a move.

At the root of all this is the continuing trade war between the U.S. and China. The Trump administration, of course, escalated tensions last week and China retaliated at an “11” on a scale of 1 to 10, according to some on Wall Street. That included letting the yuan weaken sharply, though People’s Bank of China Governor Yi Gang insisted that the country wouldn’t seek competitive depreciation as a tool in the trade dispute. That didn’t stop Trump from again accusing China of “currency manipulation” in a tweet on Monday.

It would be one thing if it were just Trump. But even Democratic presidential candidate Elizabeth Warren in June called for “actively managing” the dollar to bolster U.S. jobs and growth — code for weakening its value. As a reminder, here’s what she said in her proposal:

Warren cited currency management by other countries and blamed foreign investors and central banks for having "driven up the value of our currency for their own benefit." The U.S. should work with other countries “harmed by currency misalignment,” according to the proposal.

“If we can aggressively intervene in markets to protect the interests of the wealthy and well-connected -- as we have for decades with bailouts and subsidies -- then we can damn well use all the tools at our disposal to protect the interests of American workers,” Warren said in the proposal.

But wait, there’s more. Just last week, a bipartisan bill introduced by Republican Senator Josh Hawley and Democratic Senator Tammy Baldwin would seek to control the U.S. dollar’s exchange rate through a “market access charge” on foreign purchases of U.S. equities, debt and other assets. “This legislation creates a powerful new tool to fight back against foreign currency manipulators, encourage investment in American jobs and make our exports more competitive around the world,” Hawley said in a statement.

Even if that bill goes nowhere, the barrage of broadsides confirms that the dollar is under attack. Many market observers, for their part, already wrote the obituary on America’s longstanding policy. “Given the thrust of communication over the past two years, I continue to believe that the era of the strong-dollar policy is over,” Nathan Sheets, chief economist for PGIM Fixed Income and a former Treasury official, told Greifeld. “This is something different. What’s not yet clear is exactly how to characterize the new dollar policy and the features of the new regime.”

Some strategists are war-gaming for a more pronounced shock. Bank of America Corp (NYSE:BAC). estimates that if Trump formally states the U.S. is abandoning the strong-dollar policy, the currency could fall by as much as 10%. So far, he hasn’t done so, instead preferring to lash out at China and the European Union for what, in his mind, amounts to active and intentional devaluation.

Many market observers expect intervention by tweet only. But Wall Street is still preparing itself for the real thing. Bank of America put out an almost 6,000-word report on Aug. 1, after the escalation in trade tensions, titled “A guide to US intervention in FX markets.” Citigroup Inc (NYSE:C).’s Ebrahim Rahbari, too, published a report titled “Answering your questions about US FX intervention.” He pegged the odds of intervention over the next 12 months at 10% to 20%, with the likelihood increasing the more the dollar appreciates.

