(Bloomberg) -- Fears about the economic toll of China’s strict Covid Zero policy intensified Monday, as news that lockdowns were spreading to Beijing sent stocks, commodities and the yuan tumbling.

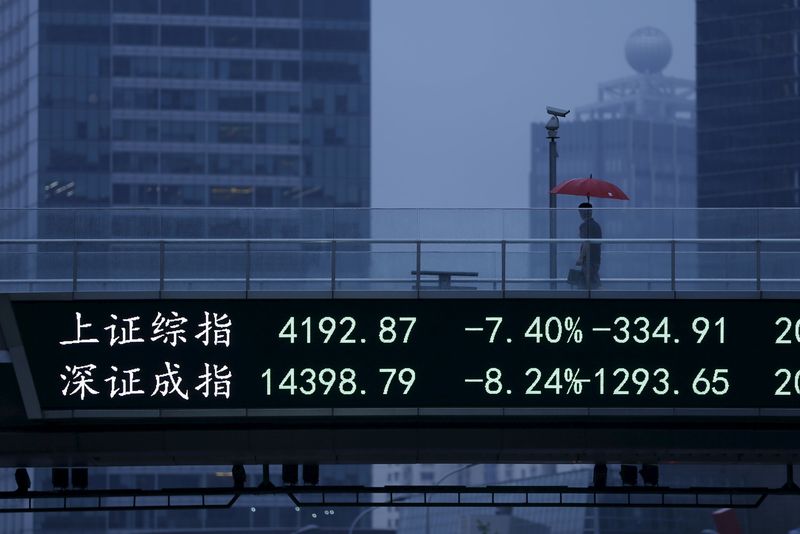

The benchmark CSI 300 Index dropped as much as 2.7%, its biggest slide in two weeks, while Hong Kong’s Hang Seng Index slumped about 3%. The onshore yuan fell to its weakest in a year on concerns about rising capital outflows.

A Covid flareup that shut down much of Shanghai appeared to worsen over the weekend after China ordered mandatory tests in a district of Beijing and locked down some areas of the capital. The news echoed around global markets with stocks, oil and equity futures under pressure and havens like the dollar and Treasuries gaining.

“There are concerns about the Covid situation in Beijing evolving into what happened in Shanghai with some prolonged lockdowns that bites the economy,” said Kevin Li, portfolio manager at GF Asset Management (Hong Kong) Ltd.

China Races to Stop Beijing Outbreak as Shanghai Deaths Climb

Traders are balking at the potential impact of coronavirus restrictions on growth in the world’s second-largest economy, which was already showing signs of slowing down thanks to a property crisis and increased regulation. The growth fears have been exacerbated by China’s widening policy divergence with the U.S., which has also been weighing on the yuan.

China’s Yuan Extends Decline on Currency Fixing, Covid Concern

“Overall, the selloff may have been further exacerbated by the dent in global risk sentiment, with the lack of positive catalyst for market participants to take on added risks for now,” said Jun Rong Yeap, a strategist at IG Asia Pte.

Wary and Weary

The renewed selling comes as investors grow weary about a lack of follow-through on policy promises to shore up growth and stabilize markets. Markets have shrugged off Friday’s latest policy vow from the People’s Bank of China to ensure stability, which repeated commentary seen in the past month.

China’s strict adherence to Covid Zero is also sweeping through commodities markets, with the nation heading for the largest oil demand shock since the early days of the pandemic. West Texas crude oil futures fell below $100 per barrel in Asia trading Monday.

China’s Oil Demand Is Tumbling the Most Since Wuhan Lockdown

Meanwhile, iron ore tumbled almost 12% in Singapore before paring around half of the drop.

“The sharp price fall is mainly due to the burgeoning Covid impact,” said Chen Wen Guang, research director at Lange Steel Information Research Center, an industry group in Beijing. With “lots of areas affected, people are beginning to worry about demand.”

©2022 Bloomberg L.P.