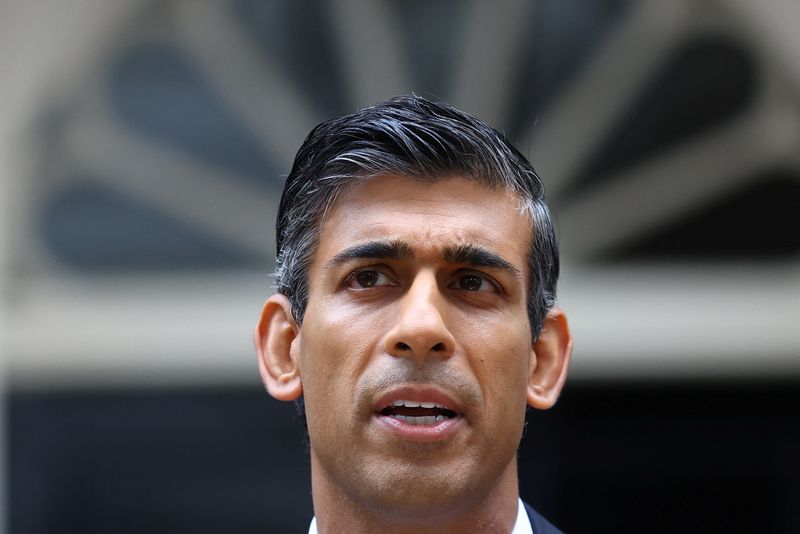

Investing.com – Prime Minister Rishi Sunak announced last week that the U.K. general election will be held on July 4. Here are the need-to-knows ahead of the poll.

UK general election 2024

The announcement of a summer election has come as something of a surprise given Sunak’s ruling Conservative party are trailing the opposition Labour Party substantially in the polls, and a vote was not necessary until early in 2025.

By calling the election early, Sunak may be hoping to seize the initiative rather than be compelled into an election by the calendar.

“This is probably earlier than Labour expected, but they are likely well-prepared, as they have been in preparation for a long time,” said analysts at Nomura, in a note dated May 22.

“It is more likely to catch the Scottish National Party off guard, since they have just got a new leader. The SNP’s lack of preparation likely benefits Labour the most.”

The latest YouGov/Times voting intention poll - the first by this polling agency after the election announcement - has the Conservatives on 22% while Labour are on 44%, a healthy lead of 22 percentage points.

This lead is fairly typical of what the opposition Labour Party has recently enjoyed, with the Conservative government deeply unpopular after 14 years marked by unprecedented levels of political turmoil.

“Voting in the recent local elections reflected intense dissatisfaction with Conservative party after a succession of shambolic prime ministers, scandals and the government’s failure to address immigration concerns in particular,” said analysts at Scotiabank, in a note. “The Conservatives have a mountain to climb to regain the trust of U.K. voters.”

In the 2019 election, the Conservatives won 376 seats versus Labour’s 197, Labour’s worst post-war defeat, and so to secure the outright majority, Labour will need to overturn 123 constituencies.

UK inflation rates

At stake is control of the world's sixth largest economy which has endured years of low growth and high inflation, is still battling to make a success of its 2016 decision to leave the European Union, and is slowly recovering from twin shocks of COVID-19 and an energy price spike caused by the war in Ukraine.

There have been signs that inflation is gradually coming under control, with headline annual consumer price growth of 2.3% in April, almost a full percentage point below the March reading, and now very close to the Bank of England's 2% target.

That said, this was still above the 2.1% expected, and importantly the 'core' U.K. CPI rate, which excludes volatile energy and food prices, is still running at a hefty 3.9%.

Investors have begun to rule out the likelihood of a June rate cut following the inflation release, especially with the Bank of England forecasting another rise in CPI, which brings the August meeting firmly into focus.

“We do not believe the timing of the election will interfere with the BoE delivering the first 25bp cut in August,” analysts at Danske Bank said, in a note dated May 23.

“Alongside the recent topside surprise to inflation, the timing of the election further reduces the chance of an earlier move in June given the pre-election black-out period, limiting the BoE’s communication on policy action.”

Key UK government policies on the line

Sunak started his campaigning by announcing controversial plans to revive national service, saying all 18-year-olds would be made to undertake a form of "mandatory" service in the armed forces if the Conservatives are re-elected.

However, this is likely to be a minor issue, with the two main parties set to focus on migration, health and security, as well as the economy.

The prompt timing of the election means that two of Sunak’s flagship policies were now in doubt - sending illegal migrants to Rwanda, and banning smoking for younger generations.

The Institute of Fiscal Studies, an independent think tank, issued a stark warning about the challenges awaiting the next government, saying the state of public finances hung over the election campaign "like a dark cloud".

And the Labour Party has been keen to dispel any fears that it will “tax and spend”, with shadow chancellor Rachel Reeves stating over the weekend that there will be no rises in income tax or National Insurance if it wins the general election.

The Labour Party has outlined some specific objectives to address key voter concerns, including cutting National Health Service waiting times, establishing a new Border Security Command, and creating 6500 new teacher positions.

They claim some of these initiatives will be funded by closing tax breaks and tightening up on tax avoidance and non-domiciled taxation, but given the tight fiscal situation these objectives are likely to be long-term issues.

“With Labour currently so far ahead in the polls, it’s likely that the party will adopt a fairly defensive manifesto that risks neither boxing itself in upon election victory, nor jeopardising its extensive lead among voters,” analysts at ING said, in a note dated May 23.

What should FTSE investors do?

Historically, U.K. equities have been relatively flat to down six months after elections, but around 6% higher following Labour victories, noted Citi.

Additionally, the FTSE 250 has tended to outperform the FTSE 100 following U.K. elections, with stronger outperformance following Labour victories.

“A mix of Defensives and Financials have tended to fare best post-election,” analysts at Citi said, in a note dated May 23.

Will the election affect GBP?

Brexit is no longer the toxic subject it once was, and a Labour government could easily push the U.K. to get closer with the EU again, which would be positive for the U.K. economy.

“While U.K. and EU relations should deepen under Labour, this would likely fall short of the U.K. joining the customs union, single market or adopting freedom of movement,” said Nomura.

“Subdued volatility in EUR/GBP is likely to pick up, owing to ECB-BoE monetary policy divergence and market expectations that Labour’s policies will lead to the pair returning to its pre-Brexit period.”

Sterling has historically been very sensitive to political uncertainty given the U.K.'s large current account deficit.

“However, this time around a Labour victory remains a clear base case for both markets and political pundits, which limits the potential for an uncertainty-induced setback to GBP,” Danske added.

There could be some GBP noise in the run up to the July vote, but the direction will still be dictated by monetary policy in the U.K. and the U.S., according to ING.

“As we don't see the BoE changing its policy plans due to the election, the overall implications for sterling should be limited,” ING added. “We retain our view that EUR/GBP will grind higher as the BoE delivers 75bp of easing this year, which is more than markets are currently pricing.”

How to stay on top of the EUR/GBP cross

There’s likely to be plenty to keep an eye on as the EUR/GBP currency cross movements continue to play out. Thankfully, with the interactive charts and historical currency info available right here on investing.com, investors can keep up with live data.