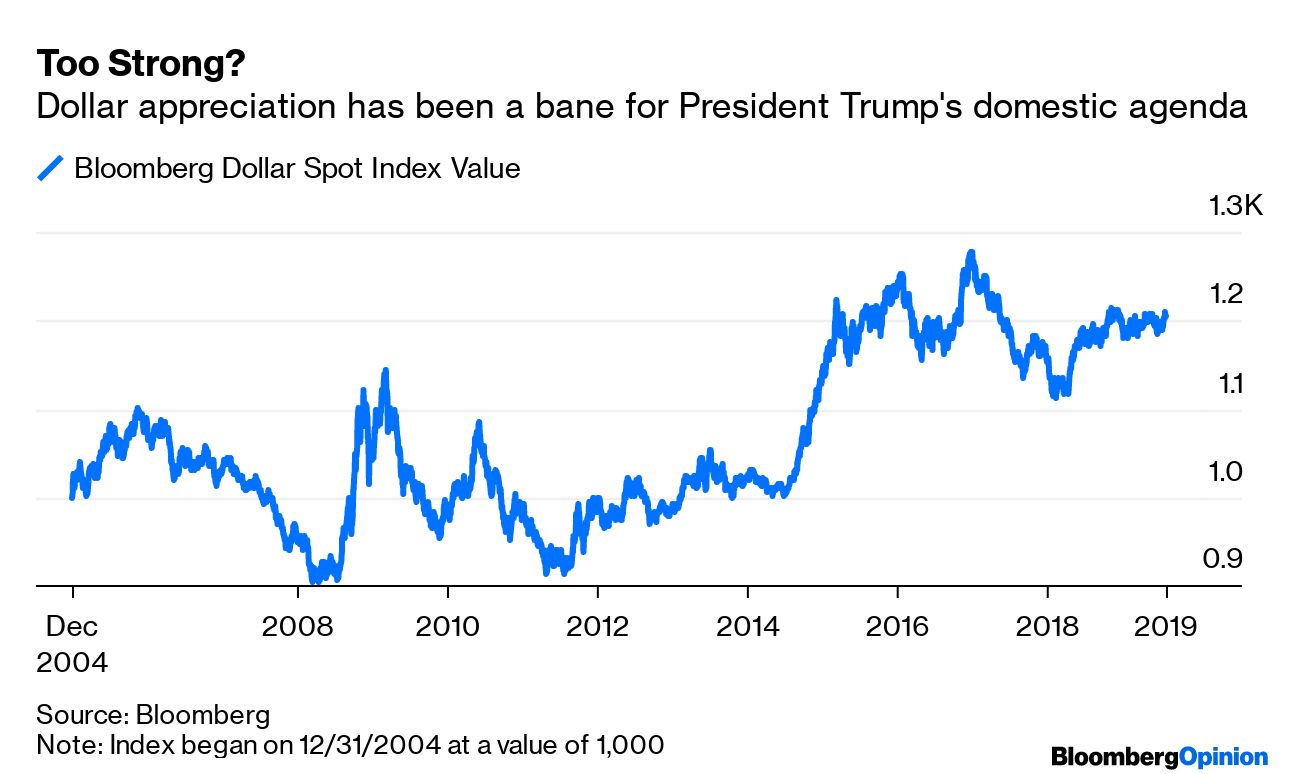

For a president who is obsessed with narrowing the U.S. trade deficit and who promised to revitalize American manufacturing, it’s understandable that persistent dollar strength is frustrating. The Bloomberg Dollar Spot Index is up more than 2% since its low point in January, though little changed since Trump’s election in November 2016. Warren, one of the highest-polling Democratic candidates to challenge Trump in 2020, has many of the same domestic economic goals.

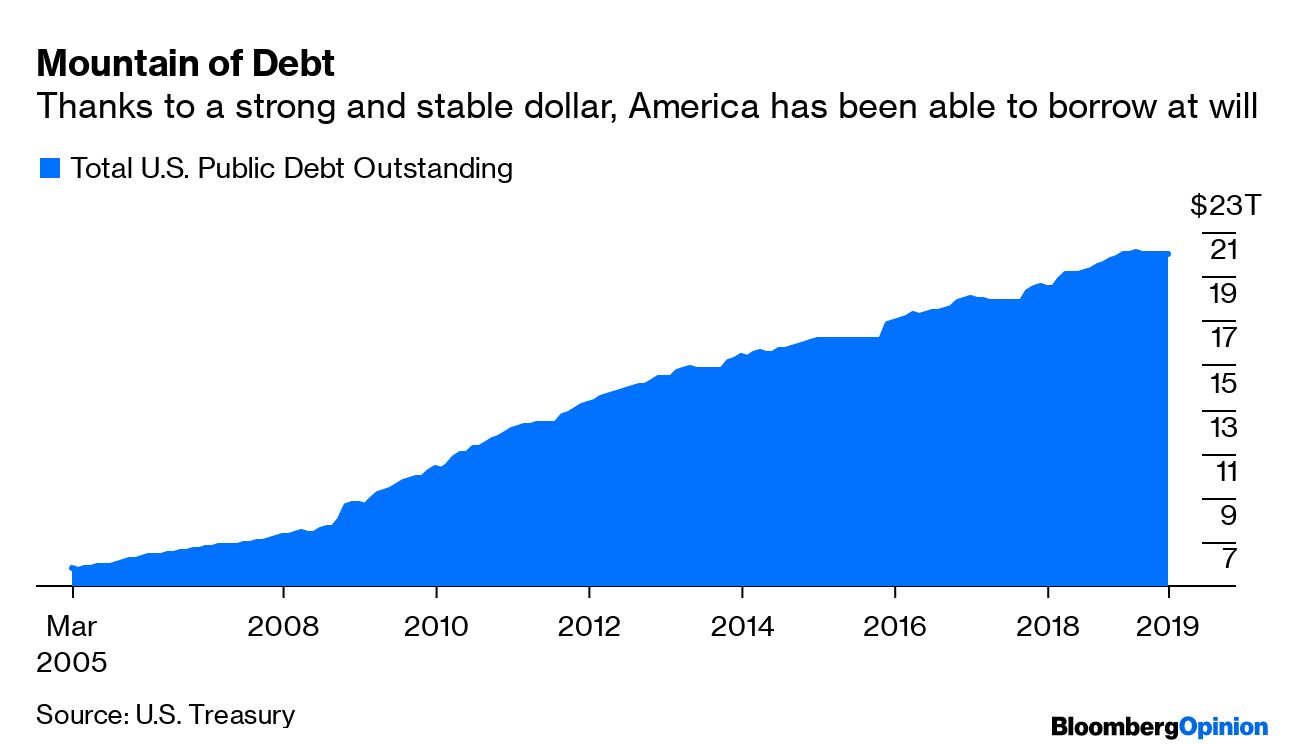

This is a classic case of “be careful what you wish for.” America has enjoyed the benefits of a strong and dependable dollar in many ways, including amassing $22 trillion of government debt without any spike in borrowing costs. Ray Dalio, the billionaire hedge fund manager who founded Bridgewater Associates, has envisioned a scenario in which that’s no longer the case because of a massive devaluation of the dollar. “We have the privileged position of being able to borrow in our own currency because we have the world’s leading reserve currency,” he said. At the time, I called losing that advantage America’s worst nightmare.

In recent years, this idea of the fragility of fiat currencies has been confined to goldbugs and doomsday prophesiers. That’s because, despite all the skeptics, the system has mostly worked. Investors across the globe have faith in the dollar, or, at least, more confidence in it than in any other currency, given that none has come close to dethroning it as the reserve-of-choice for the rest of the world. Even though the Federal Reserve is desperately trying to boost inflation, which is another way to debase a currency, it’s middling along at a consistently low rate.

Fiddling with that equilibrium for the sake of political expediency is a dangerous game. The last thing the world needs is a U.S.-led race to the bottom in currencies. Whether you think China is a full-fledged manipulator or not, America needn’t stoop to that level. A reliable dollar, free from intervention, is part of what makes the U.S. exceptional.